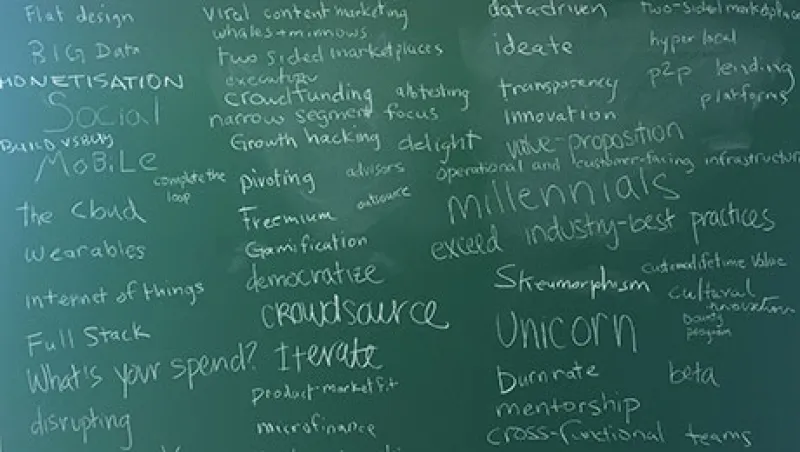

In the corner of Robinhood’s headquarters in Palo Alto, California, there’s a blackboard covered with four columns of neatly handwritten words. Whenever one of the commission-free brokerage app’s 30 employees hears a new bit of Silicon Valley jargon, he or she goes and writes it down for all the company to enjoy. On this “wall of buzzwords,” as they call it, you’ll find all the usual suspects (“wearables,” “the Internet of things,” “freemium,” “democratize”), as well as a number of more niche entries (“whales and minnows,” “blockchain-based app,” “narrow segment focus,” “what’s your spend?”).

But the one buzzword you won’t find is one that crops up whenever companies like Robinhood, which has amassed 800,000 users with an average age of 26 since launching last December, are discussed: fintech. In the past, large-scale financial technology was developed mainly by bulge bracket banks and other big Wall Street institutions. It was usually complex, ponderous and difficult to use — a world away from the slick and intuitive apps and tools seen in consumer technology. But over the last few years, with post-financial crisis regulations constraining banks’ balance sheets and forcing them to keep more of their cash in-house, independent financial technology startups have taken off. In the process, dusty old financial technology, which had a big focus on incremental efficiency gains in back- and middle-office processes, has given way, if only in a rhetorical sense. Financial technology has died, and in its place has emerged a far cooler, casually elided cousin: fintech.

Since 2008, global investment in fintech startups has tripled to nearly $3 billion; much of the activity is centered, predictably, in Silicon Valley, New York and London. A recent report by Accenture predicted that fintech investment will grow to up to $8 billion by 2018. San Francisco–based Lending Club’s $5.4 billion initial public offering late last year — the largest for a U.S.-based tech company in 2014 — represented a fresh peak for this new wave of startups, shining attention on a corner of the technology world that had long sat in the shadow of the giants of consumer tech, such as Amazon, Facebook and Google. Lending is a big focus for startups in the burgeoning sector, as are payments and billing (Stripe, Square), wealth management (Wealthfront, Betterment), personal finance (Robinhood, Acorns) and digital currency and blockchain applications (Coinbase, Blockstream). Most of these companies are building products for the retail market, but startups with an institutional finance focus are growing in number as well.

Financial technology lives on, of course, as an in-house concern at Wall Street’s biggest institutions. If anything, every major financial institution today wants to style itself, in some way, as a technology shop as well. But for young professionals, “doing” financial technology no longer means chaining yourself to an established firm. Because the falling cost of technology has made it possible for startups to get going and (buzzword alert) A/B test their products and ideas (using two variants, A and B) with far greater efficiency than in the past, there’s now a viable and potentially very lucrative career path in finance for the industry’s brightest young things that doesn’t rely on conventional progress through the ranks of the big banks or hedge funds.

Gregory Ugwi worked as a trader at Goldman Sachs before starting New York–based Thinknum, a financial modeling platform, in 2013; his co-founder, Justin Zhen, worked at a hedge fund. Bastiaan Janmaat used his experience as an investment banking analyst, also at Goldman, to launch Palo Alto–based DataFox, a private markets intelligence tool. And Simnan (Sam) Abbas got his start on Wall Street at a proprietary trading firm before co-founding New York’s Symmetric, a hedge fund performance tracker, in 2014. All four founders joined me on a set in downtown Manhattan in February to discuss their experiences breaking out on their own. Each is (buzzword alert) leveraging the insights he gained as a conventional worker bee on Wall Street to solve some fundamental inefficiency in the way the industry operates: Thinknum circumvents the ponderousness of Excel by giving users a central, browser-based hub to share, collaborate on and manipulate financial models; Symmetric has worked with institutional investors to create a service designed to bring transparency to the opaque world of hedge fund performance; and Janmaat built DataFox to make the job of investment banking analysts tracking private tech companies for potential deals easier. In the past, these products might have been built by individual institutions internally for their own use and jealously guarded from competitors; but as the up-front capital, not to say the risk appetite, needed to build technologies such as these has declined, the economics have also flipped, and it’s now more attractive to wrap a services startup around them and sell to many institutions at once.

Just how far fintech can go in the world of institutional finance, of course, remains to be seen. The space, (buzzword alert) as everyone in the trade likes to call it, is still in the first flush of a product-development boom, and the natural attrition and rationalization of this flood of new startups has yet to take place. But observing whether these small companies mainly endure as independent shops, consume each other in an orgy of consolidation, or get co-opted and eventually swallowed by the still-powerful big cats of the Street—whether, in other words, they will eventually turn out to be little more than grooming schools for big bank and hedge fund technology groups — should make for fascinating corporate theater over the years ahead. (In other words: Whales and minnows, baby.)