Five years ago the IBM computer Watson won a game of Jeopardy! against two former champions. Today it’s helping doctors treat lung cancer patients. Tomorrow artificial intelligence will give us smarter robots, autonomous automobiles and much more. Meanwhile, on the medical front advances in genomics are promising to one day make it easier to ward off disease before it begins, treat those who do become sick with regimens tailored to their bodies and even create new organisms to serve us in whatever capacity we need: plastics, vaccines, food.

Although no one can predict the future with certainty, investors—especially those with long horizons, like those saving in retirement plans—can benefit from working with active asset managers that take today’s most promising innovations into account when building investment portfolios. After all, investing for retirement, like innovation, is a forward-looking exercise. It challenges plan participants to solve today for a need—retirement income—that will only become pressing tomorrow. And it is more successful when the investor looks beyond current market trends to the developments that are creating the economy of the future—and thus will be the greatest sources of profit going forward.

“We believe innovation is the most powerful force in the economy,” says Brad Neuman, client investment strategist at Fred Alger Management, which offers growth-oriented, actively managed mutual funds and institutional accounts. “It can generate incredible investment opportunities. Academic studies show that the most innovative companies generally have higher future sales growth, higher future market share gains and higher future stock returns.”

To illustrate how dramatic the impact of innovation can be, Neuman notes that, in 1800, producing one hour of candlelight cost the equivalent of five hours of labor. By 1880, using a kerosene lamp, generating an hour of light required only 15 minutes of work. By 1950, with conventional filament bulbs, producing an hour of light required about 7 seconds of work. Today, with LED bulbs, the time is down to about half a second. “That equates to more than a 70,000-fold increase in productivity, or about 5 percent annually,” Neuman says.

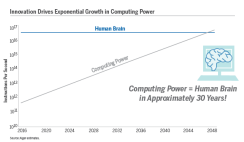

A similar trend can be seen in computing, where the development of ever-cheaper processing has proceeded at an exponential rate, from electromechanical computers built with levers and gears, to computers utilizing vacuum tubes, to the advent of the transistor, to switch electronic signals and finally to integrated circuits containing the equivalent of billions of transistors at a fraction of the cost. While specific computing technologies have come and gone, the amount of processing power that one dollar can purchase has grown at a relatively consistent exponential rate for more than 100 years. If this growth continues, affordable computers could reach the processing power of the human brain in about 30 years.

“For anyone with an investment horizon of ten or more years,” Neuman concludes, “innovation needs to be a focus.”

Alger sees a future driven by innovations in the technology and medical fields, including not only artificial intelligence but also big data, the Internet of Things, cloud computing, deep learning, voice recognition and genomics. Among the specific sectors and types of companies Alger sees profiting from these innovations, Neuman says, are security, including military and commercial drones and robots; automotive, through the development of autonomous vehicles; manufacturing, through greater automation; and health care. He also foresees gains for pharmaceuticals companies and pharmacy benefit managers: As scientists find ever faster and more economical ways to sequence genomes, drug makers will be able to create better products, while pharmacy benefit managers will be better equipped to help insurance companies determine which drugs are most effective and thus should have a place in their formularies.

All this can benefit retirement plan participants too—if they seek out active investment managers committed to identifying today’s most innovative companies.