By Amanda Townsley, CME Group

AT A GLANCE

- A series of geopolitical and economic events will help signal the path for crude oil prices

- After beginning the fourth quarter with low volatility, perceived upside price risk in crude oil options is at its highest since the invasion of Ukraine

Oil prices rose sharply in mid 2023, increasing over $20 per barrel in the third quarter. Low oil inventories, OPEC restraint, and fresh geopolitical supply risks have propelled the rally, but can these price levels be sustained? Commodities experts often say “the best cure for high prices is high prices.” Following are some events traders will be watching closely for guidance.

Federal Reserve Meetings

Higher oil prices can be linked to higher inflation, raising fears that the Federal Reserve may need to raise interest rates. The FOMC is set to make its next decision on rates on November 1. In September, the 30-Day Fed Funds futures market was giving 69% odds that the FOMC committee will keep rates unchanged, according to CME’s FedWatch Tool, with a 25 basis point cut priced as early as March 2024. Some experts say that higher crude oil prices could interfere with this expected path for interest rates. Higher interest rates can limit economic growth and liquidity, putting downward pressure on oil demand and oil prices.

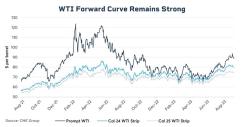

Quarterly Earnings: U.S. Shale Response

Supply restraint and capital discipline remain a mantra for the U.S. energy producer community, but so is profitability. While spot oil prices are off 2022 highs by over $20 per barrel, the forward curve for WTI has been much stronger, potentially giving producers a fresh incentive to ramp up drilling. For much of September and October, the Cal 24 WTI futures strip has exceeded $80, a level it only briefly touched on the previous rally. The CFTC’s Commitment of Traders (COT) Report, has been showing an uptick in Swap Dealer Short positions, indicative of increased producer hedging. Analysts will focus on the next round of quarterly earnings. Reports of higher demand from oil service companies and increased outlooks for capital expenditures by producers are clear signs of more supply to come.

Weekly EIA Reports: Demand Destruction

The largest daily oil price decline of 2023 came on October 4, following the Energy Information Administration’s (EIA) Weekly Petroleum Status Report which showed implied gasoline demand falling to its lowest level since the beginning of the year. The report, which typically is published on Wednesdays at 10:30 a.m. Central Time, sparked a flurry of concerns about the impact of high prices on oil demand, and these concerns are also reflected in recent expert forecasts. The EIA’s October Short Term Energy Outlook (STEO) revised Q4 oil demand lower by 130,000 barrels per day while the International Energy Agency’s (IEA) October release projected a decline in oil demand by 300,000 barrels per day for the first half of 2024. High frequency reports like the EIAs are a gauge for demand trends and inform forecasts.

Political Intervention

High gasoline prices at the pump often raise concern from the White House and other politicians, especially near elections. In September, the EIA’s report on Weekly Retail Gasoline prices showed the price for all grades, all formulations, jumped back over $4 per gallon for the first time since 2022, raising the risk of a response by the Biden Administration. Oil withdrawals from the U.S. Strategic Petroleum Reserve (SPR) were said to be an effective means to lower oil prices in 2022. With inventory levels already depleted, some believe SPR use will not be as straight-forward this time around, and other policy measures, such as sanction relief for Venezuela, are on the table.OPEC+ and Geopolitics

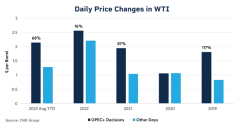

The move in prompt WTI futures prices from $81 to $90 came after major producing countries, Saudi Arabia and Russia, agreed to extend their voluntary cuts of 1.3 million barrels per day through the end of the year. At the October 4 meeting, the OPEC+ Joint Ministerial Monitoring Committee (JMMC) quotas were held constant, a decision thought to contribute to the oil price decline that day. November 26 is the first in-person gathering of the OPEC and non-OPEC leaders since June, and the last meeting before the voluntary cuts expire. OPEC meetings are historically associated with higher than average price moves.

Crude oil options prices are demonstrating that the market is increasingly focused on oil supply risks. The initial rise in oil prices had coincided with a period of relative calm: both historical and implied volatility started the fourth quarter of 2023 at multi-year lows. But as a result of the Israel-Hamas war, all that changed. 30-day implied volatility is back to 2023 highs and call skew – a measure of perceived upside price risk – has turned positive for the first time since the invasion of Ukraine.

Short-term implied volatility reflects this even more so, trading at a premium to 30-day volatility. On October 13, CME’s Crude Oil Monday Weekly option expiring October 16 (ML3V3) settled at over 52% implied ATM volatility and traded over 7,500 contracts. The Wednesday Weekly option that expires on November 1 (WL1X3) – the day of the Federal Reserve Meeting - was trading at only 39% implied ATM volatility.

Weekly crude oil options prices are one more thing to watch: they provide insight into how the oil market expects upcoming events to impact prices, and provide traders with precise tools to manage price and volatility risks that come with them. With oil supply risks now front and center, there is fresh reason to question how long it might take for high prices to really be a cure for high prices.