Leaked documents suggesting that hundreds of millions of dollars from a state-owned investment fund ended up in the bank accounts of Prime Minister Najib Razak. The sudden sacking of the prime minister’s deputy and heir apparent, along with the attorney general who was leading an investigation into the affair. An arrest warrant for former U.K. prime minister Gordon Brown’s sister-in-law, whose website has published a series of purportedly leaked documents in the case.

Over the past five weeks, Malaysians have been waking up to ever-more-lurid headlines about possible corruption at the highest levels of government. The news took another dramatic turn earlier this week when the government’s anticorruption commission declared that the money in the prime minister’s accounts had come not from the state investment fund but from a Middle Eastern donor. Far from quelling the crisis, however, the latest disclosure merely raised new questions: Who in the Middle East would want to donate $682 million, and why did the money end up in the prime minister’s personal accounts?

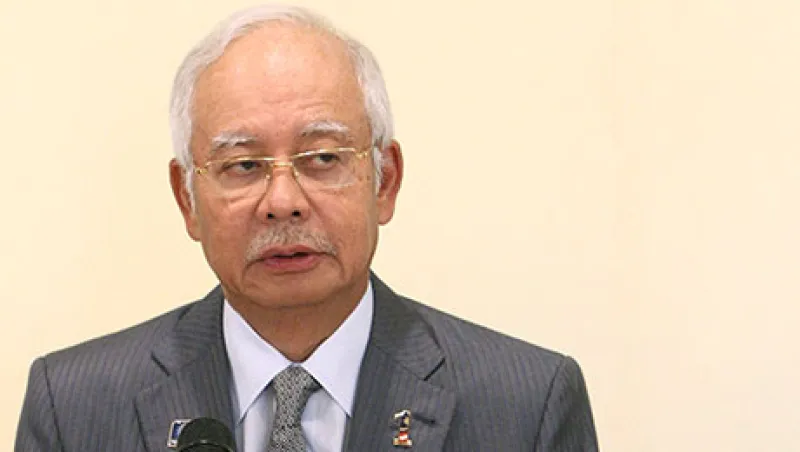

Najib, who has acknowledged receiving the funds but has declined to explain them, has denied taking money for personal gain and lashed out at critics, saying they are seeking to destabilize his government. Although his moves to silence critics within the government with a cabinet reshuffle may strengthen his hand politically in the short run, they have yet to blunt the biggest threat to his authority since taking over as prime minister in 2009.

On August 5, the Malaysian Anti-Corruption Commission (MACC) said it would ask Najib to explain the donation. The prime minister faces calls to resign from Mahathir Mohamad, who ruled the Southeast Asian nation with an iron hand from 1981 to 2003 and remains a powerful influence within Najib’s United Malays National Organization (UMNO), the leading party in the ruling Barisan Nasional (National Front) coalition. With new disclosures and rumors surfacing almost daily, few are willing to predict how the crisis will end.

“The sheer scale and audacity of what we have seen in the past few days is unprecedented,” says Ooi Kee Beng, deputy director of the Singapore-based Institute of Southeast Asian Studies.

The controversy arose out of an investigation into a troubled state investment fund, 1Malaysia Development Berhad (1MDB). Najib expanded 1MDB shortly after he assumed office, making it a strategic investment fund aimed at fostering long-term economic development. The prime minister chairs the fund’s advisory board. The fund quickly amassed major debts — as much as $12 billion — through bond issues to finance the purchases of power plants in Malaysia and overseas, many of which were made at inflated prices, critics contend.

On July 2 the Wall Street Journal and Sarawak Report, a website run by Clare Rewcastle Brown, sister-in-law of Gordon Brown, reported that investigators had found evidence that $682 million had been wired to what they believed were Najib’s personal accounts. Sarawak Report also published what it claimed was a charge sheet that then–attorney general Abdul Gani Patail had been drafting to press criminal charges of embezzlement and misappropriation of funds against Najib.

