| Related Content The All-Russia Research Team The All-Russia Sales Team All-Russia Trading Team The Emerging EMEA Research Team The Emerging EMEA Sales Team The Emerging EMEA Trading Team |

“The valuation gap between Russian equities and peers in developed and emerging markets is now approaching a ten-year high,” notes Andy Smith, director of equity research at Sberbank CIB in Moscow. With extractive industries representing nearly two thirds of Russia’s stock market, he points out, declining demand for commodities has acted as “a major net negative” on overall performance and thus investor perceptions. When one looks past commodities, however, Russia’s growth prospects seem bright indeed: “Russia’s consumer-linked equities will continue to perform well,” he insists.

Alexander Pukhaev, co-director (with Dmitry Dmitriev) of research at VTB Capital in Moscow, agrees. “The rising trend of earnings for the RTS Index halted in 2011; 2012 earnings were down 14 percent year-over-year, and even though consensus sees them edging higher this year and next, the 2011 outturn is unlikely to be surpassed,” he explains. The reason for the overall sluggish earnings growth, he adds, is “flatlining oil prices,” declining demand for metals and adverse regulatory changes affecting utilities. These negatives, Pukhaev says, overwhelm such positive growth stories as Magnit, a Krasnodar-based Russian operator of convenience stores and supermarkets; Netherlands-based Yandex, which provides Internet services across Russia; and Eurasia Drilling Co., a Cypriot outfit that provides offshore services to Russia-based oil and natural-gas producers.

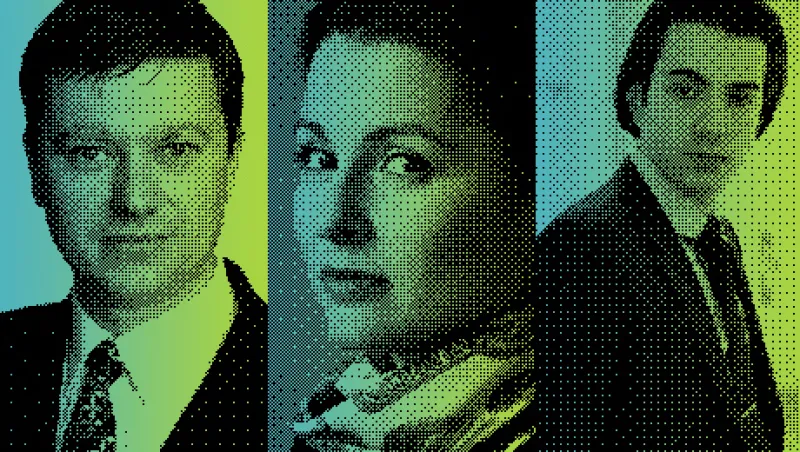

“Russia is a quite diversified economy — but on the domestic front only,” notes Sberbank economist Evgeny Gavrilenkov, who is based in Moscow. “Reading the foreign press I get the impression that the Russian economy consists of, say, ten or 15 major listed stocks, plus the president.” For information about Russian companies — the recognizable names as well as those that are rarely in the news — money managers seek assistance from sell-side firms. The one that proves most helpful, according to participants in Institutional Investor’s 2013 All-Russia Research Team survey, is Sberbank CIB. The previously unranked firm, which in January 2012 acquired Troika Dialog, captures 13 total team positions — one more than Troika claimed last year, when it finished in second place.

Down one notch to No. 2 is VTB Capital, with 12 slots, two fewer than in 2012. Deutsche Bank holds steady in third place despite increasing its team total by three, to ten, while Bank of America Merrill Lynch catapults from No. 10 to No. 4 after picking up four spots, for a total of five. Survey results reflect the opinions of 395 analysts and money managers at some 275 buy-side institutions that oversee an estimated $209 billion in Russian equity and fixed-income assets.

With regard to analysts deemed the best in their respective sectors, Sberbank lays claim to seven top-ranked researchers, followed by VTB Capital, with four. The only other firm with an analyst at No. 1 is Citi, which ties with Credit Suisse and Morgan Stanley for fifth place overall.

This year marks the survey’s tenth anniversary. Only three analysts have made the team every year: Sberbank’s Gavrilenkov, on top for a sixth consecutive year in Economics, and Alexander Kudrin, who advances from second place to claim his first appearance in the winner’s circle in Fixed-Income Strategy; and Renaissance Capital’s Alexander Kazbegi, a runner-up in Telecommunications. Kudrin has amassed 13 appearances to date, having ranked in both External (Foreign Currency–Denominated) Debt and Internal (Ruble-Denominated) Debt before those sectors were merged in 2007.

The individual who holds the record for most appearances on the team is no longer an analyst. Alexey Moiseev racked up 15 appearances — including eight first-place finishes — in Economics, Fixed-Income Strategy and predecessor sectors on behalf of Renaissance Capital (from 2004 through 2010) and VTB Capital (in 2011 and 2012). He left the latter firm in July after being named deputy finance minister for the Russian Federation.

Government’s role in spurring economic development is a key issue in many countries, and Russia is no exception. Investors have been eager to learn the details of President Vladimir Putin’s fiscal strategy, but the address he gave when presenting his 2014 budget did little to clarify matters. Russia can’t keep increasing public spending, Putin said, but neither can it curtail its dedication to education, health care and other social concerns.

“The client response was that mixed messages are increasingly a pattern in Russia and that there appears to be a lack of commitment in setting a clear-cut course that may involve difficult decisions,” explains Yaroslav Lissovolik, head of company research at Deutsche Bank in Moscow, who marks his third straight year at second place in Economics. “That being said, it is important that the authorities do realize the constraints on further expansion in fiscal spending, given among other things the high level of the nonoil budget deficit. The focus appears to be shifting in policy on the composition of fiscal spending, with priority still accorded to social outlays. Our view is that for fiscal policy to deliver a greater growth impulse, more of the spending has to be focused on capital and infrastructure outlays.”

The Kremlin will undoubtedly revisit the issue. “Putin talked about the necessity of improving budget effectiveness and the possibility of reallocating expenditures to stimulate the economy, but there were no specific proposals,” notes Sberbank’s Smith. “In an environment characterized by the risk of gently falling oil prices, the Russian government will come under mounting pressure to increase efficiency and implement reforms. Many institutional investors point out that actions mean much more than words as far as Russian government rhetoric is concerned — especially with respect to the long-touted diversification of the economy.”

Read more in the July-August international edition of Institutional Investor magazine.