To view a PDF of this report click here

Stable value investing is playing an increasingly important role in defined contribution (DC) plans such as 401(k)s. For sponsors and participants, this conservative asset class-offered through insurance company contracts-can deliver steady returns without the volatility associated with stock and bond funds.

"Stable value offers a unique combination of benefits, including principal preservation, consistent positive returns, and liquidity," says Gina Mitchell, president, Stable Value Investment Association (SVIA). "As an asset, it offers higher return potential than money market funds. It is also well positioned to respond to rising interest rates and provide inflation protection."

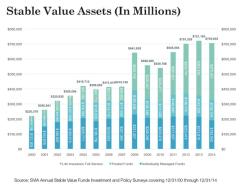

Stable value is only available through employer-sponsored DC plans and some 529 plans for educational expenses. Approximately $705 billion is invested in stable value funds, about 10.43% of $6.8 trillion held in DC plans, according to SVIA.

"Stable value is a great portfolio diversifier," says Warren Howe, national sales director for stable value, MetLife. "Having a predictable return locked down without concerns about negative returns, allows participants to take on a little more risk elsewhere in their portfolios, such as increasing an allocation to equities."

By amortizing gains and losses over the duration of the portfolio, stable value is able to smooth market volatility, says Mitchell, noting

there are three basic stable value structures:

Guaranteed Interest Contracts (GICs) and other general account contracts, where assets are owned by the insurance company and held in an insurer's general account.

Separate Account Contracts, where assets are owned by the insurer but set aside in a separate account for the exclusive benefit of the plan(s).

Synthetic GICs, where the assets are directly owned by the participating plan(s).

Because stable value is designed specifically for, and is available only through, DC plans, more retirees may opt to maintain assets within the plan after retirement, says Howe. "By doing so, they continue to receive the long-term benefits of stable value, as well as the benefit of institutional pricing for the investment options that the plan provides for participants."

Within DC plans, stable value has historically been offered as a stand-alone investment option. However Howe says that some plan sponsors are now looking at custom target date funds that include a stable value component, "We are also seeing a growing number of state 529 plans include stable value as a core component," he says. "Stable value is an ideal investment option for parents investing for a child's higher education.

Fits between money market and bond funds

Mitchell says stable value as an asset class is well positioned between money market and bond funds. "Stable value's returns are generally 150 to 200 basis points higher than a money market, and were 2.43 percent in 2014," she says. "It also offers less volatility than a bond fund."

Howe says MetLife has seen the beginnings of a trend of plan sponsors shifting from money market to stable value options. With the upcoming implementation of money market reform by the U.S. Securities and Exchange Commission (SEC) and recent plan litigation that included money market exposure in a stable value fund, such as Abbott v Lockheed Martin Corporation, plan sponsors are re-evaluating their principal preservation option, he says. "As of October 2016, money market reform for money market funds other than government money market funds will result in a floating net asset value (NAV) instead of the standing dollar NAV structure. This combined with liquidity gates and redemption fees could result in a loss in value. It may also make it more difficult for plan participants to access their balances in money market funds in times of stress."

Howe adds that moving to a government money market fund might not be an attractive strategy under the changed market conditions. "If every investor is chasing the same government securities, those yields will likely go down, resulting in extremely low returns for plan participants. In such a case, stable value would have an even more significant return advantage over money market funds."

By Richard Westlund