To view a PDF of this story click here

Ten years ago, when Wang Jingbo talked to her former boss about buying out the private banking department at the brokerage firm where she was working, she never thought the venture would become a trail blazer in China’s wealth management industry.

Noah Holdings Limited, or Noah, began modestly in 2005 as China’s first independent wealth management company. Wang and three other founding members launched the firm with just RMB 3 million in capital. They worked out of a small office in Shanghai furnished with second-hand furniture purchased from an online market.

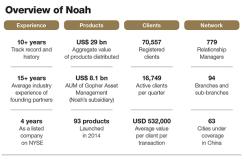

At the end of 2014, Noah Wealth Management employed 779 relationship managers in 94 offices, covering 63 cities in China. This makes Noah one of the largest and fastest-growing wealth management service providers in China, catering to the country’s swelling ranks of high net worth individuals (HNWIs)—a group now estimated to number more than 2 million with investible assets of at least US$1 million. Many of these HNWIs are Chinese entrepreneurs with flourishing businesses that are beginning to expand globally. Noah is globalizing its own services to keep in step with the needs of these clients.

“Back when we started the company, we sensed a growing need for services to help take care of people’s wealth, as nearly 30 years of rapid economic growth had lifted millions of out of poverty and created a sizeable class of people with substantial wealth,” Founder, Chairman and CEO Wang said in a recent interview with Institutional Investor.

“With that in mind, we thought Noah could be a pioneer in providing such services, even though we didn’t call it wealth management services back then. Wealth management was still a very foreign concept in mainland China in those days,” Wang says. “We want to distinguish ourselves by being a pioneer for wealth management in China, focusing on providing real wealth management advice and selecting the right products and services for our clients.” The name “Noah” was derived from the Biblical story of Noah’s Ark—meaning it will help its clients navigate stormy investment seas to find safety for their assets, says Wang, a devout Christian, “For our clients, this must be a secure haven.”

In its early days, Noah was mainly a distributor of financial products targeting its HNWI clients, operating as an independent third-party platform selling wealth management products developed by other institutions for a commission fee. But today Noah provides a wide range of its own investment products and services to more than 70,000 clients in mainland China as well as 1,300 clients overseas through its new operations in Hong Kong. According to CEO Wang, this makes Noah a leader in the industry in terms of market share as well as client retention and loyalty. The wealth management products Noah offers include private equity investments, overseas assets, fixed income, high-end insurance, mutual funds, short-term financing and public equity. Noah had distributed products with an aggregate value of RMB 180 billion, or approximately US$29 billion as of the end of 2014. Gopher Asset Management, a Noah subsidiary, had US$8.1 billion under management by the end of 2014 in funds involving real estate, private equity, hedge funds, credit funds and family office services.

Noah’s rapid growth has enabled it to become the first and only Chinese wealth manager listed on the New York Stock Exchange.

“The listing has accelerated our voyage and was to me the real beginning of private banking in China,” says Kenny Lam, Group President of Noah. Oxford- and Wharton-educated Lam is a former Global Partner of McKinsey & Company. Prior to joining Noah, he was head of McKinsey’s Asia Private and Wealth Management Practice.

But the voyage has included challenges. Early on, Noah encountered setbacks when it tried to convert the clients of securities brokerage firms into clients of its wealth management business, forcing the company to rethink its strategy for targeting clients, says Wang.

Noah then identified entrepreneurs of China’s booming small- and medium-sized manufacturing companies as its core client group. These are people whose businesses were showing strong growth, Wang says. Noah started working with local industry associations and chambers of commerce to reach entrepreneurs and executives around the country.

This strategy worked and the company grew rapidly until Wang and her management team soon realized Noah needed more capital.

In 2007 private equity house Sequoia Capital invested in Noah. This investment helped foster Noah’s expansion, according to Yin Zhe, another co-founder who is also CEO of Gopher Asset Management.

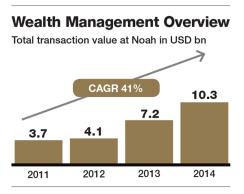

Noah’s Rapid Growth

Thanks to the Sequoia investment and the continued rapid Chinese economic growth—and Noah’s well-established brand in the market as an industry pioneer—the company since has been on a fast growth track that includes global expansion.

