< Fintech's Most Powerful Dealmakers of 2016

32. Janos Barberis

Chief Executive Officer

FinTech Hong Kong

Last year: 3

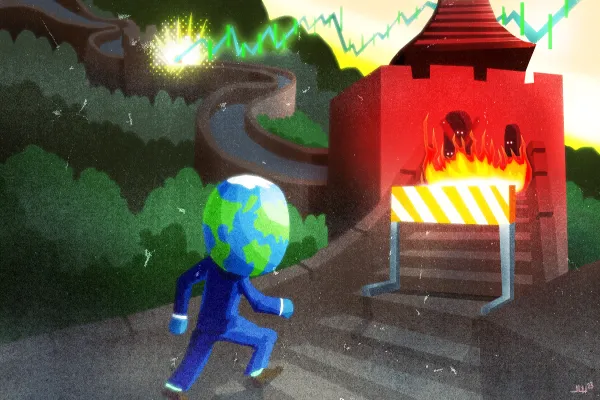

In September, unveiling a fintech innovation initiative resembling one previously launched by Singapore’s central bank (see Sopnendu Mohanty, No. 34), Hong Kong Monetary Authority chief executive Norman Chan sought to debunk what he termed “a quite commonly held perception that the development of fintech in the financial services sector in Hong Kong has been slow.” Although it may not match Singapore’s level of activity, Hong Kong has been heating up for at least the two years since Janos Barberis founded FinTech Hong Kong. The networking and events hub currently lists on its website 64 start-ups — P2P lender 5D Lend Co. and Bitcoin exchange Gatecoin, to name two — and claims nearly 2,000 “influencers, mentors, and enthusiasts” as members. CEO Barberis also brought to the Hong Kong ecosystem the SuperCharger accelerator, which offers mentoring and other assistance to what it calls start-ups and scale-ups, with supporting partners that include Fidelity International, Standard Chartered, and Thomson Reuters. Eight winners, including Gatecoin and Chinese credit scoring company Wecash, presented at the inaugural demo day, in April. SuperCharger went on a road show in September and October, stopping at Bangalore, Ho Chi Minh City, Jakarta, Shanghai, and Singapore; its second 12-week accelerator program starts in January. “The world is looking east,” proclaims Barberis, noting that while U.S. and European fintech funding declined in the first quarter, Asia was up 20 percent year-over-year. To the 28-year-old, who earned a law degree at the University of Hong Kong, worked at U.K. challenger bank Lintel Financial Services, and co-edited The Fintech Book (published by John Wiley & Sons in April), Hong Kong is an ideal base. He is plugged in locally as a member of the Hong Kong Securities and Futures Commission fintech advisory group and from there is able to monitor high-tech hotbeds on the Chinese mainland and, in other emerging markets, how digital-identity and know-your-customer technologies make banks more easily accessible and promote financial inclusion. “This has true transformative potential and shows how Asia, and particularly India, is paving the way in terms of the potential achievable with fintech,” Barberis says.

The 2016 Fintech Finance 35

General Atlantic

Bain Capital Ventures

Evercore Partners

Sponsored

Robinson IV RRE Ventures

Financial Technology Partners

Anthemis Group |

Brad Bernstein FTV Capital

von Dohlen Broadhaven Capital Partners

Goldman Sachs Group

Nyca Partners

Ribbit Capital

Partnership Fund for New York City |

Digital Currency Group

Propel Venture Partners

Santander InnoVentures

SenaHill Partners

AXA Strategic Ventures

Citi Ventures |

Accion International

Marlin & Associates

CME Ventures

Andreessen Horowitz

Euclid Opportunities

SWIFT |

Life.SREDA

TTV Capital

Startupbootcamp Fintech

Innovate Finance

Bank of America Merrill Lynch

Fintech Innovation |

AMTD Group

FinTech Hong Kong

Future Perfect Ventures

Monetary Authority of Singapore

de la Miel Rakuten FinTech Fund |

| |