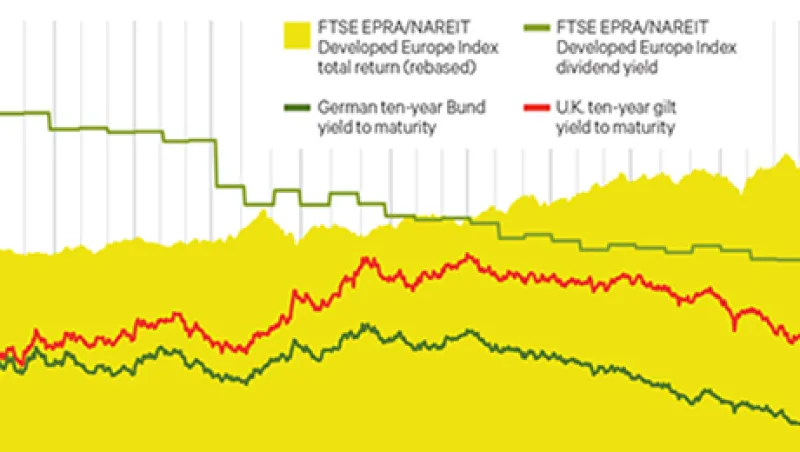

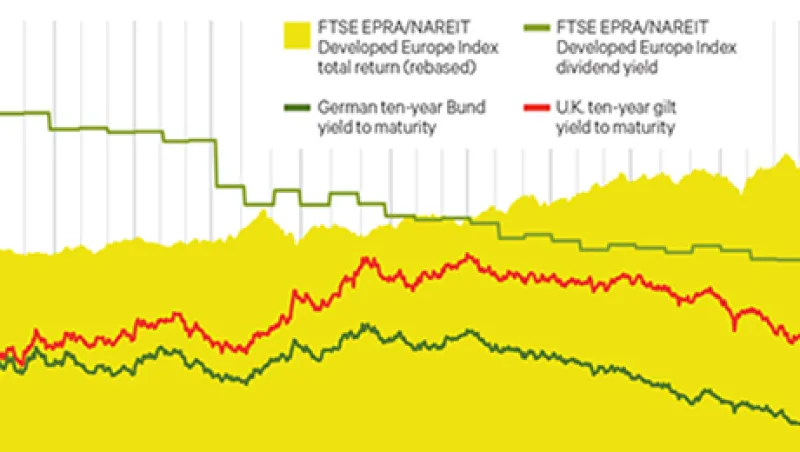

Falling Yields on European REITS Force Investors to Be Choosy

Lower interest costs and the euro zone’s new quantitative easing program have helped boost demand for real estate investment trusts.

David Turner

February 23, 2015