It may be a cliché to say we live in a globalized world. Nonetheless, we are fascinated by the complexities, cross-currents and implications thereof. Think about human migration, international trade, climate change, war and terrorism, commodities production and capital flow dynamics. It is simply not tenable anymore — if it ever was — to hold an insular, domestic view.

The same holds true in the investment world, in which opportunity and risk ever more commonly transcend borders. That makes going global in both frame of mind and portfolio allocation increasingly important, especially for fixed-income investors facing the monumental challenge of meeting investment objectives in the ultra-low-rate world of policy distortion.

We at BlackRock have written that investors have been contending with a landscape that forced them to take greater levels of risk for diminished reward potential. And that is to say nothing of the political and event risks that abound in the world today. In this environment, we have suggested that maintaining investment flexibility would be vital to successfully navigating markets. That view has not changed.

Still, to what extent are investors already exposed to global markets? Many researchers have long counseled against home country bias, the tendency for investors to hold a greater proportion of their investments in domestically based assets. That is largely because adding foreign securities to a domestic portfolio can shift its efficient frontier in such a manner as to potentially enhance total returns while lowering volatility levels and improving overall diversification. That lesson has not been ignored.

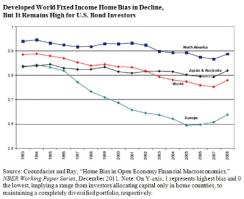

Indeed, research in the past five years has shown a decline in home bias among investors in developed markets, particularly those in North America, in recent decades, albeit more on the equity side of the portfolio than in fixed income, which still displays a relative lack of diversification (see chart). In the wake of the late-2000s financial crisis, it’s also not surprising that we saw an uptick in fixed-income home bias across the globe, as many developed-markets investors sought refuge in familiar flight-to-safety assets. That suggests there is further capacity for many investors to take advantage of the potential diversification benefits of globalizing bond allocations.

As to why fixed-income home country bias developed in the U.S. to the degree that it has, there are many likely reasons. Certainly, among them is the extraordinary ubiquity of the Barclays U.S. aggregate bond index, which came to dominate the industry in the 1980s and 1990s as the standard benchmark reference for fixed-income markets. Further, another potential explanation for investor hesitancy in embracing global bond allocations is concern over taking currency risk. The most cogent version of the argument against currency risk comes from David Swensen, the chief investment officer of Yale University’s endowment, in his 2005 book, Unconventional Success.

As Swensen puts it, “An unhedged foreign currency bond consists of a U.S. dollar bond plus some foreign exchange exposure.” Essentially, he suggests that foreign bond exposures are unnecessary for U.S. investors, because when one compares like foreign bonds by maturity and credit quality to domestic analogues, and then hedges foreign currency risk in the forward markets, we end up with a risk-return profile very similar to the U.S. bond in the first place. He then reminds us that foreign currency exposures are not thought to hold any intrinsic expected return in and of themselves and that currency trading can be a tricky business. In the end, Swensen concedes that unhedged foreign currency exposure does in fact provide potential diversification benefits in a portfolio context, yet he suggests such exposure can be derived from foreign equities.

Swensen’s case can be persuasive, and our own research also suggests that hedging the currency risk of the Barclays global aggregate bond index has indeed resulted in risk-return characteristics that are similar to the overall U.S. Agg. Still, we would like to point out that comparing a domestic index or bond with like foreign counterparts, on both a hedged and unhedged basis, is not reflective of the active management of a bond portfolio. Furthermore, from the perspective of adequate benchmarking, both the U.S. Agg and the global Agg lack exposure to inflation-linked bonds and the opportunities that market offers. And each benchmark — particularly the U.S. Agg — is also only very minimally exposed to emerging-markets debt, a growing and increasingly important part of the global fixed-income opportunity set. Arguments that too quickly dismiss exposures to foreign bonds and forex, never mind the broad set of yield opportunities around the world, fail to appreciate these key factors. Indeed, the economic and investment landscape is going through a period of profound change. Investment processes that fail to adapt will simply be unable to achieve stated goals.

Rick Rieder is chief investment officer of global fixed income for BlackRock.

Get more on fixed income.