To view a PDF of this report click here.

In the not so distant past, many Americans could rely on a corporate pension to provide a steady flow of income in retirement. They didn’t have to make decisions about saving money, building a portfolio of assets or managing their financial risks.

Today, more workers are faced with numerous retirement strategy choices as defined contribution (DC) plans such as 401(k)s and other defined contribution (DC) plans have largely replaced the traditional defined benefit (DB) pension plans. This changeover has not been easy for most employees, who find it difficult to save for the future or make sense of the complex financial markets.

As a result, some of the key features of DB plans have steadily migrated to the DC world, such as auto-enrollment and default options that place participants in target date funds (TDFs) and target risk funds (TRFs) with pre-designed investment allocations based on a participant’s age or risk tolerance.

“We are proponents of auto-enrollment in DC plans because the great majority of participants will not be engaged in the retirement planning process,” says Dick Davies, head of DC and co-head of North American Institution, AllianceBernstein (AB).

Now, TDFs are moving into an era of customization, where other factors come into play in constructing a default product and designing a participant’s glide path, the asset allocation mix that typically becomes more conservative as the participant draws closer to retirement.

“With DB plans, companies contributed an appropriate amount of money, made the allocations and engaged professional managers for their portfolios,” says Toni Brown, SVP, Defined Contribution, Capital Group. “Now, you can get those three aspects in the DC world through auto enrollment, auto escalation and a qualified default investment alternative (QDIA) such as a TDF. However, the longevity risk and market risk are now borne by the participant, and they vary from individual to individual.”

Rick Fulford, executive vice president, head of U.S. Retirement for Pimco, points to the innovative approaches providers are taking toward serving plan sponsors. “There is a great deal of innovation in the TDF space, leading to better outcomes,” he says. “However, there are also growing risks for sponsors. Because many participants rely on TDFs to meet their retirement goals, picking the wrong fund or one that is misaligned with the objective of their plan can affect the outcomes.”

A changing provider marketplace

While DC and DB plan sponsors have a growing array of options in designing and executing their retirement strategies, Edmund Murphy III, president of Empower Retirement, notes there has been an ongoing consolidation in the recordkeeping sector. “We have seen strategic exits, mergers and acquisitions because scale is important,” he says. “Capital resources are necessary for providers to improve the plan experience for clients and participants.”

Murphy adds that providers need to offer multichannel “touch points” with participants, including a growing emphasis on mobile. “I see mobile taking off in terms of how participants will interact with their DC plans and all their other benefits,” he says.

“This is a relationship business,” says Jeffrey Gould, head of Putnam Global Institutional Management. “The firms that that take their relationships seriously and try to add value outside a specific product will be most successful.”

Looking at how the industry is changing, Glenn Dial, head of retirement strategies at Allianz Global Investors, says, “We believe the retirement industry will evolve from the current 3Fs – funds, fees and fiduciary services – to the 3Rs – results, reliability and risk, as sponsors move to align their strategies more closely with outcomes. That will be a big evolution in our field.”

Outsourcing the oversight of a DB or DC plan is another trend in the retirement market. “Engaging an outsourced chief investment officer (OCIO) can help to manage the trifecta of fiduciary, regulatory and investment risks facing plan sponsors,” says John McCareins, practice lead, Institutional OCIO, at Northern Trust.

Rather than investing in internal staff and trying to work through the risks, hiring an OCIO lets a plan sponsor retain a strategic advisor who shares the fiduciary liability and brings a greater degree of streamlining and flexibility to the administrative process, while providing board-level reporting, McCareins adds. “We have seen an upward migration in OCIO demand from plans as sponsors recognize that the approach can provide a higher level of expertise, as well as shared fiduciary responsibility and flexible execution.”

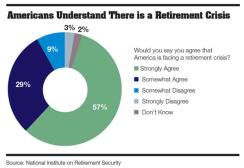

A retirement crisis

A recent report by the National Institute on Retirement Security (NIRS) indicates that 86 percent of Americans believe there is a retirement crisis. That report – as well as other studies – indicates that Americans are deeply worried about their retirement outlook, particularly the large majority of workers facing a substantial savings gap.

However, there are a number of challenges facing employers and plan sponsors as they seek to develop more effective retirement strategies:

• Many employers do not offer DC or DB plans for their employees, making it more difficult for them to save for retirement.

• Many employees who have contributed to DC plans find it difficult to move their accounts to a new employer. “We need to make those roll-ins much easier,” says Brown. “We should also encourage retirees to stay in their DC plans because having more assets drives down fees and costs for everyone.”

• Many near retirees don’t know how to maximize their Social Security benefits. “There are more than 300 different ways to claim Social Security, and how many advisors are available to help them make those decisions?” says Murphy.