In late July, Deputy Prime Minister Muhyiddin Yassin called on Najib to explain the situation at 1MDB and address the mounting speculation. Two days later, on July 28, Najib fired Muhyiddin, as well as attorney general Gani; Shafie Apdal, a senior minister and vice president of UMNO; and several other cabinet ministers, in what Malaysian political circles dubbed the “Tuesday afternoon massacre.”

The new attorney general, Mohamed Apandi Ali, a conservative former judge and UMNO official who is regarded as a close ally of Najib, has dismissed the purported charge sheet as a fake. Since August 1 authorities have detained eight officials — one from the AG’s office and seven from the MACC — for questioning about the alleged leak of sensitive documents related to the charge sheet. Authorities also issued an arrest warrant for Rewcastle Brown, who runs her website from London and insists Malaysia has no grounds to extradite her.

The affair has also raised doubts about the tenure of Malaysia’s long-serving central bank governor, Zeti Akhtar Aziz. Zeti was part of a four-person task force, led by Gani, that was investigating allegations of wrongdoing at 1MDB. On July 30, two days after the “massacre,” a spokeswoman for Bank Negara Malaysia, the central bank, felt obliged to deny rumors that the governor had resigned. Meanwhile, the inspector general of police, Khalid Abu Bakar, said the police might question Zeti and MACC deputy chief Mohamed Shukri Abdul on suspicion of leaking information about the 1MDB investigation.

The task force has been disbanded following the government shake-up, leaving the MACC and Bank Negara to continue their investigations separately. Some are skeptical about those efforts, though. The sacking of the attorney general “is a signal to those involved in the 1MDB investigation to move carefully,” says Ambika Ahuja, a London-based political analyst for risk consulting firm Eurasia Group. Najib’s government shake-up also put a temporary halt to a separate investigation of 1MDB by Parliament’s Public Accounts Committee by bringing four of the seven members of the committee into the prime minister’s cabinet.

The affair and Najib’s efforts to contain it have put pressure on the ringgit and Malaysian bonds, almost half of which are held by foreign investors. The ringgit has been the worst-performing emerging Asia currency this year, recently falling below the level of 3.80 to the dollar that authorities defended with capital controls and a fixed peg during the 1997–’98 Asian financial crisis. The ringgit was trading at 3.9125 to the dollar on August 6.

“The legal offensive against 1MDB investigators undermines Najib’s credibility among foreign investors,” says Eurasia’s Ahuja. Mauro Ratto, head of emerging markets at Pioneer Investments in London, echoes those concerns. “We are worried about politics as well as the economy and governance” in Malaysia, he says.

Mark Mobius, executive chairman of Templeton Emerging Markets Group, puts a positive spin on the controversy. “In a way, what’s happening in Malaysia is a good thing because over the long term it will make the country more transparent,” he says. “With smartphones, Twitter and blogs, it doesn’t take long for everyone to find out details of financial scandals. We are seeing this in Brazil and in other emerging markets and now Malaysia.”

Najib and his Barisan Nasional coalition barely won reelection in May 2013, losing the popular vote to a coalition headed by Anwar Ibrahim by 53 percent to 47 percent but winning a majority in Parliament thanks to the overrepresentation of the country’s rural areas in the chamber. The government did particularly well in the southern state of Johor, as well as in the East Malaysian state of Sabah. Muhyiddin hails from Johor; Shafie hails from Sabah.

The latest disclosures and Najib’s dismissal of Muhyiddin and Shafie threaten to split UMNO and undermine its popular support, says Manu Bhaskaran, a prominent Asian economist and CEO of Centennial Asia Advisors, a Singapore-based arm of Washington strategic consulting firm Centennial Group. “The sacking of the deputy prime minister is big news which will unsettle the system,” he says. “Many Malaysians — particularly those in the rural areas who were not too bothered by the 1MDB scandal, which has been more of an urban obsession — are now likely to realize that something serious is brewing.”

Eurasia’s Ahuja contends that Najib has strengthened his position in the short term even though the affair casts doubt on his ability to govern effectively over the longer term. “Najib’s approach to the scandal at 1MDB, combined with the fact that there is no easy mechanism to dislodge him from power, is working in his favor,” she says.

