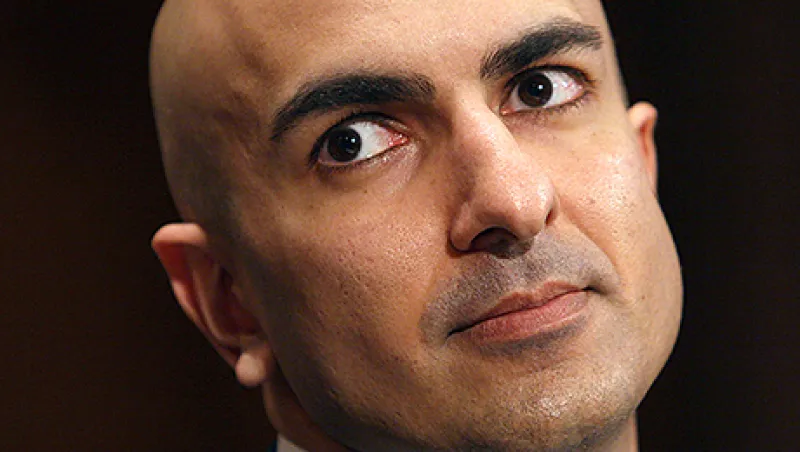

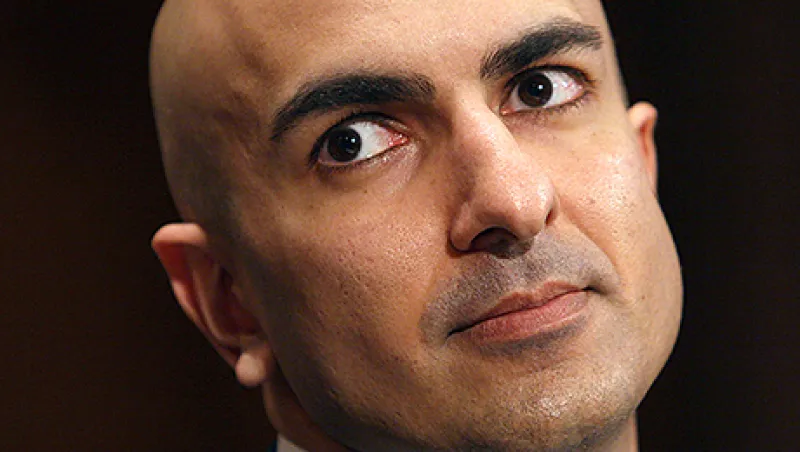

Will New Minneapolis Fed Boss Kashkari Be Too Easy on Wall Street?

Ex–Goldman Sachs banker Neel Kashkari, who will soon influence U.S. monetary policy, has opposed stimulus measures by the Federal Reserve.

Aaron Timms

December 2, 2015