Kathleen Kelley’s rise in the male-dominated hedge fund community seemed as inexorable as it was unusual. After earning a master’s degree in econometrics and quantitative economics from the London School of Economics and Political Science in 1986, Kelley worked as an economist at the Federal Reserve Bank of New York, then landed a job at renowned hedge fund firm Tudor Investment Corp. in 1990. “We hired Kathleen as a young macro analyst and encouraged her to start trading,” recalls firm founder Paul Tudor Jones II. “As one of her early mentors, I saw in her the tenacity, focus and work ethic that define potential success in this industry. Kathleen took the opportunity and ran with it.”

As the first — and for years only — female portfolio manager at Tudor, Kelley spent a decade as a macro trader, focusing on fixed income, foreign exchange and commodities. She says she was up in eight of her ten years and posted a gain of more than 50 percent in 1998. “Given Paul’s background and active interest in commodities, I always tell people I learned commodities sitting outside Paul’s office,” she says. She left Tudor in 2001 to work as a macro strategist at hedge fund firm Vantis Capital Management, then jumped to Mark Kingdon’s Kingdon Capital Management in 2005 to manage a macro portfolio with a commodities theme.

After six years Kelley resigned to spend time with her children, moving to London for a year. There she hatched a plan for a bold comeback, as founder and CIO of her own hedge fund firm. In 2012 she returned to New York and launched Queen Anne’s Gate Capital Management, a global macro firm with a commodities focus, named after the tony street just off London’s St. James’s Park where she had lived. “I knew I had to try,” she explains. “I had spent my whole career focused on macroeconomics and commodity markets, and I felt that there should be more women running their own firms.”

By the time the firm opened, though, commodities prices were already past their peak. Two years later they started to plunge, taking Kelley’s ambitions down with them. In late 2014 she shut down the fund, which had $115 million in assets at its peak. Kelley, now a senior commodities consultant at BlackRock in New York, blames the commodities slump and a challenging postcrisis capital-raising environment for her firm’s demise. “The timing was not ideal,” she acknowledges. “If I were to do it over, I probably would have launched later, when I had a bigger AUM.”

Every fund manager’s story is unique, but Kelley’s tale mirrors a broader trend. Just before the 2008 global financial crisis, some determined women were beginning to enter the upper echelons of hedge fund management. But in the following years progress stalled. Although many women who launched funds before 2008 remain successful, their numbers have not increased significantly, and some, like Kelley, have seen their firms founder.

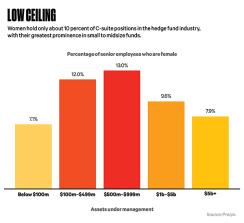

According to a March 2015 report by alternative-assets data provider Preqin, women hold only 10.3 percent of C-suite positions at single-manager hedge funds and 11.1 percent at funds of hedge funds.

A number of factors explain the low numbers, industry executives say. The financial crisis caused a shakeout in the hedge fund industry, and a stretch of mediocre performance in recent years has led many investors to cut back their hedge fund exposure — the California Public Employees’ Retirement System and the New York City Employees’ Retirement System have decided to get out altogether — or concentrate allocations among fewer firms. Those forces are making it harder for new managers to break into the business. And for most women it’s harder to get started or reach the top tier of the hedge fund industry than it is for their male counterparts — in any climate. They are underrepresented in many of the key precursors to hedge fund success, such as MBA programs. They often lack the deep network of connections that can spell the difference between success and failure. Some studies have shown that women hedge fund managers have a harder time raising money than men do and need to perform better to survive.

“Since the crisis it’s been very hard for newer firms,” says Tracy McHale Stuart, CEO of Corbin Capital Partners, a $4.5 billion fund-of-hedge-funds firm in New York. “The biggest issue is the supply — recruiting women into the industry. We continue to see so few women.”

Marcia Page, who will step down later this year as CEO of Minneapolis-based Värde Partners, believes it’s more difficult for new players, particularly women, to break into the business today than it was when she helped found the now-$10 billion distressed-debt firm in 1993. “It’s been so clear that since 2008 fundraising has been challenging even for the more established funds as due diligence has intensified,” says Page, who will stay on at Värde as chair. “New funds are at a disadvantage, as you literally have to knock off an incumbent manager to take their place. I would have expected the pipeline for women in finance to be significantly deeper than it was 30 years ago, but that isn’t the case.”