The disclosures to date have also raised troubling questions about the government’s oversight of 1MDB.

Because the investment fund didn’t have the cash flow from power plants to pay its bondholders, the government transferred valuable real estate to 1MDB for what now seem to be token sums of money. Three years ago, for instance, the fund bought from the government a 70-acre plot of land in Kuala Lumpur that is intended to be developed into a financial center, for 320 million ringgit ($82 million). In recent months a nearby plot of land sold at a price per square meter nearly 20 times greater. As Finance minister, a portfolio he holds in addition to being prime minister, Najib approves government land sales.

1MDB has invested in several joint ventures, including one with a Saudi Arabian company, PetroSaudi International. The fund contributed $1 billion to the venture, 1MDB PetroSaudi; PetroSaudi was supposed to put in assets worth $2.7 billion. PetroSaudi was unable to acquire the assets, though. The venture was terminated, but 1MDB never got its $1 billion back.

Former prime minister Mahathir said recently that by his calculations RM27 billion of 1MDB’s money “is unaccounted for.” For their part, 1MDB executives contend the investment fund is merely experiencing temporary cash flow issues. Although the company has $12 billion in debts, they assert that its assets are worth $13.3 billion.

The corruption allegations and the troubles at 1MDB come at an inopportune time for Malaysia. The country is Asia’s only major oil-exporting economy, and oil-related taxes generated 40 percent of government revenue when crude prices topped $100 a barrel. Following the decline in global crude prices over the past year, such levies now fund only 28 percent of the budget, prompting the government to find other revenue sources; it imposed a new, 6 percent goods and services tax in April.

“Consumers appear far more concerned about the effects of the recent introduction of the general sales tax on their spending power than any fallout from 1MDB,” London-based research firm Capital Economics said in a recent report. “The bigger threats to Malaysia’s economy lie elsewhere in the form of the slump in the currency, which has highlighted the country’s rapid build-up of U.S. dollar debt, and the decline in commodity prices, which has caused a collapse in export revenues.”

“Malaysia is now probably the worst-positioned economy in Asia,” says Alicia Garcia-Herrero, Asia-Pacific chief economist for Natixis in Hong Kong. Malaysia’s total debt now sits at 220 percent of gross domestic product, she estimates, compared with 88 percent for Indonesia. Household debt stands at a lofty 88 percent of GDP, ahead of Thailand’s 86 percent; the ratio of household debt to income is at 146 percent, compared with 121 percent for Thailand.

“Malaysia is not the only country where you have these issues, but everywhere else they are cleaning up the mess while Malaysia keeps building the mess,” says Garcia-Herrero. She argues that Malaysia’s big problem is complacency: “They have always thought of themselves as a middle-income economy with higher per capita income that didn’t have the sort of problems that Indonesia had.”

If the U.S. Federal Reserve Board raises rates in September, as many analysts expect, money could flow out of emerging Asia economies, and Malaysia would likely be one of the hardest hit, says Centennial’s Bhaskaran. “Najib needs to address the issue of corruption and restore political stability,” he says. Then the government can work for the completion of the Trans-Pacific Partnership trade deal involving Japan, the U.S. and ten other nations, and “use it as a lever to push other economic reforms,” he adds.

Can Najib ride out the crisis and steer the economy back to health?

“The basic political structure in Malaysia is that it is not about a strongman, as it was in the case of Indonesia’s Suharto or Marcos in the Philippines,” says the Institute of Southeast Asian Studies’ Ooi. “It is about the entrenched strong party, UMNO, which is very hard to dislodge even when you have Mahathir and Muhyiddin and other former cabinet ministers” effectively opposing Najib.

Barring a no-confidence vote in Parliament or convincing evidence of corruption, it is difficult to remove a sitting prime minister, the academic notes. With the next election nearly three years away, he says, “Najib’s gamble is that if he can buy time, hopefully people would have forgotten 1MDB and the scandals.”

Get more on emerging markets.