< The 2016 Trading Technology 40

17

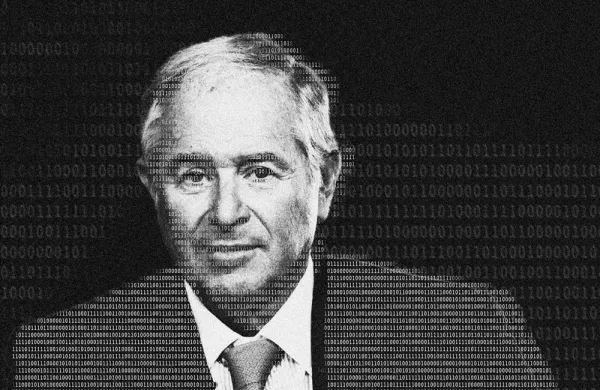

Philip Weisberg

Global Head of Foreign Exchange, Rates and Credit

Thomson Reuters

PNR

Cooper Union electrical engineering major Philip Weisberg began his career in 1989, writing trade blotters and getting coffee for traders in the currency group at J.P. Morgan & Co. He would go on to become a major force in the automation of foreign exchange trading. Working in the bank’s LabMorgan technology incubator in the late 1990s, Weisberg led the development of FXall, becoming CEO of the electronic trading platform when the business was spun out in 2001. He was still running the company in 2012 (ranking 35th on Institutional Investor’s Tech 50 that year) when Thomson Reuters acquired it for $625 million. In his current role as the financial data giant’s global head of foreign exchange, rates and credit, Weisberg, 48, has overseen the integration of FXall into Thomson Reuters’ FX Trading platform, which includes the company’s Matching central limit order book and Dealing peer-to-peer conversational trading system. “Marrying up the two companies was a great benefit because we could provide the combination of services to clients,” he says. The 14,000 Dealing counterparties and 1,500 FXall buy-side traders using Matching have access to electronic communication networks and other liquidity venues with a total average daily trading volume of more than $350 billion. “Technology has enabled all the market participants to basically see each other and connect with each other,” Weisberg says. Regulatory reform — including increased capital requirements and restrictions on proprietary trading in the wake of the financial crisis — is having a major impact on the forex market, says Weisberg, who represents Thomson Reuters in the Bank for International Settlements’ Market Participants Group. “People are redefining what is acceptable behavior on a sales floor and on a trading floor,” he explains, “and in order to meet those requirements, while it’s not mandated that the trades be done electronically, it’s a much easier way to reach the higher hurdles that the industry is setting in terms of conduct.”

2016 Trading Technology 40

Bloomberg

BlackRock

BATS Global Markets

KCG Holdings

Nasdaq |

Markit

Citi

Fidelity Institutional

Goldman Sachs Group

CME Group |

Intercontinental Exchange

CBOE Holdings

MarketAxess Holdings

EBS BrokerTec (ICAP)

Hong Kong Exchanges and Clearing |

IEX Group

Thomson Reuters

MillenniumIT

International Securities Exchange

Citadel Securities |

Convergex

Broadway Technology

REDI Holdings

Cinnober Financial Technology

Aquis Exchange |

Mana Partners

Arcesium

S3 Partners

AQR Capital Mgmt

Algomi |

PDQ Enterprises

Corvil

Portware

OTC Markets Group

Rakuten |

Dash Financial

Electronifie

SR Labs

Metamako

Tradier |

| |