To be sure, there are female success stories out there. Last year star quantitative manager Leda Braga branched off from BlueCrest Capital Management and set up her own firm, Geneva-based Systematica Investments, to run her $10.2 billion BlueTrend managed-futures strategy. Last month Braga was No. 44 on the 2016 Rich List of Institutional Investor’s Alpha, with earnings of $60 million. It was the first time in 15 years that a woman had appeared on the magazine’s annual ranking of the 50 highest-earning hedge fund managers.

For most other women hedge fund managers, achievements have been much more modest, and they haven’t come easily.

Nili Gilbert and Valerie Malter got together in 2010 with Malter’s husband, Stuart Kaye, to launch Matarin Capital Management in Stamford, Connecticut. The team had plenty of Wall Street experience. Malter, who oversees the firm’s business operations, had logged 30 years at firms including J.P. Morgan Asset Management, Scudder Kemper Investments (now part of Deutsche Asset Management) and Invesco’s Chancellor Capital Management; her husband was a former principal and portfolio manager at Aronson+Johnson+Ortiz and head of research for quantitative strategies at Invesco. Gilbert was a former quantitative analyst at Invesco who had been recruited by Kaye in 2003 after earning an MBA from Columbia Business School. Gilbert and Kaye are responsible for the firm’s model development, portfolio construction and management.

The group had little in the way of backing and launched the firm’s first two funds in large part by raiding the individual retirement accounts of Malter and Kaye. The firm’s five principals, who include portfolio manager Ralph Coutant and client development director Marta Cotton, also used their own savings to build a reserve to last three years. “We set aside enough capital to make sure we were able to operationally support the business,” explains Malter. “Most funds don’t survive because they simply run out of money.”

Matarin started with a long-only fund at a time when a number of hedge funds were adding such strategies to their lineups, then launched a market-neutral hedge fund strategy. In August 2012 the firm reached a milestone, winning its first allocation — $5 million — from an institutional investor. Five weeks later the team was preparing a newsletter to announce the win when it got a deflating call: The consultant involved in the deal had just been fired. The allocation fell through. “We won and lost $5 million in five weeks,” Malter says.

But the partners persevered and gradually started winning clients, including allocations from Rock Creek Group, a women-owned global investment firm in Washington, and Progress Investment Management Co., an $8 billion firm that invests with small, rising fund managers. They also got a $100,000 Bridge to Business grant from the Robert Toigo Foundation, an organization that promotes women and minorities in finance. After four years they had reached the $250 million mark. Today Matarin manages $712 million for 21 institutional clients.

For Nancy Davis the key to getting off the ground was a differentiated strategy. She has an impressive pedigree, having spent seven years at Goldman Sachs’ proprietary trading group — a time-honored route to launching a hedge fund — rising to head of derivatives and over-the-counter trading. She then managed a $500 million global macro derivatives portfolio at Highbridge Capital Management, a multistrategy hedge fund unit of J.P. Morgan Asset Management, before doing a short stint as a global derivatives macro strategist at AllianceBernstein.

Determined to become her own boss, Davis founded Quadratic Capital Management in 2013 to run an options-based discretionary macro fund, something that set the firm apart from competitors offering garden-variety long-short equity funds. “In a competitive environment emerging managers need compelling attributes to even merit consideration by increasingly sophisticated allocators,” she says. Equally important was a September 2014 deal she struck with Ramius, the investment management unit of Cowen Group, under which the firm provided a reported $100 million of seed money in return for a 40 percent stake and extended its own operational, risk management and regulatory platform to Quadratic. With a distinctive strategy and solid backing, Davis was able to attract investors, including a $50 million allocation last year from the Illinois Teachers’ Retirement System that may grow to $100 million.

“Ramius gave the new fund institutional presence, which was a factor in choosing them as our first allocation to a women-owned fund under the emerging manager program,” says Kirk Sims, who runs the Illinois fund’s emerging manager program. “Quadratic was a good fit for the investment profile of our hedge fund portfolio.”

Quadratic may be off to a strong start, with about $400 million in assets, but Davis is realistic about the long road ahead and the challenge of attracting more investors.

Hedge funds don't exist in a vacuum. They sit at the top of the asset management ladder — the most competitive and lucrative perch in the industry. For women to play a bigger role, they need to make progress all the way up the ladder. As Matarin’s Cotton puts it, “A bigger pipeline would make a difference.”

