To view this report as a PDF click here

Imagine a scenario where you have to decide between two menus for all of the meals for the rest of your life. Would you choose the same meat and potatoes (maybe in different proportions) day in and day out? Or would you choose professionally prepared meals that would not only be more nourishing and satisfying, but ultimately lead to better overall long-term health and well-being?

What happens when we apply the same concept to the current state of fixed income offerings within 401(k) line ups? Does the commonly accepted belief that “simple is better” actually lead to improved retirement outcomes for plan participants? While simpler may be better when it comes to participant choice, consider this: in most defined contribution (DC) plans, 25-year olds and 65-year olds hold exactly the same fixed income portfolio, often a strategy benchmarked to the Barclays U.S. Aggregate Index.

Is this logical? Is holding the same portfolio for these two age groups logical, despite the rich and diverse fixed income tools that could be made available? Most would probably agree that equity diversification is important for younger participants. However, isn’t fixed income diversification arguably more critical for participants who are closer to retirement and who have larger plan balances, and a more urgent need for a purpose-built portfolio for their fixed income investments?

Consider corporate defined benefit (DB) plans, which have generally adopted a fine-tuned approach to matching fixed income sector allocation decisions to specific liability objectives. Many DB plans are able to make more meticulous portfolio construction decisions with respect to credit, duration, currency and yield curve exposures.

After all, what is a corporate DB plan? A portfolio that sets aside money today to meet an expected stream of future payments tied to a future retirement date. What is a DC plan? A portfolio set aside today to meet an expected stream of future payments tied to a future retirement date. Why then, do plan sponsors, often the same plan sponsors, approach fixed income portfolio construction so differently?

What if we extended the fixed income toolkit—expertly wielded within white-label investment options to preserve the simplicity of participant choice—and seized the opportunity to provide DC plan participants with more precise fixed income tools, similar to their DB peers?

We contend that loosening the artificial constraints placed on fixed income within DC plans can help plan sponsors provide their participants with enhanced diversification and the potential for better risk-adjusted returns. In addition, we believe that more customized, precise fixed income portfolios may better serve the individual needs of participants, certainly more so than clinging to one-size-fits-all, index-based compromises that DC plans have historically inherited. How Macro Policy Mutates the Index

We tend to think of the Barclays U.S. Aggregate Bond Index as an unchanging monolith. The index is fixed income and vice versa; it’s virtually a mathematical identity. However, is this true? Or does this pervasive belief blind us to latent risks and the opportunity afforded by increased sector diversification within fixed income?

The Barclays U.S. Aggregate Bond Index (the Index)—like most conventional indexes—is issuance-weighted. Since 2008, the U.S. government has actively sought to stimulate the economy through increased consumer and government expenditures, leading to an increase in U.S. government borrowing through unprecedented intervention in the U.S. Treasury markets. As a result, the Treasury component of the Index is about 35%, more than 10% higher than it was in 2008.

On the whole, government-related debt—including U.S. Treasury, agency, sovereign/supranational debt and securitized debt guaranteed by a federal agency or government sponsored enterprise —now represents more than 70% of the Index.1 However, cheap financing simultaneously triggered many corporations to borrow at record low interest rate levels. The changing composition of the Index resulting from these changes has consequences for the risk/reward profile of portfolios built with hefty servings of index-based exposure.

Lower yields paired with longer duration – The Index’s increasing emphasis on lower-yielding, interest-rate sensitive Treasuries and corresponding changes to prevailing interest rates for other components of the Index have an impact on the potential future overall total return. What’s more, the overall duration of the Index has increased 50% (50%!) since 2008, increasing interest rate risk.

Bifurcation of component credit quality – With corporations taking on additional debt, the average credit quality of the corporate bond component in the Index has slipped, as the proportion of Baa-rated corporate bonds—the lowest allowable quality tier—has increased by 10%.2 This creates a situation that is increasingly similar to a dysfunctional “barbell” strategy. High quality government-related debt is paired with (increasingly) lower-quality corporate debt to construct the Index.