• Most DC plans don’t take an employee’s health status into account when preparing financial projections. However, a healthy employee may face a higher longevity risk (outliving his or her money) than an employee with a serious chronic condition like obesity or diabetes.

• Federal regulators have been reluctant to allow DC plan sponsors to include guaranteed income options, such as immediate or deferred annuities, in their offerings, although that position is changing.

“We as an industry can do a better job of helping employees understand how to move through that transition phase,” says Murphy. For instance, surveys indicate that older employees who work with a paid advisor have an 82 percent replacement income score while those who didn’t have only a 55 percent replacement rate.

“If you work with advisor you have a road map and can be better allocated in how you approach the market,” he says. “Those advice-based insights can be embedded into the products themselves, such as TDFs, annuities and managed accounts within 401(k)s. This is all part of the personalization of retirement strategies.”

Increasing savings rates

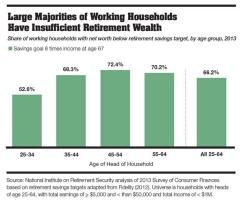

How bad is the U.S. retirement savings problem? A new report, “The Continuing Retirement Savings Crisis,” issued in March by the NIRS says the typical working household has virtually no retirement savings. The problem is particularly acute for employees nearing retirement. The study said 62 percent of working households age 55-64 have retirement savings less than one times their annual income, which is far below the level needed to be self-sufficient in retirement.

For DC plan sponsors, encouraging participants to make the contributions needed to build their assets for retirement remains a major challenge. “The retirement industry must continue to educate and communicate the importance of saving, while recognizing that it doesn’t move the needle as much as we would hope,” says Brown.

That’s why auto-enrollment and auto-escalation provisions in DC plans play a key role in improving employee savings. “The most popular level for auto-enrolling participants is 3 percent,” says Brown. “But auto-escalation provisions are important because participants will eventually need to increase their contributions to the 12 to 15 percent saving level.”

Brown adds that some sponsors have implemented a higher contribution level for initial enrollments and for auto-escalation levels without much push back from participants. “The levels of opt-outs have been relatively small,” she says.

However, Murphy notes that some companies may have a limited ability to match participant contributions, especially at the higher rates. “Even if the employer wants to escalate, it may be a financial challenge to deliver that match,” he says.

Overall, the U.S. personal savings rate was 5.8 percent in February, according to a March 30 report by the U.S. Department of Commerce’s Bureau of Economic Analysis. That includes savings for immediate goals, as well as retirement.

“We play close attention to savings through our recordkeeping platform and believe the average rate will increase in the next few years,” says Frank van Etten, deputy chief investment officer, Multi-Asset Strategies and Solutions, Voya Investment Management. “After all, if you don’t save enough, even an appropriate asset allocation won’t deliver an adequate level of replacement income in retirement.”

Designing DC plans

Providers are helping DC sponsors with fresh approaches to plan designs, including streamlining participant options, an emphasis on default products and auto features, and the inclusion of alternative asset classes along with cash, stocks and bonds.

“DC plan sponsors want to define the desired participant experience, both behaviorally and in terms of retirement readiness,” says McCareins, practice lead, Institutional OCIO, at Northern Trust. “Plan sponsors should have an investment policy statement in place and adhere to that policy to minimize litigation risks.”

Sponsors know that they can get the attention of participants briefly at the time of enrollment, but after that only 10 to 20 percent of participants are active and engaged, says Gerald Erickson, principal, Milliman. “So, you need a good top-down design with lots of auto features. In other words, you make inertia work in favor of participants, rather than against them.”

In keeping with that theme, DC sponsors are adding more re-enrollment and default investment provisions in their plans. “Unless the participant opts out, the assets get moved into an age-appropriate TDF,” Brown says. “This is very effective, because it increases the diversity of the participants’ holdings, so there is less reliance on one asset, such as the company stock.”

A growing number of plan sponsors see the benefit in offering two main choices: a one-decision product that is fully diversified and tracks a participant’s risk preference or age over time, and a “do-it-yourself” option with multiple funds, says Bob Boyda, head of global asset allocation, Manulife Asset Management.

“DC plan participants are seeking simplicity and ease of use,” he adds. “That has provided the impetus for offering one-decision funds, such as target risk and target date products.”

Boyda says Manulife’s research shows that participants who own these one-decision funds tend to hold on to their assets without moving money around. “As a result, they get all the advantages of long-term investing, such as dollar cost averaging and compounding of interest over time,” he says. “Participants owning one-decision funds on average do 120 to 150 basis points better than other participants over a five- to ten-year period.”

On the other hand, DC plan participants who take a do-it-yourself approach are most at risk. “They tend to be too concerned about volatility and make bad decisions,” Boyda says. “The buy-and-hold model works much better for most participants.”