Noah is well-positioned to continue solid growth and embrace better, sustainable development in the next 10 years as it builds on its strengths in wealth management, asset management and its newly launched Internet finance business.

“We expect that the demand for wealth management services for HNWIs, institutional investors, family offices and white-collar professionals will only grow stronger in China over the next 5 to 10 years,” Wang says.

According to a research report

released by CITIC Securities in the third quarter of 2014, there are 2.38 million high net worth families in China with average financial assets of US$3.7 million. Such a large universe of HNWIs and China’s changing social dynamics are expected to serve as a foundation for Noah’s future growth.

To power its growth, Noah—known for innovations in the industry such as launching the first private equity fund of funds in China—aims to strengthen wealth management and asset management services and accelerate its Internet finance portfolio, Wang says. Wealth management and asset management are currently the two pillars of Noah’s business, according to Group President Lam.

“We have quite a few mandates now at around US$50 million each under discretionary management. We think this is the way to go in terms of private banking. Real private banking has a good proportion that is discretionary mandates, and that’s what we’re moving toward. It plays to our strength in client relationship and asset management,” says Lam.

For the wealth management business, Noah has built its distribution network covering most of the key first and second tier cities in China. By the end of 2014, Noah had 94 branch/sub branch offices in 63 cities throughout China. Each branch/sub branch office can provide Noah’s full range of services–from investments to education services to insurance. This has helped Noah deeply penetrate local markets across China and build significant relationships with its target client entrepreneurs.

In addition to improving and refining its product selection process and risk controls, Noah is broadening its product and service offering. “We started by focusing on alternative investments. We now have diversified into secondary markets, discretionary services, education, insurance and trust services among others. Our long-term relationships with our clients have allowed us to build a platform that is comprehensive but very targeted toward serving the needs of high net worth clients,” says Lam.

While the number of clients and the scale of assets under management continue to increase, Noah caps the number of clients that each level of relationship managers can serve to ensure better service quality. With the growing popularity of the Internet in China, traditional sales channels and business modes are undergoing profound changes.

Noah also has launched a new Noah mobile application positioned as an online community of Noah’s high-net worth clients. The app provides Noah’s clients with an efficient and convenient way to communicate directly with relationship managers, product team and even with Noah’s management.

The Noah app provides roadshows and product information to its clients. At the same time, relationship managers can serve their clients more efficiently.

Noah’s wealth management division also started conducting educational programs so clients can learn more sophisticated wealth management concepts such as family office practices. These educational retreats—including family members—help Noah build personal relationships with clients, Lam says.

Under this program, hundreds of Chinese families have been brought to Wharton, Stanford and Yale where they spent three to four weeks going through tailored programs on family offices, business innovation and private equity investments, all taught by these renowned universities’ faculty, Lam says.

The Other Pillar: Asset Management

Noah’s other business pillar, its asset management business, is a multi-boutique asset management firm specializing in funds of funds in private equity, real estate, and hedge funds.

“Noah has always followed a very stringent set of investment guidelines and a focused strategy. We are and want to continue to be a leader in each asset class that we are in,” says Noah’s co-founder Yin Zhe. “Our professional investment team has deep, targeted industry knowledge and experience. Project operations expertise is part of the formula for our industry-beating performance.”

One of the real estate guidelines, for example, stipulates that the firm focuses only on working with the top 100 developers in the country by sales, Yin says. Gopher Real Estate Fund Series I, a residential property fund focused on Chengdu, the capital city of Sichuan province, achieved a 29 percent internal rate of return when it exited in the first half of 2014.

Gopher Real Estate Fund Series II, another residential property fund focused on Fujian, racked up a whopping 78 percent internal rate of return when it exited also in the first half of 2014.

Gopher Asset Management has also strategically added office buildings, retail commercial space and overseas properties into its property portfolios, Yin says.

Gopher also has set up a dedicated unit called Gopher Nord to serve institutional clients. This business has grown tremendously since its inception in 2013, according to Yin.

In the third quarter of 2014, Gopher Nord raised RMB 3.02 billion in funds from its institutional clients, accounting for 17 percent of the total capital raised.