Highly correlated index components – It may seem that the Index offers access to a diversified subset of sectors. In addition to Treasuries, there are also mortgages and investment grade corporates. In fact, the Index has moved largely in lockstep with U.S. Treasuries for the last 15 years, reflected by the high correlation between Treasuries and the Index of 0.90.3 Looking across the components of the Index, the lowest correlation is 0.57 over the same period—hardly compelling from a diversification perspective

(Figure 1). Without the ability to navigate outside of the Index to use potential sources of return and diversification, positioning for a changing interest-rate environment may be challenging.

The Case for White-Labeling in DC Plans

The question naturally becomes – how can plan sponsors diversify within the fixed income component of DC portfolios? We understand the reluctance to offer high-yield bonds or leveraged loans as standalone investment options. Instead, we believe that the use of white-label options can effectively “crack the code” for plan sponsors to offer their participants the ability to build a more broadly diversified, customized portfolio without passing on that complexity. In fact, given the breadth of the fixed income market, white-label multi-manager options may be essential to help participants get the most out of the fixed income portion of their portfolio.

White-label, multi-manager options enable plan sponsors to deliver sophisticated portfolios to participants wrapped in simple, easy-to-use packages. After all, when we go to a restaurant, we don’t specify the exact list of ingredients the chef should use; instead, we select our meals from a simplified menu of complete entrées.

White-labeling facilitates a number of objectives: at its simplest, it is used to rename a single investment with a general description of the fund’s style or asset class (e.g., Fixed Income). However, a more sophisticated deployment provides the plan sponsor and/or its consultant with a mechanism to construct multi-manager investment options that include exposure to fixed income sectors not typically found on the core menu.

Using the Right Ingredients

Why go through the effort of adopting white-labeling and creating more sophisticated portfolios? Perhaps the more pointed question is why not? When the tools, partners, expertise, benefits and risks are available and understood, what is the justification for continuing to force a one-size-fits-all design on all participants? Our reasoning is two-fold, and both are critical to achieving better retirement outcomes through:

• Potentially better portfolio risk-return trade-offs – The addition of lower-correlated asset classes can improve the risk/return trade-off in a portfolio; in many respects, diversification remains the closest thing to a “free lunch” in investing. A larger opportunity set creates more opportunities to use the right strategies for the job.

• More customization – White-label designs allow plans to vary the fixed income portfolio design for different participants, either as standalone options or within custom target date funds (TDFs). Young employees, for example, can own more aggressive portfolios, say with higher exposures to high-yield and emerging market debt, while participants closer to retirement might own purpose-built

portfolios designed to help manage the transition between saving and spending, including higher-quality and shorter-duration debt.

Better Diversification

TDF glide paths, as well as most of the lifecycle finance literature, suggest that equity allocations should decline over a participant’s working career. To state the obvious, that also means the fixed income allocations are increasing; the average fixed income allocation of TDF mutual funds aimed at 25-year olds is 9.18% and for 65-year olds, it’s 52.65%.4 With today’s limited fixed income menus, are we offering an effective set of diversifying tools, or are we blandly asking if they would like more potatoes with their potatoes?

When it comes to diversification, it is generally true that more is better, as long as the additional assets offer the potential to improve the risk/return profile of the overall portfolio. We have certainly taken that lesson to heart on the equity side. Much has been said about equity diversification in portfolios and plan line-ups reflect it. Today, most plan menus include 10-12 equity options, covering the range of style boxes. Even in a “modern” streamlined plan menu, there are typically multiple equity options paired with a limited selection of one or two fixed income choices—usually an option tied to the Index and a capital preservation choice (e.g., a money market fund or stable value investment option).

We are not challenging the wisdom of offering a diversified set of equity investment options; as a general matter, we should provide tools for younger participants to build diversified, equity-focused portfolios (in addition to building widely diversified TDF portfolios). If you look at a correlation table across the typical nine style boxes (e.g., large, mid, small, value, core, growth) plus international and emerging market equity over the last 15 years, the lowest cross correlation is a still-high 0.70 between U.S. small value stocks and emerging market equity. While this may be enough to achieve adequate portfolio diversification, it may not be enough to dramatically reshape an efficient frontier.

Fortunately, once a white-label structure is adopted, plan sponsors are no longer limited to the choices built into the Index. In fact, across the broad fixed income landscape, fixed income correlations can be much lower, with even some negative correlations (Figure 2). Diversifying within the fixed income component of a portfolio may provide a greater ability to weather shifts between asset classes and markets, with potentially less volatility.

