The U.S. Inflation Reduction Act (IRA) arrived with much fanfare, shining a spotlight on the investment potential of the global transition to net zero. But the IRA and other global regulations are not necessarily the driving force in net-zero investment today.

In fact, it is companies that are in the driver’s seat.

Many businesses are now setting and progressing voluntary emissions reduction targets to reduce risk, maintain market share and remain competitive against their peers. Over 8,000 companies have made commitments to net zero under the U.N.’s “Race to Zero” campaign.

These companies are not only motivated by their own decarbonization goals, but by the growing understanding that they are now competing on the carbon content of their products. Customers are increasingly focusing on ESG to help address emissions across their own personal value chains.

What’s more, changes to the plumbing of the financial system are moving climate change from the fringes to the forefront. These changes include mandatory climate disclosure, climate stress testing, science-based transition plans, portfolio alignment and frameworks to wind down stranded assets. These developments will bring climate change into the core of financial decision-making.

This means that companies’ ability to secure financing and attract customers increasingly depends on their ability to meet their emissions targets. Leading financial institutions have committed to accelerating the decarbonization of the economy through the Financial Alliance for Net Zero (GFANZ) and are pivoting their balance sheets toward the transition.

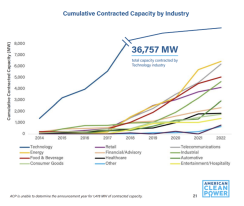

For companies, the easiest way to reduce their carbon emissions is by switching to renewable energy. They can do that a few different ways, including procurement, power purchase agreements (PPAs) and onsite generation. And demand is growing rapidly, with clean energy procurement hitting an all-time high in 2022 to reach 50 gigawatts globally.

That upward trend spans all industries, but large tech companies like Amazon, Microsoft, and Meta have led the way. We expect demand from these companies to increase by more than three times by the mid-to-latter part of this decade as generative AI computing grows. This could make the energy load of just one of these companies with a 100% renewable power target equal the current load demand of the entire U.K.

Investors are increasingly recognizing that lower-carbon emitters earn valuation premiums, and that this trend will likely broaden across sectors over time. We are already seeing evidence that companies with plans to be aligned to the Paris Agreement are trading at valuation premiums and creating excess returns. That's true at both the company level and the asset level in advanced economies, and it will become true across the emerging and developing economies. Becoming low carbon is a core driver of value and competitiveness.

Alternative asset managers like Brookfield are also deploying dedicated capital into the transition. Brookfield’s record-breaking $15 billion global transition fund has deployed or committed most of its capital since it closed in 2022. These investments span a range of critical technologies—think Scottish windfarms to power London’s largest retail and business district, renewable energy sourcing for one of the largest office portfolios in the U.S., distributed generation, batteries, carbon capture and more.

The demand for green power and other decarbonization products is stronger today and far outweighs the supply of new projects that are available. Companies are increasingly seeking decarbonization solutions since before the latest wave of supportive government regulations. The financial incentives the IRA provides simply accelerate a process that was going to happen naturally. And the incentives don’t need to last forever. As the industry continues to scale and cost curves continue to decline, these solutions will stand on their own.

Leading businesses and investors like Brookfield believe the transition will be faster than the existing targets governments have established.

In other words, they have a need for speed—and it’s time to buckle in.