The target clients are insurance companies, banks, listed companies and the financial arm of enterprises, Yin says. “As we build up the team and clientele, and as our products mature, we expect to see sound growth in this line of business.”

Expanding Beyond China

Noah set up its Hong Kong unit, Noah HK, in 2012 as its first step outside of mainland China. The Hong Kong operation already has more than 1,300 clients as of the end of 2014, according to Shang Chuang, General Manager of Noah’s Hong Kong operation. “We probably have just scratched the surface in terms of helping our existing clients to invest abroad, and we are already experiencing increasing momentum,” says Shang. Overseas capacity-building will be another major push over the next few years as Noah builds itself into a private bank of choice for Chinese globally, Group President Lam says.

As many of China’s HNWIs from domestic-focused investment strategies to global asset allocation, Noah also is beefing up its overseas capacities to cater to this trend. Noah continues to launch more USD investment products through its Hong Kong office and has successfully completed fund-raising for funds of funds in the hedge fund, credit fund and private equity categories. USD products accounted for about 5 percent of total transaction value in the first nine months of 2014. The company plans to offer clients global asset allocation solutions by further diversifying its offshore products, and by partnering with leading asset management companies globally.

Noah is actively serving Hong Kong and Taiwan now and will soon serve countries and regions with Chinese communities, such as Australia, Canada and U.S.

“What we want to be is the private bank of choice for Chinese globally,” says Lam.

“Building our asset management business is the strategic direction of Noah,” says Chang, Noah’s Executive Director and also the firm’s Chief Marketing Officer. Prior to Noah, Chang was China CEO of ABN AMRO Asset Management. “The year 2014 will be remembered as the beginning of China’s coming golden asset management era,” she says. “Noah, as a well-established brand, is set to benefit from this expected explosive growth.”

Mobile Private Banking for White-collars

Apart from its current two business pillars of wealth management and asset management, Noah will embrace Internet finance, according to Lam. “We’ve grown tremendously in the last three years. This year and next is a bit of a ‘let’s make sure we build a sustainable platform’ time, and also ‘let’s invest in a few things that we think will be the next wave’. So that leads us to Internet finance in addition to an overseas push.”

In June 2014, Noah introduced YuanGongBao (literally meaning “Employees’ Treasure”), an app-based wealth management platform that targets white-collar employees of fast-growing companies in China. YuanGongBao provides them with a wide range of private banking-type services and products. Many of the owners of these companies are themselves Noah’s high net worth clients.

The new app-based private banking platform has proven to be very popular. In the six months following its launch, it transacted more than US$220 million in products and services, according to Lam. It has been adding new products since its launch, including insurance and lending. China’s internet finance market is still in its infancy and will be a massive “blue ocean” market, which could become a new growth spot for Noah, CEO Wang says. “We have a unique proposition for our Internet finance business—which is to allow young professionals and white-collars to enjoy the premium financial products and services that were previously only accessible to HNWIs,” she says. “They are probably not qualified to be HNWI clients now but they are young, aspiring, have bright career prospects and therefore have huge potential in the future. We want to grow with them.”

Using the internet service platform, and with the growth of asset management capabilities, the type of clients Noah serves has expanded from high net worth individuals to include high net worth families, white-collar professionals and institutional and enterprise clients.

“We talked a lot about wealth management in China and how it has been growing rapidly. But we are just getting started,” Lam says. “Whatever the economic cycles, we believe the wealth of Chinese people will continue to accumulate and the need for proper wealth management will only continue to rise. The market needs an institution that focuses not only on product push but on real product screening, discretionary management and asset management capabilities. Noah is exactly such an institution,” says Lam. Noah believes that in the next five to ten years, wealth management demand from white-collar professionals, high net worth individuals, families and institutional clients will enjoy tremendous growth potential. Noah will continue to benefit from its end-to-end and asset-light business model and established comprehensive service platform. Noah’s highly selective asset management strategy, with its core capabilities for finding high quality assets and managing risk, will continue to boost the company’s market share and profitability.

Contact Information

Investor Relations

Noah Holdings Ltd (NYSE: NOAH)

Address No. 32 Qinghuangdao. Rd.

Building C, Shanghai 200082, China

E-mail: ir@noahwm.com