Yet the pipeline feeding the industry seems no bigger today than it was a decade ago, and many of the forces that have traditionally knocked women off the ladder are operating just as strongly today.

In 2013, 56 percent of U.S. undergraduate students were female, according to the most recent statistics from the Department of Education. But women are far less prevalent in the MBA programs that feed a lot of talent into the investment management industry. Some 36 percent of new full-time students at 36 leading U.S. business schools last year were female, according to the Forté Foundation, a nonprofit that seeks to promote women’s access to business education.

A recent study by Catalyst, a New York–based nonprofit focused on women’s inclusion in the workplace, found that although more than half the employees of U.S. financial services firms are female, their representation in senior leadership positions remains low in every sector. Among funds, trusts and other investment vehicles, women make up 52 percent of all employees, a rate that drops to 44.7 percent for first-tier and midlevel managers, then falls to 27.4 percent at the executive and senior levels. In investment banking and securities dealing — fields that produce many hedge fund managers — women hold just 16.1 percent of executive and senior-level positions.

BlackRock’s Kelley says she was keenly aware of her increasingly male surroundings as she rose in the hedge fund industry. “Analyst classes are 50-50” male-female, she says, referring to the initial intake of new analysts, typically straight out of universities or business schools. But Kelley increasingly found herself the odd woman out as she progressed. “It’s hard to see where your career path is when you see rooms filled with men,” she says.

Jane Buchan echoes that sentiment. As co-founder and CEO of Pacific Alternative Asset Management Co., Buchan is a model of female success in the business. Irvine, California–based PAAMCO manages more than $10 billion in assets, making it one of the largest female-owned fund-of-hedge-fund firms in the world. Yet she says the industry has an ingrained male culture that continues to make it difficult for women to break through. “There really is more pronounced bias in alternatives” than in other areas of investment management, she contends. “This involves having a certain background, going to certain schools and specific jobs. So when somebody fits the mold, there is confirmation bias.”

Then, of course, there is the loaded issue of parenting. Motherhood has long been viewed as a career impediment, particularly in high-pressure jobs like hedge fund management. Shelley Correll, a sociology professor at Stanford University and director of the school’s Clayman Institute for Gender Research, says there is indeed a “motherhood penalty,” as it’s called in a 2007 paper she coauthored in the American Journal of Sociology, but she attributes it to “a perceived incompatibility between family and workplace” rather than to actual performance issues for working mothers. The paper was based on a study in which university students were asked to evaluate a variety of fictional job candidates with identical job qualifications but differing parental statuses. The evaluators consistently ranked mothers as less competent and less committed than women without children, or men. Fathers, by contrast, were ranked as the most competent, even ahead of men without children.

Paul Tudor Jones famously seemed to give voice to this perception bias at a panel discussion at the University of Virginia three years ago. “You will never see as many great women investors or traders as men — period, end of story,” the celebrated hedge fund billionaire said. The reason, he explained, is not because they are incapable but because motherhood acts as a “big killer” to the intense job focus that macro trading requires. Jones apologized after reports of his comments produced an outcry of complaints. Kelley, who had the first two of her three children while working at Tudor, says the environment at the firm was “very supportive.” She has nothing but praise for the mentor who gave her her big career break. “Paul is my hero,” she says.

Bias in other parts of the industry holds women back, many executives say. “The majority of allocators are men,” points out Dawn Fitzpatrick, New York–based global head and CIO of $5.6 billion hedge fund firm UBS O’Connor. “The academic data shows that people tend to want to work with people who look and act like them. We need to do a better job of educating people on the unconscious bias they have and the demonstrable benefits to bottom-line results of well-constructed team diversity.”

One route around these roadblocks might be to create more opportunities for women whose careers have not taken the well-worn path of business school to portfolio analyst at an investment bank. Women like Leslie Biddle.

After graduating from Maine’s Colby College with a BA in economics in 1989, Biddle wanted to “save the world,” so she took a position with the U.S. Agency for International Development and worked on projects in the Middle East and Africa. She moved to Overseas Private Investment Corp., where she handled political risk insurance and trade financing, then parlayed that experience into a job at utility operator AES Corp., where she learned how to run financial models and develop power plants. In 2002 she took a job as an energy investment specialist at Goldman Sachs; she made managing director two years later and partner in 2006, her rapid ascent “defying the direct and indirect biases often experienced by women,” she says.

