When Hudson Bay Capital’s Sander Gerber set out to build a portfolio management system, he didn’t plan to challenge Harry Markowitz.

Yet after developing a new statistic to understand how two securities move relative to each other — so-called co-movement — that’s exactly what he ended up doing. Gerber’s goal was to have a clearer understanding of exactly how diversified his portfolio was after finding that historical covariance, the measure used by Markowitz adherents, wasn’t cutting it.

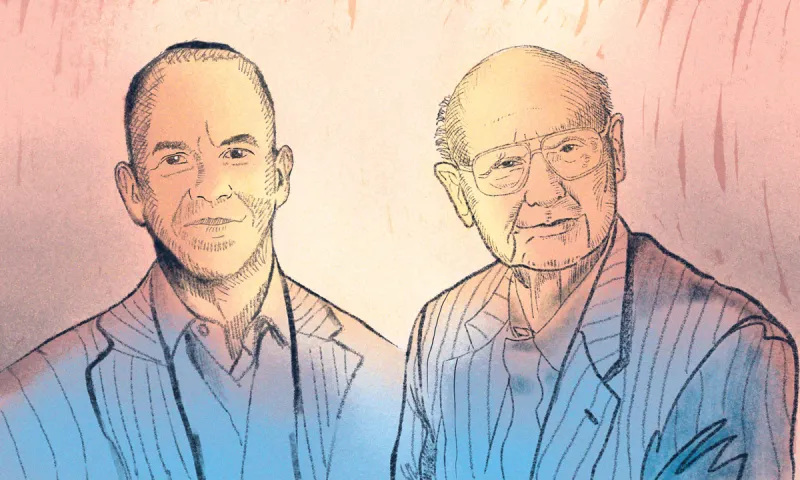

To Gerber’s surprise, the father of Modern Portfolio Theory, which laid out a framework for the now-ubiquitous investment management strategy, was receptive. The two eventually collaborated to research whether this measure, now known as the Gerber Statistic, held water.

It did. The research, published in the February 2022 issue of the Journal of Portfolio Management, shows that using the Gerber Statistic instead of historical covariance — a measure used by most investors — leads to outperformance in cumulative return, average geometric return, and Sharpe ratio.

The Gerber statistic assesses the level of risk and diversification in a portfolio by determining whether securities move in tandem, in opposition to one another, or have no relationship at all. The stat uses certain thresholds to filter out noisy data that may signal that relationships exist, even when, in reality, they do not.

Without the Gerber statistic, investors could end up building portfolios that aren’t as diversified as they think.

Blind Reliance on Models Is a Mistake

The statistic’s development has its roots in Gerber’s own background as an equity options market maker on the floor of the American Stock Exchange, where he said he learned from a “guttural perspective” how the markets operated. Between the yelling, the hand signals, and paper orders, Gerber said he saw firsthand that there’s a “crescendo and diminuendo in the markets” that can indicate human error. For Gerber, it was a perfect illustration of behavioral economics.“I saw how models broke down,” Gerber said, commenting on how his time on the floor made him think of the limits of all models, including MPT. He added: “I’m not saying all models are bad. To have a blind reliance on the model is a common failure. It happens again and again and again. People don’t understand the risk they have.”

After gaining experience on the exchange floor, Gerber decided to start a firm to trade his own capital. Originally called Gerber Asset Management, the firm grew into Hudson Bay Capital, a multi-strategy hedge fund that now manages $13.6 billion in assets. In 2021, the fund returned 13.5 percent net of fees.

“I had multiple risk-takers trading my money and I didn’t want to lose money,” Gerber said. “I wanted to give them the freedom to trade and exercise their talent and their alacrity.”

To do that he developed a system for portfolio management that eventually included the Gerber Statistic. Gerber, who studied both philosophy and finance in college, was used to thinking in frameworks and found them useful in managing money. But in Gerber’s view, the widely-used MPT framework was fed data that misrepresents a portfolio’s diversification.