However, DC plans can also include options that provide opportunities for savvy participants to generate alpha (higher risk-adjusted returns) around the edges of their portfolio. Boyda says that might include an equity allocation in the employer’s industry, such as pharmaceuticals or energy, since participants are likely to be more familiar with that sector. “While many sponsors look at passive equity funds, active managers can add value by identifying cash-generating companies that can provide potential returns through the years,” he adds.

Guaranteed income is another emerging issue in DC plan designs. Immediate annuities can help participants make the transition from accumulation to decumulation, while deferred annuities that provide income at age 80 or 85 protect against longevity risk. “Today, regulations are more accepting of annuities as an in-plan solution to the retirement income issue,” says van Etten.

While guaranteed income products will become more popular, they are complex and hard to understand, says Dial. “They are also different from the DB pension plans, because the retiree – not the plan sponsor – carries the market risk.” In other words, a 64-year-old with a pension might be able to count on getting $25,000 a year for life. However, a 401(k) plan might provide that same 64-year-old with anywhere between $15,000 and $35,000 a year, depending on market fluctuations.

Focusing on TDFs

Because target date funds are a key component in today’s DC plans, service providers are focusing on key issues like TDF design, asset mix and glide paths (changes to asset allocations as a participant nears retirement age). “We are in the early stages of the evolution of target date funds, but the pace of innovation is picking up quickly,” says Dial.

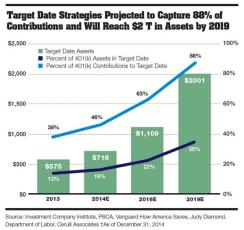

Robert G. Capone, managing director and head of Defined Contribution and Sub Advisory for AQR, notes that the DC market now has approximately $6 trillion in assets and that TDFs have become the dominant QDIA in DC plans with nearly $3/4 trillion of assets under management.

Last year a sampling of DC plans by Callan showed that more than 80 cents of every $1 contributed to DC plans went to TDFs, and others estimate that TDFs will become half of total DC assets by 2020, he says.

However, Dan Loewy, CIO and Co-Head of Multi-Asset Solutions, AllianceBernstein (AB) says most target date funds are managed as “relics of the past” and don’t incorporate today’s best practices and solutions.

“Most use a single proprietary fund manager for all the options rather than engage an independent fiduciary to oversee the performance of the various managers,” Loewy says. “Target date funds generally incorporate only traditional investments like stocks, bonds and cash, rather than non-traditional diversifiers. They also focus on accumulation and don’t have a guaranteed income component.

Van Etten has seen a trend toward open architecture in target date funds. “Incorporating multiple managers from across the industry After all, a single-asset manager focuses on one area of the investment universe,” he says. “However, a multi-manager solution allows sponsors to seek out the best-in-class managers for different types of assets.

“We believe in a hybrid approach within target date that includes passive funds with lower costs,” he adds. “However, there are asset classes where passive alternatives are costly or difficult to replicate passively, such as bank loans or emerging market debt. Unless you exclude these asset classes from your opportunity set, you will need actively managed strategies in order to gain exposure to areas that can add value to the portfolio.

To increase diversification, illiquid asset classes, such as private equity, private real estate and infrastructure, can also be included within the plan design. “Pension plans have been doing this for years because these assets can provide very attractive risk premiums along with risk diversification,” says van Etten. “Today, adding these asset classes in a way that controls risk can provide benefits to participants outside a ‘plain vanilla’ plan design.”

Loewy says a state-of-the-art DC plan should resemble a traditional DB plan with a multi-manager platform, a broad set of asset classes, diversification across geographies and traditional and non-traditional strategies that all come together to provide an income stream in retirement. “We think a well-constructed target date fund can accomplish the same things,” he says.

Davies agrees, adding that the use of non-traditional or alternative investments will increase with packaged products that offer inflation mitigation or capital preservation along with a wider opportunity set for generating potential returns. “The biggest challenge is reaching the mid-size employers who need to move beyond their traditionally concentration on three or four asset groups and offer far more diversified 401(k) plans,” he adds.

Differing TDF approaches

One of the big questions for DC plan sponsors is how to improve the TDF to mitigate retirement savings risks without sacrificing performance. “There are two desired outcomes for participants: wealth accumulation and wealth preservation,” says Capone. “To accomplish these outcomes, we need to help participants increase diversification of their portfolios through exposure to various asset classes with low or no correlation to one another while also limiting drawdowns by better managing portfolio volatility.”

Capone says most TDFs today are overly reliant on equities, which are four times more risky than bonds. “It is important to reduce that equity risk concentration for the near retiree, who may not have the luxury of time to recoup the losses that could occur in a severe market downturn like that of 2008,” he says. “We think that a risk balanced diversified portfolio offered as a component of TDFs can help participants achieve such results.”