Biddle rose to global head of commodity sales and CFO of the firm’s investments in the metals and mining sector. She left Goldman in 2011 and took a year off before joining Serengeti Asset Management — a $1.5 billion, New York–based multistrategy hedge fund firm founded by a former Goldman colleague, Joseph LaNasa III — as a partner in 2013.

Though Biddle has thrived, she worries about the paucity of women in senior roles in the industry. “What happened between college and the C-suite?” she says. “The cultural biases don’t funnel women to risk-taking roles that lead to leadership positions.” But aspiring female financiers can’t afford to get discouraged, she says, adding, “Women have to move into more risk-taking roles to overcome the biases.”

Any discussion of women in hedge funds has to touch on performance. One of the most widely cited statistics used to tout the ability of women managers — and by implication to allege bias against them in the industry — are the performance indexes published by Chicago-based Hedge Fund Research. The company’s Women Index, which tracks 61 single-manager funds run or owned by women, has shown average annual returns of 2.1 percent since 2007, almost double the 1.1 percent returns posted by the HFRI Fund Weighted Composite Index, the firm’s broad industry benchmark. However, those numbers may not be everything they seem.

A 2015 study by professors Rajesh Aggarwal and Nicole Boyson of Northeastern University’s D’Amore McKim School of Business, based in Boston, debunked the received wisdom of the HFR numbers and came to some other intriguing conclusions. Their study, commissioned by PAAMCO CEO Buchan, looked at the performance of 9,520 hedge funds where the sex of the portfolio managers was known, over the period of 1994 to 2013. The sample was overwhelmingly male: Fully 95.4 percent of the funds had only male portfolio managers. Just 244 funds, or 2.6 percent of those surveyed, had women-only managers; the remainder were mixed.

By stripping out the survivorship bias inherent in a comparison of the HFR indexes, Aggarwal and Boyson found no significant difference in performance between the genders. But the professors also found that female-only funds were smaller than their male counterparts. Assets under management of extant funds with only female portfolio managers averaged $151 million, compared with $222 million for male-managed funds; women-run funds that failed had $95 million, on average, compared with $117 million for their male equivalents. And the performance of the surviving funds? Women-managed funds that survived generated average annual returns of nearly 7.5 percent, compared with 6.7 percent for funds run by men. “Our results suggest that there are no inherent differences in skill between female and male managers, but that only the best performing female managers manage to survive,” the professors wrote.

The small number and sizes of women-managed funds are striking considering the demonstrated ability of female managers, suggesting that the industry is ignoring a lot of potential, Aggarwal says. “There is currently no evidence that the pipeline for female portfolio managers is increasing,” he adds. “Pension funds, endowments and institutional investors have a blind spot when it comes to female managers. They are simply overlooking talent.”

Some institutions, however, have programs that seek to promote female managers. Illinois officials say the state’s public pension fund system has one of the most progressive emerging manager programs in the nation. James Clayborne Jr., majority leader of the state senate, has been a vocal advocate of the program. “We make all the public pension funds accountable through an annual review process where they have to appear before the state senate and explain how much progress they’re making in their minority- and women-owned business agenda,” the Democratic lawmaker says. “We apply the Rooney rule in trying to reach out to all,” he adds, referring to the National Football League policy requiring teams to interview minority candidates for head coaching and senior operation positions. “We don’t need the managers to come from Harvard, Yale or Stanford,” Clayborne says. “They just need the ability to generate alpha.”

Notwithstanding the political hype, actual progress has been slight. So far, the $44 billion Illinois Teachers’ Retirement System has made only one commitment under its emerging manager program, the allocation to Quadratic Capital. Program head Sims is blunt about the limitations of the initiative. “The public pension funds are not seeders,” he says. “I advise women when they’re starting out to go to friends, family offices and funds of funds to build up before coming to us.”

The New York State Common Retirement Fund began its emerging manager effort in 1994 and currently allocates $5.2 billion of its $184.5 billion in assets under the program. Overall, nearly $9.5 billion of the fund’s assets are managed by firms that are owned or run by women or minorities. That total includes an allocation of nearly $40 million to women-owned or women-managed hedge funds through Rock Creek Group.

The California State Teachers’ Retirement System would seem to be a natural candidate to seed female hedge fund managers. The fund oversees $186.6 billion in retirement assets for members whose ranks are 72 percent women. CalSTRS established an emerging manager program in 2004 that covers six asset classes: fixed income, global equity, private equity, real estate, absolute return and inflation-sensitive investments. In 2011, CalSTRS’s board approved a five-year strategic plan, “Diversity in the Management of Investments,” aimed at increasing emerging manager participation across all asset classes.

