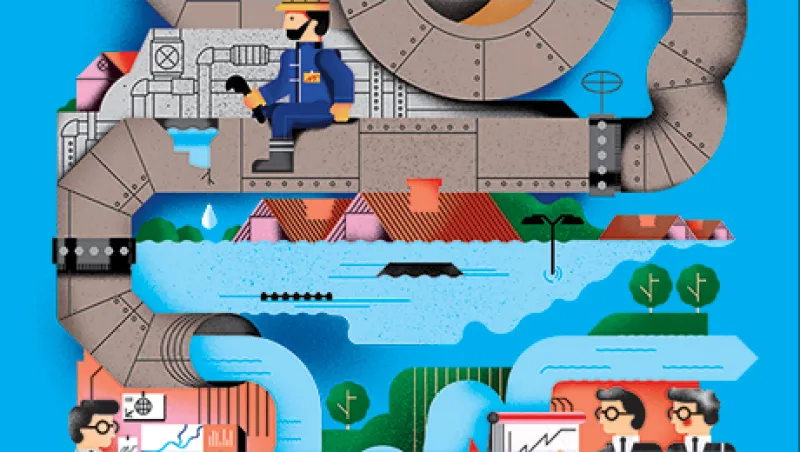

While a new kind of public humiliation — “drought shaming” for homeowners sporting verdant lawns and sparkling pools — made headlines in water-starved California this spring, another perennially dry state underwent a shock in the opposite direction. The rain came so hard and fast in Texas in May that some areas reportedly saw 300 to 600 percent of their normal annual rainfall in just a few weeks. The images were striking: homes destroyed, fields turned to temporary muddy lakes, men sitting at the top of a hill on a washed-out road with fishing lines dipped in the water below. It may have seemed like good news for a state that’s been dealing with drought conditions for years, but few cities are equipped with infrastructure to handle that much water all at once. More than 20 people died as the flooding destroyed homes and businesses, and despite the high waters, climatologists say the storms may not be enough to end the state’s megadrought.

“All of that water will likely be lost, because the infrastructure isn’t there,” says Simon Gottelier, a New York–based senior portfolio manager and director at Impax Asset Management, which manages $1.8 billion in water sector investments.

Switching so quickly from drought to flooding and back again is an extreme scenario, but it’s one many experts are saying may become more common thanks to the combination of climate change, poor water management and crumbling infrastructure. Many state and local governments are working to fix the latter problem, facing the urgency of upgrading 100-year-old pipes that are in constant need of repair. The task is daunting, but there’s a silver lining for investors in that a great deal of private money will be needed to get these projects off the ground.

Three main areas of the sector hold the most opportunity for asset managers and funds looking for long-term, stable income streams and the occasional big-ticket asset: the construction and operation of desalination plants, the implementation of new wastewater treatment and reuse facilities, and infrastructure maintenance and modernization. Opportunities can come in the form of public-private partnerships, collaborations with private institutions such as banks or indirect investments through bonds sold by municipalities.

According to the American Society of Civil Engineers, in 2010, water systems spent $36.4 billion to address $91.2 billion worth of water infrastructure needs. By 2020, the disparity is expected to grow, with planned spending at $41.5 billion of the $125.9 billion needed annually. That gap is where many institutional investors will find attractive deals, if they have the patience and expertise to understand the market.

“Educating people is the first step,” says Michael Underhill, founder and CIO of Capital Innovations, a $1 billion Pewaukee, Wisconsin–based real asset investment manager who believes many investors still aren’t convinced of the opportunities that the water market holds.

Water infrastructure investment is “in the first inning of what is going to be an 11-inning Yankees–Red Sox game,” says Underhill. His firm worked with the California Public Employees’ Retirement System to create its infrastructure program in 2008; he has seen water become an increasingly vital part of that strategy. Institutional investors like CalPERS have been leading the charge toward water investment in the U.S., but they’re still far behind their peers in Australia and Europe, where water infrastructure has been a mainstay of portfolios for decades.

Investing in the water sector does come with a unique set of challenges. For one, options are still limited. There are few exchange-traded funds and mutual funds dedicated specifically to water. Even the University of California, which has a significant mandate for responsible investing, has shied away from making water a standalone strategy. The problem, says Tim Recker, managing director of private equity and real assets at the UC Board of Regents, is the opacity of the market. “If you work with the right people it can make sense, but it’s not transparent exactly what everybody’s paying,” he says. That makes it hard to justify taking the plunge. “It’s clear there’s a need for water infrastructure,” Recker adds. “The challenge is finding opportunities that provide the right risk-adjusted return for us.”

Perhaps the biggest lingering issue is determining the value of water. For many Americans, water has long been perceived as essentially free. Homeowners pay anywhere from $24 to $70 per month on average, according to water research and reporting group Circle of Blue, and many renters never see a separate water bill. Updating the U.S.’s water infrastructure will probably require raising rates in many areas, but it can be hard to determine exactly how much and to convince ratepayers why, especially since many see water as a right rather than a commodity.

