When looking at key economic statistics, it’s important that we not adopt a fairy tale view about where we hope the economy is going but, rather, observe what the data concretely tell us or don’t. The disappointing May employment report, released by the Bureau of Labor Statistics on June 3, launched two competing narratives regarding the health of the U.S. labor market, and by extension of the economy overall. The first — overly optimistic — story line sees recent job weakness as a temporary blip on a path of continued strength. The second — overly pessimistic — interpretation suggests that recent jobs weakness augurs for recession. We at BlackRock think both narratives inadequately capture the reality of the economic moment and the challenge it presents for investors.

After a long stretch of historic strength, labor markets are beginning to moderate. That view is not intended to be a premonition of an overly negative economic outlook. We do not foresee a recession in the U.S. anytime soon — though we do think the solid U.S. economic growth powered by the labor market recovery has probably seen its best days in this cycle.

The May nonfarm payroll print of only 38,000 jobs gained came in well below the consensus estimate of 160,000 jobs. Both March and April numbers were revised downward by a total of 59,000 jobs. And even if we adjust for delayed weather-related drags from the warmer winter weather, as well as the well-publicized strike at Verizon Communications, the numbers are truly disappointing. In fact, the three-month moving average for payrolls is down to 116,000 jobs from an average level of roughly 230,000 in 2015. Yet if we shouldn’t expect last year’s pace to be maintained, we also shouldn’t anticipate recession. What, then, is in store for the labor market?

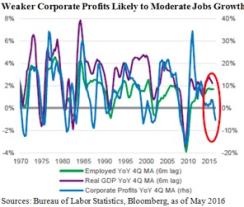

Ultimately, we think there will be much more moderate — yet still positive — growth. That near-plateau may be disappointing, but it is hardly surprising. For several months, we’ve argued that employment would trend down by mid-2016. That view was based in part on the fact that large-scale employment gains would be difficult to sustain in the face of existing labor market tightness. Additionally, we have grown increasingly concerned about the rolling over of corporate profits, as payrolls tend to track corporate profits quite closely — albeit with a six-month lag. We thus expect weaker jobs numbers to persist as the year progresses (see chart).

Finally, a profound secular transition in the economy continues, involving the long-term shift in leadership away from manufacturing-related areas of employment and toward the service and information sectors. That move closely corresponds to both consumer spending patterns and to the direction business activity is heading, and so the prospects for service sector employment warrant close attention, particularly as policy-related drags may force slowing there.

Specifically, we’re concerned that one of the strongest sources of job growth in recent years, the leisure and hospitality sectors, which delivered a three-year moving average of 35,000 jobs gained a month through May, could now face a significant headwind: higher wages. The tight labor market is pushing up compensation; plus there have been some meaningful increases in minimum-wage rates in several states over the past several months. It must be noted that nearly 15 percent of total leisure and hospitality industry employees are paid at the minimum wage, a higher percentage than any other employment category, according to JPMorgan research. Further, this research suggests that the hotel, restaurant and leisure industries are some of the most labor-intensive and wage-sensitive in the entire economy, which is to say that the dollar revenues per employee are also some of the lowest.

Thus when wage costs are increased through policy, rather than market mechanisms, revenues and profits can take a hit unless businesses can exhibit pricing power to correspondingly increase what they charge end-customers to offset their own labor cost increases. That may be possible if wage gains are widespread enough across the economy. But it is also quite possible that these businesses will fail to pass on additional costs and that hiring in this robust sector of the economy could slow materially. Already, average leisure and hospitality jobs growth has receded to an average of 13,000 jobs per month over the past three months — or only 37 percent of its three-year average level. If that trend were to continue, it would weigh on the overall jobs growth picture, and it would also complicate the Federal Reserve’s task of normalizing interest rates.

In the end, the economy has come a long way in recent years. How much of that improvement was because of exceedingly low rate policies is hard to say. We do think we have begun to witness a different elasticity between interest rates and growth and, ultimately, hiring. And that suggests the Fed is long overdue on a move to merely accommodative conditions, from a truly extreme policy stance. We can only hope that the baton of tangible stimulus for economic growth will get handed to the fiscal channel, which may take several months — and a major election — to get its act together.

Rick Rieder is chief investment officer of global fixed income for BlackRock in New York.

Get more on macro.