“CalSTRS walks the talk,” says Geraldine Jimenez, a portfolio manager who oversees diversity matters for the fund. “We are committed to our emerging manager initiative.” Jimenez could not say whether CalSTRS has a woman hedge fund manager in its portfolio, however. Although the fund is committed to the principle of diversity, a 1996 amendment to the California constitution prohibits state entities from considering race, sex, ethnicity or national origin in public contracting.

Jimenez expresses concern about the general scarcity of women in asset management. “What I am seeing is not good,” she says. “We see many women in MBA programs. As they go into asset management, they are selecting out at a young age. I see that as very troublesome.”

Women-owned funds do not seem to fare any better gaining entry into foundation and endowment portfolios. Trusted Insight, a leading syndication platform for alternatives, published a September 2015 report that identified the top 30 female CIOs or directors in university foundations, which managed a collective $136 billion. With women running so many endowments, one might expect a greater tendency to allocate to female managers, but that apparently is not the case. “Most endowments and foundations are quite agnostic in their search for investment managers who can add value to their portfolios,” says Sandra Urie, who is due to step down as chairman and CEO of Boston-based consulting firm Cambridge Associates at the start of July. “They seek talent, experience and expertise wherever it may reside, and while most do not explicitly focus on woman- and/or minority-owned firms, they also do not exclude them.”

Hedge fund allocators say funds of funds and family offices offer the best bet for seeding rising women hedge fund managers. PAAMCO’s Buchan agrees, adding, “Women need to expand the geographic scope of where to look for capital and at sources that look at you as a human being.”

Female managers can’t expect any favors from female allocators, though. “The first priority for women managers is delivering better-than-average returns,” says Susan Webb, co-founder and CIO of Appomattox Advisory, a woman-owned New York fund-of-funds and advisory firm. “You have to make money. They have to be able to execute the strategy. We are agnostic to whether a manager is male or female.”

Women also can turn to specialty seeding firms to get a start, as Quadratic Capital did. Jason Lamin, a former consultant to the Teacher Retirement System of Texas and founder of New York consulting firm Lenox Park, is a big proponent of seeding. “The long capital-raising cycle is highly inefficient and distracts the portfolio manager from what she does best — investing,” he explains. Seeding provides institutional legitimacy and operational infrastructure to new firms, allowing managers to scale up quickly.

Yet seeding does not come without risks. Many managers balk at the equity stakes seeders demand, and the seed firm’s values may not always align with those of the founders. “We opted to raise capital by ourselves instead of a seeder, as we wanted to maintain the core values we have as a team,” says Matarin Capital’s Gilbert. Concessions to seeders can make it harder for firms to raise additional capital later on, cautions UBS O’Connor’s Fitzpatrick. “Preferential liquidity combined with preferential fees to the seed investor can ultimately be deterrents to a broader successful capital raise,” she says.

Some women hedge fund managers are drawing on their own experiences to try to pave the way for future generations.

Victoria Hart’s career journey began in 1996 with a BS in chemistry from Wellesley College. She used that degree to get hired as a chemicals and health care analyst at consulting firm Arthur D. Little, followed by various stints on Wall Street as an investment banking analyst or associate at the former Donaldson, Lufkin & Jenrette; Deutsche Bank; Citigroup; and Merrill Lynch & Co., adding telecommunications, technology, media and consumer discretionary to her sector knowledge. Along the way she picked up an MBA from Columbia Business School.

In 2007, Hart joined East Side Capital, a New York–based long-short hedge fund firm backed by George Soros. After four years she was ready to open her own shop, Pinnacle View Capital, in New York. “I decided to launch my own hedge fund given the breadth of my involvement in the markets, as I have a wider lens and more tools to evaluate investments,” Hart says. “It was a good time, as I had 16 years of diverse experience yet was still young enough to have the stamina for the challenges of starting up a hedge fund.”

With less than $150 million in assets under management at Pinnacle today, Hart knows full well the trials of capital raising as an emerging woman manager, but the operational burden of running her own shop took her by surprise. “It’s important to align yourself with the right service providers, as some can be more strategic as you grow, whereas the wrong ones will deplete your financial resources more quickly with little value add,” she says.