On the other hand, Boyda says a long-term view of retirement outcomes places equities, rather than fixed-income securities at the heart of a retirement income strategy. “We have largely won the battles against inflation, and glide paths should take that into account by adding more equities,” he says. “A more aggressive strategy can take advantage of the compounding effect of wealth in the equity market over a long period of time.”

Fulford says TDFs should incorporate assets that can track return expectations and interest rates at the time of retirement. “A participant who retires in a favorable market environment will have a much better outcome than one who retires during a severe downturn – even if both have accumulated the same amount of assets,” he says. “In other words, the TDF glide path design should consider retirement liabilities, not just the income goal.”

Fulford says that TDFs traditionally have been constructed with cash as the foundation, adding risk-oriented assets to build a diversified portfolio. “But if you look at retirement income as the goal, cash is no longer a risk-free asset,” he says. “An environment with interest rates at 5 percent produces different income outcomes for a retiree than when the rates are at 1 percent.”

Fulford believes a better approach is to begin with long-duration TIPS (Treasury inflation protected securities) and use other assets to build a diverse return-generating portfolio while mitigating downside risk. “During a participant’s 30- to 40-year investing period, there will be environments where stocks and bonds don’t perform well. Therefore, adding alternative asset classes, such as real estate, emerging market stocks and bonds, high-yield and commodities can produce better long-term returns with lower overall risks.”

Developing more

customized solutions

In designing their plans – particularly participant glide paths – DC sponsors should seek out customized solutions that provide the best fit for their participants, say service providers.

“Plan sponsors, consultants and advisors realize that the concept of one-size-fits-all is not the best approach,” says Dial. “The demographics of plan participants are different, their risk tolerances are different and their savings rates are different as well. All those factors need to be taken into account in developing a customized approach.”

For instance, a more conservative the glide path may be appropriate for participants with a relatively high level of savings. “In the past, many glide paths were very aggressive because savings rates were so low,” Dial says. “Now, if savings rates do go up, then sponsors should review and adjust their target date funds and glide paths accordingly.”

Risk mitigation strategies are also important for participants nearing retirement age. “Allianz has been using the umbrella concept in Europe for more than a decade,” says Dial. “If there is a downpour like in 2008, you can open that umbrella and implement risk mitigation strategies within the portfolio. That involves putting in risk paths at certain points above and below the equity glide path to provide a level of asset protection.”

Along with asset allocations, glide paths and risk mitigation strategies, DC plan sponsors can help participants make the transition to retirement by offering personalized guidance and advice. As van Etten says, “Sponsors need very clear communication strategies with online tools to show participants how their income situation looks in retirement.”

Defined Benefit Plans Balance Risks with Return Opportunities

There is no question that American workers love the idea of a pension plan. After all, it can provide them with a lifetime stream of retirement income without worrying about investment, inflation or market risks.

While many employers are downsizing their pension offerings, these defined benefit (DB) plans still play an important role in the retirement marketplace. In addition, Congress is considering legislation that would allow more small businesses to join multiple employer plans (MEPs) – a move that could create extend pension coverage and create opportunities for service providers.

Today, DB plans are looking at the varied approaches to meeting the financial needs of participants without taking on undue risks. “There are no cookie-cutter approaches on the DB side,” says Gerald Erickson, principal, Milliman. “Some plan sponsors are derisking to a certain extent. while others are actually re-risking to capture greater equity returns. We are also seeing hedging strategies designed to protect the downside risks on their equity portfolios.”

One important trend is that DB (and DC) plan sponsors are moving toward an outcome orientation in their investment strategies rather than an arbitrary risk and return focus, according to John McCareins, practice lead, Institutional OCIO, at Northern Trust. Rather than aiming for a 7 percent return as the historical precedent, a DB plan sponsor might reframe its objective and seek a 6 percent return and realize lower volatility based on its liability profile and funding strategy.

With corporate DB plans, the treasury and finance staff manage the assets to match a specific liability profile,” adds McCareins. “That means they have to develop a dynamic asset allocation. In other words, have the assets working smarter, not harder. That often leads to a discussion about investing in alternative assets with return patterns that are similar to their liabilities.”

Jeffrey Gould, head of Putnam Global Institutional Management, says DB plans are looking at multi-asset return strategies that can add value to a portfolio that is weighted toward fixed-income instruments. “Unconstrained strategies, such as credit and mortgage securities, can provide diversity as well as potential returns,” Gould says. Absolute return and risk parity strategies are also attracting interest from DB plan sponsors seeking a more balanced risk profile not overly tied to interest rates.

Public pension plans generally have lower funding levels than corporate DB plans, and are often willing to take on more risk,” says Gould. “While they have benefited from the bull market in equities, sponsors are looking for products that can diversify risks and returns away from an equity profile. They are also considering assets that will be effective in a rising-rate environment.”

By Richard Westlund