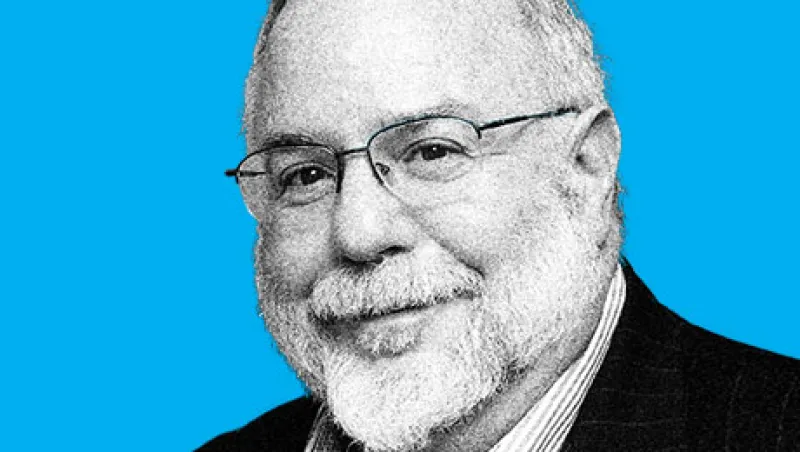

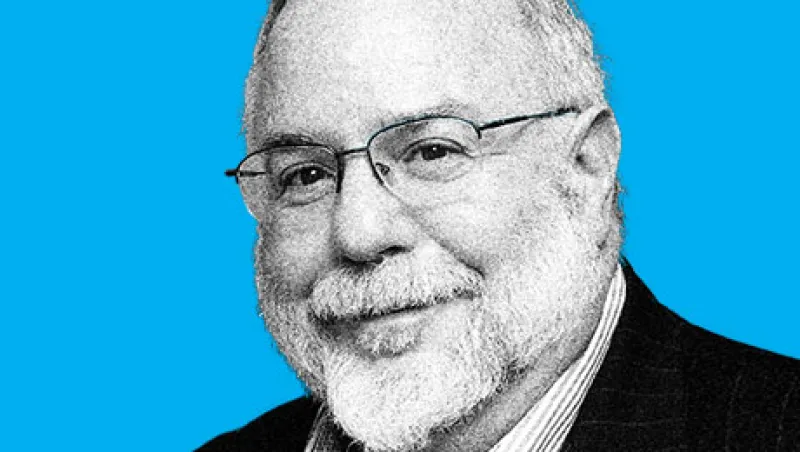

Finance Must Serve Investors and Economy Better, Jon Lukomnik Says

Governance expert Lukomnik argues that the growth of intermediaries has helped create a financial system focused on short-term gain.

Frances Denmark

December 1, 2016