They might have been the bugbear of the 2008–’09 financial crisis. But now might just be time to take another look at mortgage-backed securities.

Mortgage-backed securities, or MBSs, as they are commonly known, generally have tended to offer a high degree of liquidity, a high historical Sharpe ratio and a low correlation to risk assets. Their complexities can create market dislocations, making them a particularly ripe source of potential alpha-generating opportunities for active managers.

Whereas MBSs rarely take center stage during investor conversations regarding asset allocation, the sector can be a useful ingredient in a high-quality fixed-income allocation. After all, the U.S. residential and commercial MBS markets exceed $7 trillion and make up about 30 percent of the Barclays U.S. Aggregate Bond index and 12 percent of the Barclays Global Aggregate index, according to the Securities Industry and Financial Markets Association (SIFMA) and Barclays, respectively, as of June 30. The largest and most liquid component of MBS exposure in the Barclays Agg is mortgage bonds guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae. There also are sizable private-label residential and commercial MBS markets.

Agency MBS valuations are not cheap at current levels. These securities are accompanied by both interest rate and prepayment risk. Prices have been inflated by the accommodative policies of the Federal Reserve, which owns more than $1.75 trillion in agency MBSs. In our view at PIMCO, investors should consider four historical benefits provided by agency MBSs:

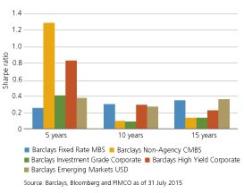

High historical Sharpe ratio. The agency MBS sector has provided among the most consistent sources of risk-adjusted returns relative to like-duration Treasuries of any fixed-income asset class. Massive central bank accommodation and global demand for yield have resulted in outsize risk-adjusted returns in many credit sectors, though the agency MBS Sharpe ratio has remained consistent over time.

Volatility sales have often been a primary driver behind this phenomenon. Considering that the typical U.S. 30-year mortgage loan can be prepaid at any time, MBS investors — the lenders — are short a call option to the borrower to prepay, or call, their mortgage at their discretion. The resulting risk profile is a long position in a government-guaranteed bond and a short position in a call option. Being short an option creates the exposure to volatility. Over the long term, investors have earned attractive compensation for incurring this risk (see chart 1).

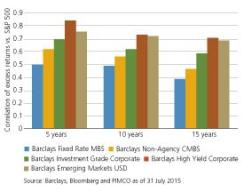

Low correlation to risk assets. Excess returns from agency MBSs have had among the lowest correlation to risk assets of any fixed-income sector (see chart 2), and, relative to like-duration Treasuries, the primary risk factor in agency MBS is prepayment risk, rather than exposure to credit fundamentals or bond market liquidity. Even within the credit component of the MBS market, private-label commercial mortgage-backed securities have had a lower correlation to equities than corporate and emerging-markets debt.

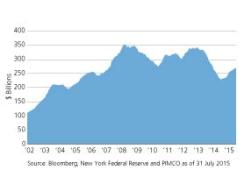

Ample liquidity. Liquidity is another key distinguishing factor of the agency MBS sector, especially in an environment in which regulation has reduced the role of intermediaries. Diminished liquidity can result in wider bid-ask spreads and more fragility during periods of market dislocation. Although liquidity in agency MBSs may be weaker than historical levels, according to SIFMA, on average, the sector continues to trade more than $200 billion in securities a day (see chart 3), with minimal bid-ask spreads relative to many other credit sectors.

This situation allows for active relative value trading within the sector, in an environment in which the beta of agency MBSs may be less attractive than historical norms. Especially in the current environment, long-short trading within the agency MBS market has the potential to be a source of liquid alpha.

Active management opportunities. The complexity of the mortgage market has facilitated consistent, excess return potential. Prepayment risks are intricate, and sophisticated MBS investors often disagree materially on the value of embedded call options. Given the large footprint of investors not driven by total-return goals, the agency MBS market is constantly dislocated and mispriced. This trend can lead to opportunities for active managers to extract additional risk-adjusted returns beyond what passive exposure to the sector has historically provided. In private-label mortgage markets, differences in collateral and security structures — among several other factors — may provide further opportunities for excess returns.

The MBS market offers the potential for investors to outperform Treasuries without drastically increasing the correlation of their fixed-income holdings to their equity exposure. The agency MBS sector historically has demonstrated a tendency to successfully address these goals while also providing attractive opportunities for active managers to generate excess returns.

Jason Mandinach is a senior vice president and product manager at Pacific Investment Management Co.’s headquarters in Newport Beach, California, responsible for mortgage-related strategies.

Get more on fixed income.