< Fintech's Most Powerful Dealmakers of 2016

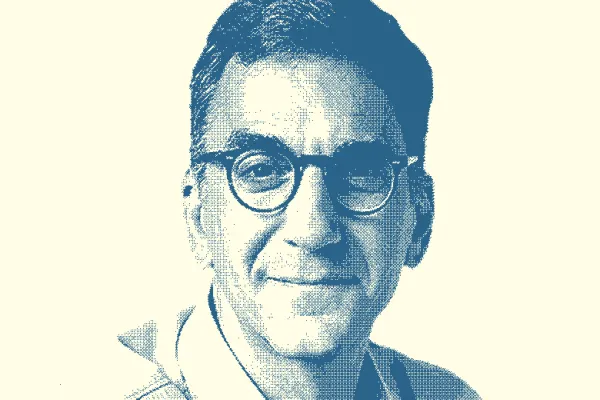

19. Michael Schlein

President and Chief Executive Officer

Accion International

Last year: 21

Cambridge, Massachusetts–based Accion International has had a hand in building 65 microfinance institutions in 32 countries since 1961. Under Michael Schlein, the former Citigroup executive and Securities and Exchange Commission chief of staff who became Accion’s CEO in 2009, the nonprofit is increasingly known for the fintech financing dimension of its mission to bring financial services to the poor. “We have been building double-bottom-line enterprises,” says Schlein, referring to Accion’s goals of “having a big social impact and harnessing the capital markets.” Accion has two vehicles outside of traditional microfinance: Venture Lab, which is supported by the likes of the Bill & Melinda Gates Foundation, Credit Suisse, and MasterCard, and has made more than $9 million in seed-stage investments in 24 companies since 2012; and the Accion Frontier Inclusion Fund, which makes early- and growth-stage investments and is managed by Washington-based Quona Capital, a venture firm focused on fintech in emerging markets. “It is the first global fintech fund for the un- and underbanked in the world,” says Schlein, 55, who has a bachelor’s degree in economics and master’s in political science from Massachusetts Institute of Technology and in addition to serving as president and CEO of Accion chairs the New York City Economic Development Corp. Frontier Inclusion Fund transactions this year included participation in a Series C funding for Indian small-business marketplace IndiaMART and an $8 million round for Mexican lending platform Konfio, which uses alternative, noncredit data analytics to gauge a prospective borrower’s creditworthiness. “This technology can create a much more predictive profile of users and provide an on-ramp to further financial inclusion,” explains Schlein, adding that nearly 1,000 fintech companies were vetted in selecting about 30 for the current portfolio. “We’re working to ensure that this technology, and the industry’s transition to digital, ultimately improve lives and drive further inclusion.”

The 2016 Fintech Finance 35

General Atlantic

Bain Capital Ventures

Evercore Partners

Robinson IV RRE Ventures

Financial Technology Partners

Anthemis Group |

Brad Bernstein FTV Capital

von Dohlen Broadhaven Capital Partners

Goldman Sachs Group

Nyca Partners

Ribbit Capital

Partnership Fund for New York City |

Digital Currency Group

Propel Venture Partners

Santander InnoVentures

SenaHill Partners

AXA Strategic Ventures

Citi Ventures |

Accion International

Marlin & Associates

CME Ventures

Andreessen Horowitz

Euclid Opportunities

SWIFT |

Life.SREDA

TTV Capital

Startupbootcamp Fintech

Innovate Finance

Bank of America Merrill Lynch

Fintech Innovation |

AMTD Group

FinTech Hong Kong

Future Perfect Ventures

Monetary Authority of Singapore

de la Miel Rakuten FinTech Fund |

| |