For instance, say the S&P 500 moves 10 basis points. While that movement may dovetail with a 10 basis point move of another index used within a portfolio, an investor may deem the move too small to show a true relationship between the two. Using historical covariance, that relationship would show up as a co-movement.

The Gerber Statistic allows investors to filter out these small movements. Unlike historical covariance, it does not calculate the degree of movement, only attempting to measure whether or not the movement indicates a meaningful relationship.

Gerber used the statistic for years within Hudson Bay’s Deal Code System, a portfolio management framework for a high conviction strategy that is not correlated with the broader markets and with thresholds set to limit losses.

But Gerber thought his idea could use input from a heavy-weight academic.

Is There Another Way to Express Markowitz’s Ideas?

After an email exchange with Markowitz, Gerber flew out to San Diego, where Markowitz is based, so the two could discuss the idea in person.Walking down the beach, with the wind whipping loudly, Gerber told the legendary economist that he believed the way MPT was being applied was based on a faulty assumption.

In 1952, Markowitz laid out the tenets of MPT, which emphasized the benefits of an entire portfolio of investments, including its risks, diversification benefits, and correlations between securities. Markowitz, along with William Sharpe and Merton Miller, shared the 1990 Nobel Prize. Their work changed the way people invested and is still the backbone of the asset management industry.

Also called mean variance, MPT’s practical application relies on inputting a covariance matrix, which shows relationships between two data points — in this case, securities. In the decades that followed MPT’s development, industry practitioners began calculating covariance using historical data, Gerber said. They are still using that practice today.

“That's not what Harry wanted to have done,” Gerber said. “He wanted it to be based on the human judgment of forward-looking assumptions, not based on number-crunching of the past. The Gerber statistic solved for something he had been looking for.”

In the early 2000s, researchers came up with a way to exclude some of the market noise showing up in the model using an approach called the shrinkage estimator. The shrinkage model, however, still relies on the historical covariance matrix.

In Gerber’s view, historical correlation is not as useful as forward-looking assumptions. This is what the beach meeting was about — explaining to Markowitz that there could be another way to express his ideas.

“I thought this might be insulting, so I tried to be soft with it,” Gerber said. But Markowitz agreed. At first, Gerber thought he had misheard him. After all, it was noisy along the beach. Gerber asked Markowitz to repeat himself.

“He said, ‘I don’t think [historical correlation is] useful,’” Gerber recalled. “It was from that time we decided to collaborate.”

After more conversation, they began to work with Philip Ernst, a tenured associate professor of statistics at Rice University. “It’s great when you latch onto a new idea that really works well,” Ernst said of the research. Other co-authors included Yinsen Miao, Babak Javid, and Paul Sargen.

In a mathematical sense, the Gerber Statistic is a generalization of a statistic called Kendall’s Tau, which shows movement relationships between pairs. The Gerber Statistic also layers thresholds for co-movements into the measurement.

“We want to strip out noise and focus on meaningful relationships,” Gerber said.

It worked. The research showed that in every risk scenario, the Gerber statistic offered a more favorable risk-return profile than the historical correlation model. In all but the most conservative risk target, it also beats out the shrinkage estimator.

Diversification Is Still the Only Free Lunch

“You don’t have to input the past,” Ernst said of the benefits of the Gerber statistic versus these other two models. “You can decide what is a meaningful co-movement and what isn’t.”Hudson Bay has been using the statistic as a part of an internal risk monitoring system to make investment decisions.

As an example, the risk model showed a relationship between a Chinese stock index and certain U.S. equities. After doing some research, the team came to realize that these U.S. companies, particularly when they were combined in a portfolio, had significant exposure to China.

“When China didn’t move a lot, you wouldn’t see it,” Gerber said. Aggregated, it did. The firm chose to layer on a China hedge to mitigate some of that risk, a decision based on the Gerber statistic.

The hedge fund manager emphasized that the model doesn’t make decisions for Hudson Bay. Instead, it helps the firm decide where and how it needs to diversify.

And that comes back to Markowitz’s original work.

“There’s only one free lunch in the markets,” Gerber said. “The free lunch is diversification because if you can achieve it, you can lower risk and achieve the same return stream.”