“Until you have a pricing mechanism that’s a bit more uniform and standardized, it’s going to be pretty challenging” to make significant returns in water-related investments, says Jagdeep Singh Bachher, CIO and vice president of investments for UC Regents.

Despite these hurdles, opportunities to invest in water are growing. Thanks to the recovery of the real estate and job markets, many municipalities are starting to put more resources into maintenance and look beyond that to new capital expenditures. These projects are an attractive mainstay for institutional investors — they tend to generate returns of 1 to 2 percentage points over global GDP growth, according to Impax. And as municipalities are able to do bigger projects, bond financing opportunities are increasing as well.

The green bond market has been heating up in recent months, with some analysts predicting that 2015 will be the most active year yet for the asset class globally. In the U.S., Arizona, Indiana, Massachusetts and Washington state issued new green muni bonds in the first quarter. Most of the funding from these bonds goes toward clean water and low-carbon buildings, according to the Climate Bonds Initiative.

Last year DC Water, the U.S. capital’s water and sewer authority, issued the first ever green century bond, selling $300 million of debt that doesn’t come due until 2114, to help pay for infrastructure projects. Investors receive revenue from the water and sewer system, which isn’t subject to market volatility the way many other assets are. “We did a road show to investors in the century bond market, and they were fascinated by what we were offering,” says George Hawkins, DC Water’s general manager. “There was a tremendous thirst from private money in the taxable market that wanted to buy into and provide financing for us to do these projects.”

DC Water may be a green bond pioneer, but the place where water scarcity, politics and opportunity meet most explicitly is in California. The state is in its fourth year of drought, which Governor Jerry Brown has attempted to address with a mandatory 25 percent reduction in statewide water use and $10,000 fines for residents and businesses that are found to be wasteful. The moves have been historic, but many say the state government has done little to address the underlying issues: poor water management and severely lacking infrastructure.

“California is basically a case study of how not to deal with water,” says Capital Innovations’ Underhill. “They’re in the fourth year of a drought and [the governor] just decided to tell people to cut back on usage. They’re clearly not looking at it as a crisis yet.”

California, however, is by many accounts the best example of how investors can get involved with water infrastructure. Stamford, Connecticut–based Poseidon Water, which partners with water authorities on infrastructure projects, has teamed up with San Diego County’s water agency to construct the largest desalination plant in the Western hemisphere. The plant, which cost about $1 billion to build, is located in Carlsbad and is expected to be fully functional by the fall. Water from the plant will cost $1,849 to $2,064 per acre-foot, according to the county water authority, which translates to higher fees for consumers and higher returns for investors if the cost curve can be properly managed. That hasn’t been the case yet in the U.S., according to UC’s Bachher.

Wastewater treatment, reuse and reclamation — a decidedly less flashy area of investment — is booming in the Golden State. “If you went to California, it would be hard to find a desalination facility, but reuse projects are springing up everywhere there is a shortage of supply,” says Impax’s Gottelier.

It’s the fastest-growing and most lucrative opportunity for most institutional investors, primarily because of the stability — regardless of how the local climate and economy are faring, people need clean water. And unlike desalination plants, treatment and reuse projects have a lengthy positive track record in the U.S. In California’s Orange County, authorities have used water reclamation and reuse strategies to recharge a nearly depleted aquifer, and utilities, infrastructure companies and water reclamation companies together pull in $360 billion in annual revenue, with an annual growth rate of 4 to 6 percent, according to Impax.

The Calvert Global Water Fund, sub-advised by Ireland-based Kleinwort Benson Investors, started in 2008 and has come in at 4 percentage points above the market on average each year for the past 14 years, outperforming in 11 of those years. Its portfolio includes U.S. holdings, and its performance is representative of wastewater and utilities performance in general, according to co-portfolio manager Matt Sheldon.

“The water market tends to move generally quite slowly; the decision makers are municipal engineers, and the consequences of making the wrong decision are quite high,” Sheldon says. “This creates really strong business models.”

There is also, of course, another incentive: a dedication to sustainable investing. Managers say they’ve seen an increase in interest from institutional investors on both sides of the coin — those who see water infrastructure and other water investments as simply a smart natural resources allocation in a traditional asset allocation model as well as those focused on responsible or impact investing.

It’s hard for anyone — investor, farmer, almond or avocado enthusiast — to avoid reminders of the U.S. water crisis. Even one of the year’s blockbuster action flicks, Mad Max: Fury Road, takes place in a dystopian world where water is a scarce commodity over which people fight to the death. Whether driven by the attraction of a stable, long-term investment or by the specter of a Mad Max-like fate for the U.S., investors are paying closer attention to the sector.

“Water is the new black,” says Capital Innovations’ Underhill. “But you have to know how to get at it.”