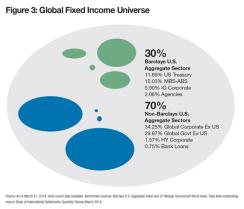

The opportunity set across the fixed income universe is much broader than the markets represented in the Index. Total U.S. Treasury, government-related, agency and securitized debt—the sector components of the Index—represent a mere 30% of the fixed income investment universe worldwide (Figure 3). Investors willing to venture beyond traditional core fixed income can access an extensive global opportunity set across a wide spectrum of sectors, quality, maturity and regions. Global corporate and government debt, municipals, high-yield corporate and bank loan debt could provide additional sources of return and access to growth in markets that may outperform U.S. fixed income sectors. Of course, under certain market scenarios or conditions, portfolios that include riskier sectors may underperform. Those sectors may also offer the potential to diversify investors’ risk exposure away from the duration risk which dominates the Index.

For example, several sectors outside of traditional fixed income are generating yields significantly higher than U.S. core fixed income. While traditional sources of income yield a fraction of what they used to, attractive yields are available to those willing to invest in less traditional and potentially more risky strategies—for example, emerging market and global debt (Figure 4). The global high-yield market has grown significantly and offers some of the lowest correlations to the Index. Moreover, global high-yield currently offers shorter duration and higher credit spreads and may outperform in a market driven by interest rates.

More Precision

Let’s go back to a notion we raised at the start: DB plans and DC plans are different formulas trying to solve the same retirement security equation. So why are the tools we use so different, especially for plans that are of a similar size?

Arguably, individual DC plan participants face a more complex retirement investment and spending equation than the chief investment officer of a DB plan: they can’t pool risk and their liability is naturally inflation-sensitive (while most DB plan chief investment officers are concerned with nominal liabilities). DC plan sponsors can help their participants avoid the consequences of making either an asset allocation or a spending mistake. Many individuals in this situation no longer have the luxury of additional years of future contributions or investment returns to get back on track, and returning to the workforce may not be an option. Nonetheless, we are asking these participants to solve this complex and high-stakes problem with very limited tools.

We can do more. What about thinking about DC plans in liability-driven investing terms? The bond market provides nearly limitless customizability; sponsors could create fixed income portfolios based on plan demographic characteristics that much more closely match an individual’s spending or withdrawal needs. For example, an individual planning on retiring early and using her DC plan to delay claiming Social Security until age 70 versus someone opting for a more conventional retirement at 65 may have different spending and withdrawal needs. Those portfolios could be built from common underlying building blocks (sliced by credit quality and duration, for example) and combined in different proportions.

It’s Too Hard?

No, it isn’t. What we have outlined may seem daunting, complex and new. It may perhaps even seem laced with more fiduciary risk. However, the expertise and experience to help manage through the process is readily accessible. Furthermore, these reasons are not sufficient to avoid exploring the potential benefits for current participants and future retirees. We know it can be done and we are confident that delivering sophisticated, institutional and customized portfolios and tools―the—right ingredients—can help create more secure retirements.

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. This material should not be relied upon as a basis for making an investment decision. Information is current as of the date of this material and obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. Because market and economic changes are subject to rapid change, the information, analysis and opinions provided may change without notice and we disclaim responsibility for updating this material. Franklin Templeton accepts no liability whatsoever for any direct or indirect consequential loss arising from the use of any information, opinion or estimate herein. Any views or opinions expressed may not reflect those of Franklin Templeton Investments as a whole. Investing entails risks, including possible loss of principal. Indexes are unmanaged and are not available for direct investment. Past performance is no guarantee of future results.

By: Drew Carrington, CFA, CAIA, Senior Vice President, Head of Institutional DCIO, Mary Beth Glotzbach, Vice President, Institutional DCIO, and Christopher Franta, CFA, Vice President, Senior Product Manager, Fixed Income

Contact Information

ºDrew Carrington, CFA, CAIA

One Franklin Parkway

San Mateo, CA 94403

Drew.Carrington@franklintempleton.com

www.ftinstitutional.com/dc

© 2015 Morningstar, Inc. All Rights Reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.©2015 Franklin Templeton Investments. All Rights Reserved.