Three years after Pinnacle’s launch and with no prominent seeder behind her, Hart realized how vital business networks are. In 2015, she founded Seven Degrees of Women in Finance, an invitation-only networking group for female fund managers. Today the group has almost 200 members.

“To see more female launches requires more female portfolio managers to be currently managing portfolios at well-established, premier hedge funds, so that they have the right backing when they step out on their own,” Hart contends. “Until that happens, those who are fortunate to be part of the inner circle have an advantage.”

Whether they’re first thinking of going into finance or ready to launch a hedge fund, women need well-developed career networks to have their best shot at success. These networks will need to provide a viable and equivalent substitute for what PAAMCO’s Buchan describes as men’s career advancement advantages: similar backgrounds, schools and jobs. Whereas men have traditionally recommended, promoted and aided their fellow managers’ careers, women, being late to the game, have not developed these informal but crucial conduits. Now some astute women in finance are working to build these missing links.

One such initiative is 100 Women in Hedge Funds. The nonprofit group was started in 2001 to provide a leg up to women in the industry. Today the organization boasts 15,000 members around the world and hosts a variety of educational, networking and fundraising events. In January 2015 the group launched its Next Gen agenda to inspire, mentor and provide support to young women looking to start careers in finance and investment. “Our goal is to provide women across the board — whether they’re in high school, college or entering the industry — access to internships, mentoring and peer networking,” says the group’s chair, Sonia Gardner, who is co-founder and president of New York–based, $11.6 billion global investment firm Avenue Capital Group.

Last year 100 Women in Hedge Funds held allocator symposiums bringing together institutional investors and female portfolio managers. The events, in San Francisco and New York, attracted nearly 100 allocators and 75 managers. The organization’s London chapter is set to launch a European version this month. Compared with many other allocator gatherings, the events’ female-only focus and exclusive invitation list provide more opportunities for attendees to meet institutional investors.

Girls Who Invest is focusing its efforts on younger minds. Founder Seema Hingorani, formerly CIO of New York City’s five public pension funds, believes reaching out to women at the university or even high school level is the best way to develop a pipeline of talent for the industry. “Our program is dedicated to exposing young women to asset management,” she explains. “But at the very least, we also want to prepare them to manage money for themselves and their family.”

The group will hold its first training class, a four-week program for 30 college sophomores and juniors at the University of Pennsylvania’s Wharton School (Hingorani’s alma mater), this summer. The program will focus on core financial concepts and asset valuation, and teach students about the asset management ecosystem. After the program participants will be placed in internships at several large asset management and hedge fund firms. They won’t be learning only from other women, Hingorani points out: “There are a lot of enlightened men in our industry, and we need to partner with them to be successful in our mission.”

Another initiative helping women build career networks is Women Moving Millions. Founder Jacki Zehner was the first female trader to make partner at Goldman Sachs, in 1996. She left Wall Street more than a decade ago, trading in power suits for rugged outdoor wear in Salt Lake City and embarking on a crusade to promote opportunities for women through her family foundation. Her latest effort has gathered more than 230 members, who have pledged close to $600 million to benefit organizations and initiatives for women and girls around the world. “There is this saying that privilege is invisible to those that have it,” Zehner says. “I think the same is true for bias, including gender bias. You cannot look at the numbers and say it does not exist; it has to. Then the question becomes what to do about it.”

Institutional investors and the consultants who support them clearly have a stake in changing the status quo for women. “While performance must always be central to allocation decisions, we must consider adjusting some of the other inputs, like length of track record and minimum AUM requirements, if we want a different outcome,” says Lenox Park’s Lamin, who advised Texas Teachers on its 2013 initiative on emerging manager best practices. “The organizations that have been successful in sourcing and allocating to smaller managers have been very intentional about reviewing their current effort and then adjusting their approaches accordingly. Unfortunately, there aren’t very many of them to speak of.”

Aside from building women’s networks and developing a pipeline of female talent into the asset management and hedge fund industries, structural changes will need to take place at the investor level. One example: relaxing standards to allow public pension funds to allocate to emerging fund managers with less than a three-year track record.

The current investment consulting business model also may need to change to allow deviation from the established, industrywide due diligence standards for allocation consideration, to allow gender diversity and inclusion to become part of both consulting and investor institutions’ cultures and systems. Once senior management sets the tone for inclusion, gender diversity stands a fighting chance.

“It has to be a concerted effort,” says Serengeti’s Biddle. “Cultural biases do not end on their own.” •

Get more on hedge funds.