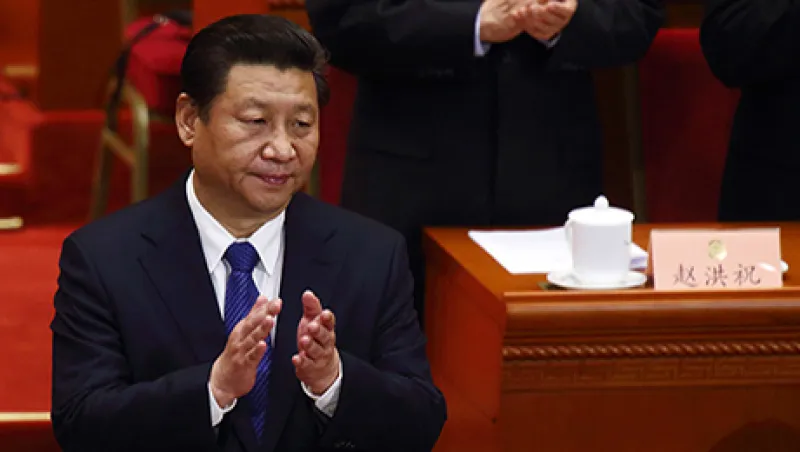

After months of global financial market turbulence set off in part by concerns over Chinese growth, and by a roller-coaster ride for equity markets there, Beijing is mounting a campaign to reassure the world that nothing has changed. Chinese President Xi Jinping’s trip to the United States begins today. While cyber hacking and military actions in the South China Sea will figure highly in talks with U.S. leaders, Xi will also use the opportunity to reassure investors that China’s economy remains sound and that current troubles are merely bumps in the road, while stressing ongoing economic reform. The U.S. is not the sole focus of Beijing’s charm offensive. The Economic and Financial Dialogue summit in Shanghai between leaders from the U.K. and China concluded Monday with the announcement of 53 agreements. Among them was the news that the People’s Bank of China would begin selling short-term Yuan-denominated debt securities in London, the first Chinese currency debt sold outside the mainland and Hong Kong. Timing of the move was left vague, but Chancellor of the Exchequer George Osborne praised the agreement in public remarks after the event. The U.K. has supported the inclusion of China’s currency into the International Monetary Fund’s special-drawing-rights basket.

U.S. existing home sales slow. National Association of Realtors data released on Monday indicated a slowdown in existing home sales, with a 4.8 percent reduction in the pace to an annualized 5.31 million in Augus—significantly lower than consensus forecasts. The moderation was largely driven by markets in the Southeast and West Coast where prices have risen sharply in recent quarters.

Community banking watchdog objects to Goldman Sachs deal to buy GE’s online bank. In a letter dated September 19, National Community Reinvestment Coalition CEO John Taylor requested a formal hearing into the proposed acquisition of General Electric’s online-retail banking assets by Goldman Sachs. The statement by the NCRC, which is backed by more than 600 U.S. community-action groups, specifically raises concerns over the relationship between Goldman Sachs and the staff of the New York Federal Reserve.

LSE plan to sell Russell in peril. Media reports surfaced today indicating that the London Stock Exchange Group’s negotiations with Shenzen, China-based Citic Securities to sell the Chinese firm Russell Investments is in jeopardy because of volatility in Chinese equity markets. The deal, which had been estimated at nearly $1.8 billion, would have allowed the LSE to sell off the investment portion of Frank Russell Co., acquired in 2014, while retaining the Russell index business.

Heavy corporate bond issuance continues. Some analysts attributed a selloff in U.S. Treasuries across the curve to over $15 billion in fresh corporate debt offerings. According to data provider Dealogic, U.S. corporates have raised $1.2 trillion in bond markets so far in 2015, the highest level on record for a comparable period.

Day of judgment for Moynihan. Bank of America Merrill Lynch CEO Brian Moynihan faces a challenge in a special shareholder vote today from a group that wants him to step down from his position as chairman of the board. BofA investors, including the California Public Employees’ Retirement System, have cited potential conflicts of interest in demanding an independent head for the board.