I’ve been interested in including extra-financial factors in investment decisions for a long time. Five or six years ago, I was that crazy guy sitting alone mumbling about "fools trying to quantify the unquantifiable," "people ignoring meaningful signals that don't fit models," and "hokey religions and ancient weapons not being a match for a good blaster at your side ..." Today, I’m still mumbling like a crazy person ... but I’m not alone. More and more people agree that extra-financial factors have relevance to long-term value creation.

In the wake of the Asian financial crisis, the Long-Term Capital Management debacle, the Internet bubble and bust, the "perfect storm," the global financial and subprime crisis, the European debt crisis, and whatever insanity the ongoing QE will inevitably unleash on our economy, many investors are throwing out their old finance textbooks and taking out a blank piece of paper and a pen. We're seeing more concentrated portfolios; more focus on risk factors; more interest in "beliefs"... It’s really all changing. This is what I’ve described as a sort of “post-modern portfolio theory.” It seeks to re-root finance in the real economy, and (gasp) it is focused on actually driving value over the long run.

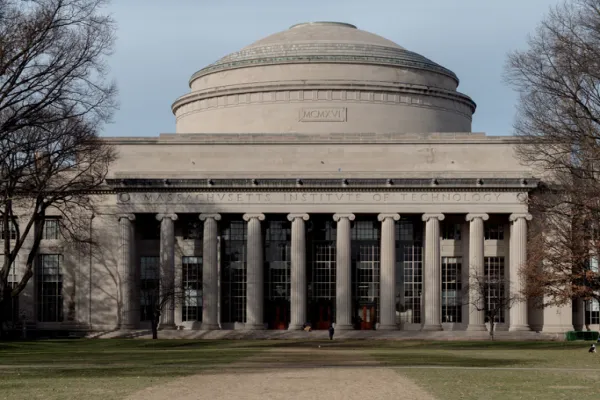

In my view, finance is not a zero sum game but it sometimes appears that way because the asset management industry is inappropriately structured and incentivized. This is partly why I endorse evergreen vehicles like this VC one and that PE one . It’s why I think ‘investment beliefs' are so important , and why I believe we should be drawing inspiration from Islamic Finance’s grounding in the real economy for our own financing tools. It’s also why I run a research center at Stanford that has for its mission to facilitate understanding of the financing, development and governance of the strategic assets that underpin industrial dynamism and economic growth. In short, I’m all about rethinking the finance mechanism to try to drive value over the long run.

I bring all this up (again) because the NAPF has just published a nice report examining the responsible investment trend and the path that many investors are taking towards the inclusion of extra-financial factors. Here’s a blurb :

“...responsible investment is an approach whereby material extra-financial factors are incorporated into investment processes and activities. The objective of responsible investment is decreasing investor risk and improving risk-adjusted returns... Responsible investment is not about pension funds’ investments ‘going greener’ but about achieving better outcomes for their members.”

Sounds legit, right? I think it's lovely stuff. Anyway, this report offers two really useful additions to the literature (and it also has one oversight):

1) Evidence: The report does a nice review of all the literature on responsible investment and shows, quite unequivocally, that ESG does in fact offer investors a change to boost returns over the long run. So this isn’t about doing right... it’s about doing well by doing right.

2) Materiality: The report also offers a very nice way of thinking about which extra-financial criteria matter and which ones do not. This is what the authors called, “materiality”:

“The materiality of different extra-financial factors will vary across sectors and geographies; however, their materiality means that at some point in the future, they will manifest as a financial impact... Material extra-financial factors are those issues which are likely to have at least a long-term effect on business results and performance. Examples of extra-financial factors include, but are not limited to, corporate governance, bribery and corruption, executive remuneration, human rights, occupational health and safety, research and development (R&D), customer satisfaction, climate change, consumer and public health, reputation risk, and the environmental and social impacts of corporate activity.”

I think this notion of materiality is a really useful way of thinking about how to overlay the extra-financial factors on top of your traditional investment framework.

Anyway, so that’s what I like about this report. AndI think it’s really worth your time to read.

What I don’t like about this report is how it seems to focus all of its “implementation advice” on how asset owners can manage external managers. Sorry, NAPF, but I don’t see how asset owners are ever going to get to an effective responsible investment capability that uses external managers exclusively. Why do I say this? Ironically, the justification for my taking this position is written in this very report! Let me explain.

For the short-term external asset managers (1 to 5 years), many of the extra-financial criteria simply aren’t material. Or they aren’t as material as they are for long-term institutional investors (10 to 30 years). But, as per the NAPF report, for an investor to view extra-financial factors as material (and thus take them seriously), they have to be convinced that there is a relatively high probability that these extra-financial factors will transition into financial factors in the life of their portfolios. And, in most cases, this means the investor needs an inter-generational time horizon -- so more than 90 percent of private, external managers are out.

To me, that really means that responsible investing should begin with in-house teams of investment professionals that are building inter-generational portfolios ... and not be focused on helping hedge funds or public equity managers try “see the light”. So, the NAPF has a bit more work to do.