The People: Most couples in their forties have entered their prime earning years, and with the end of tuition bills in sight as their children complete college, they suddenly have more money at their disposal than ever before.

The Behavior: For the human brain, this newfound liquidity could feel like a raise — a.k.a. the perfect excuse to splurge on that new car or timeshare in Hawaii. But now is the ideal time to make up for the under-saving they were doing when life was much more expensive.

The Expert Advice: According to Robert Stammers, Director of Investor Education at the CFA Institute, the organization that helps chartered financial analysts educate their clients in areas including retirement security, making up for this lost time is particularly difficult when couples have spent decades convincing themselves that this life stage is actually the finish line. “In the back of their mind the entire time they’ve been thinking, If I can just get the kids out of school, then I can buy all of the things I couldn’t afford before,” he explains. “But that’s a real trap, because now is when they can optimize their retirement savings.”

For that reason, Stammers believes this is the ideal time for such a couple to get disciplined by holding their expenses steady. “They have increases in income,” he explains, “so if they’ve set their lifestyle static and live within that, then all of their extra income can be put into a retirement account and start earning returns for the future.”

This is particularly important when one considers retirement liability — the amount of money that people need to amass to live for 30 years in retirement. “For a lot of people, that number is larger than they realized,” says Stammers. “It’s very hard for most people to hit that number if they don’t take the time to maximize savings in their forties.”

In fact, in a world where the U.S. Census Bureau estimates that the 90-plus population will quadruple between 2010 and 2050, the chances of a retired couple running out of money in their golden years are higher than ever before.

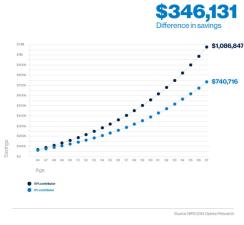

The Data: The temptation to spend newfound money on an extravagant purchase is strong, but now is when to make up for lost time. Take a hypothetical 45-year-old couple that is starting with $50,000 in savings, has an annual household income of $100,000 and plans to retire at 67. If they go from saving 9 percent to 15 percent of their salaries — and receive annual cost-of-living raises that keep pace with inflation — a 7 percent return on investment will yield nearly $350,000 more at retirement.

The Change: Using traditional methods, a couple preparing for retirement will spend whatever they’ve budgeted for the month, then save the money that is left over. But Stammers recommends using the inverse approach as a trick to stay on track: save the amount you need for retirement first, and only spend the excess.

Doing so makes saving for the future an active, not a passive, pursuit. “It gets you into this discipline of budgeting and tracking your expenses so that you live within your means and optimize what you save,” says Stammers, who emphasizes the importance of putting away even the smallest amount. “Over time, simply putting capital into the market is going to increase the probability of reaching your financial goal.”

As such, Stammers believes it’s vital to make saving as automatic as possible, and he sees target date funds as a great way to remain goal-oriented — particularly for investors who aren’t confident about managing their own money, and play it too safe as a result. “One thing that target date funds do is keep people in something that’s going to give them some return, as opposed to just being in a money market,” he explains. “This has the potential to give them a decent return over the long term. If you’ve got a target date fund, you’ve got a long-term lens.”

While it’s harder to quantify, target date funds also offer peace of mind. “At the CFA Institute, we say that if you’re having trouble sleeping at night, then you’re either in the wrong products or the wrong portfolio,” Stammers adds. “You should be able to put your money away consistently over time, and not be worried that you’re not going to make it to the end line.”

And if a couple over-saves? Stammers has yet to hear that complaint: “Let’s put it this way. No one is going to get upset by having too much money in retirement.”

RISKS: Investing involves risk. Some investments are riskier than others. The investment return and principal value willfluctuate, and shares, when sold, may be worth more or less than the original cost, and it is possible to lose money. Pastperformance does not guarantee future results. Asset allocation and diversification do not assure a profit or protect against loss in declining markets.

The target date is the approximate date when investors plan to retire and may begin withdrawing their money. The asset allocation of the target date funds will become more conservative as the target date approaches by lessening the equity exposure and increasing the exposure In fixed income type investments. The principal value of an investment in a target date fund is not guaranteed at any time, including the target date. There is no guarantee that the fund will provide adequate retirement income. A target date fund should not be selected based solely on age or retirement date.Participants should carefully consider the investment objectives, risks, charges, and expenses of any fund before investing. Funds are not guaranteed investments, and the stated asset allocation may be subject to change. It is possible to lose money by investing in securities, including losses near and following retirement.

© 2016 Prudential Financial, Inc. and its related entities. Prudential, the Prudential logo, the Rock symbol and Bring Your Challenges are service marks of Prudential Financial, Inc., and its related entities, registered in many jurisdictions worldwide.

0297226-00001-00