PIMCO identified a secular investment theme a few years ago, and the logical progression of events is playing out close to the script. Circa 2007 we identified a theme we called “stable disequilibrium,” which preceded the financial crisis. “The new normal” of subdued growth and central bank action followed naturally from this. And then the new normal morphed into “the new neutral,” which is characterized by lower than historical growth rates and, consequently, lower than normal policy rates. The next logical step is a natural market ecology that consists of large market movements caused by improperly positioned participants and even more radical policy responses.

Policy responses emanating from the willingness and the ability of central bankers to try to support their local markets and hopefully their real economies can best be characterized as a culture of “credible irresponsibility,” which we first discussed in a forum a few years ago. Credible, because they can do it — they have the ability, at least in the short term, to follow up on their promises to deliver even more massive doses of stimulus (witness the well-anticipated quantitative easing announcement on January 22 by the European Central Bank). Irresponsible, because in a game of chicken, the unpredictable actor, who appears to be acting irresponsibly in the short term, has the better chance of being the winner. From the perspective of market participants, credible irresponsibility was best illustrated by the decision of the Swiss National Bank on January 15 to suddenly, and without warning, drop the floor it had put in place for the Swiss franc versus the euro (see chart 1).

The massive currency swings that this created resulted in irrecoverable damage to many large and small investors. But consistent with our theme, this swing was nothing but a continuation of the natural evolution of the interaction of policy and markets that will result in fatter tail events and market distortions.

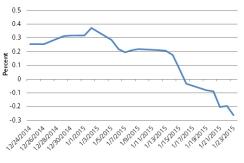

The greatest distortions are evident in the interest rate markets. Swiss yields (both government bonds and swaps) are negative out to ten years. In other words, you have to pay the Swiss to lend them money. There is a rational (relatively speaking) explanation for this: Swiss short rates are negative — Swiss target rates are minus 0.75 percent, and one-month deposit rates quoted at minus 1.625 percent on Monday traded at minus 3 percent just a week ago (see chart 2). (One would naturally trace the highly volatile movement in deposit rates to the unwind of currency-forward positions that were not prepared for such a surprise, though evidence of this smoking gun will probably emerge in the weeks and months to follow.) Since long-term rates are nothing but an average of short-term rates in the future, and if we assume negative short-term rates out into the future, the negative longer-term yield follows arithmetically.

But we should step back and reflect on whether, as investors, we are willing to pay for the privilege of lending (in absolute terms) for the next ten years to a country that depends on banking and exports (both of which suffer under perpetual negative rates) and that willfully allowed a 30 percent strengthening of its currency against its trading partners after promising the opposite. Whatever the answer to that question, one cannot ignore the fact that this type of market distortion is a natural aftermath of fluid policy action and opens the door to unforeseen risks and fat tails.

Whereas it might not be easy to protect against unforeseen events (see PIMCO’s October 2014 Viewpoint, “Can Anything Go Wrong for the Markets?”), one can readily see that the logical aftermath of “the new neutral” is an environment of unpredictability, market distortions and fat tails. The theme for portfolio construction that works in such environments is one of opportunistic strategies combined with tactical allocation and well-protected exposure to risk assets. Hanging your hat on the central bank put is becoming fraught with dangers the likes of which none of us have seen — ever. Good luck.

Dr. Bhansali is a managing director and portfolio manager in the Newport Beach office. He currently oversees PIMCO's quantitative investment portfolios.