In May 2022, a 19-year-old student at Dartmouth College published a paper aimed directly at the university’s leadership entitled, “A Case for Institutional Ownership of Digital Assets.”

The report urged Dartmouth’s endowment office and board of trustees to consider sinking some of the school’s cash holdings into Bitcoin, with author Jackson Gerard noting that to do otherwise “could be an irresponsible financial decision” and that, “in times of macroeconomic uncertainty, commodities and real assets would appear to be the safest and most logical investment.”

Gerard, who was studying economics and computer science at the time and has since graduated, partly put himself through school using his own Bitcoin college fund. “I basically received backlash from everyone I talked to,” he tells Institutional Investor. “I went to drop off my heavy paper at the Dartmouth investment office in Hanover [New Hampshire], but they weren’t really interested. I don’t think they wanted to take advice from a student.”

Not to be put off, he went ahead and applied for a position at the Dartmouth investment office, following a stint at the structured products desk at Wells Fargo. He spoke with verve about digital assets during his interview but still detected a stoical ambivalence. “Dartmouth was a particularly difficult case,” he recalls. “I think it just ruffles feathers. It’s an old institution and people don’t want to take risks. There’s a legacy there.”

If Dartmouth had bought some Bitcoin back when Gerard recommended it, the university could have made a fourfold return. The cryptocurrency traded at around $30,000 when he published his paper. It shot above $120,000 shortly after he graduated in June. Dartmouth’s endowment, meanwhile, reported a return of 10.8 percent for the fiscal year ending June 30, topping $9 billion for the first time, but lagging the other Ivies.

Judging by Dartmouth’s most recent filings, it appears to be as disinterested as ever in splashing out for crypto. But it’s being outstripped by a rising number of elite competitors and other university endowments across the country that are swiftly moving into the digital asset space — and seeing their investments pay off. (Dartmouth has recently one-upped its peers in other areas, as it deftly managed liquidity, despite a significant allocation to private equity.)

Chief among them is Harvard University, which disclosed in a regulatory filing in mid-November that its biggest publicly traded investment is BlackRock’s iShares Bitcoin Trust. The $56.9 billion endowment more than tripled its position in the exchange-traded fund in the third quarter to just over 6.8 million shares, up from 1.9 million shares in the previous quarter. It amounted to a valuation of $442.9 million as of September 30, although it has since fallen with Bitcoin's latest drop below $100,000.

As the manager of the ETF, BlackRock now owns more Bitcoin than any other entity in the world — more than $75 billion — with the notable exception of Bitcoin creator Satoshi Nakamoto.

Other universities investing in BlackRock’s Bitcoin ETF include Brown University, which reported shares valued at $13.8 million in the third quarter, while Emory University reported $289,000 of shares for the same period. In a recent filing with the Securities and Exchange Commission, Emory also said it had built up a massive $52 million stake in the Grayscale Bitcoin Mini Trust, more than doubling its investment from the second quarter.

In all, there are at least a dozen universities making strategic bets on digital assets, with many having undertaken experimental forays in the crypto sector over the past several years. What’s more, as Institutional Investor first reported in October, the latest quarterly data show digital assets have become the secret sauce many university endowments don’t want to talk about, even as they grease returns.

“You’re not going to see anyone shouting about investing in crypto, even if it gives them a 20 percent return,” says Michael Markov, chairman and co-founder of Markov Processes International, a provider of research and analysis covering opaque investments, such as endowment portfolios. “There are too many political risks — differing opinions on whether to invest in crypto, and endowments don’t want to create controversy among its investment managers, students, trustees, alums. They say nothing, you hear nothing.”

That silence speaks to the conundrum that’s plagued crypto from the start. “The big question has always been, are we acting as fiduciaries by investing in crypto, or are we violating our duty by ignoring it?” notes Todd L. Ely, a professor of public administration specializing in endowments and education finance at the University of Colorado Denver. “At some point, the Ponzi scheme grows to such a scale that it’s not a Ponzi anymore.”

While university endowments are a notoriously secretive lot, they are particularly reticent about crypto. Most declined to comment on the record for this story. Still, a handful of elite institutions are beginning to see meaningful results from their digital asset bets for the first time. Leading the way are Harvard, Brown, Massachusetts Institute of Technology, Cornell University, University of Michigan, and Stanford University.

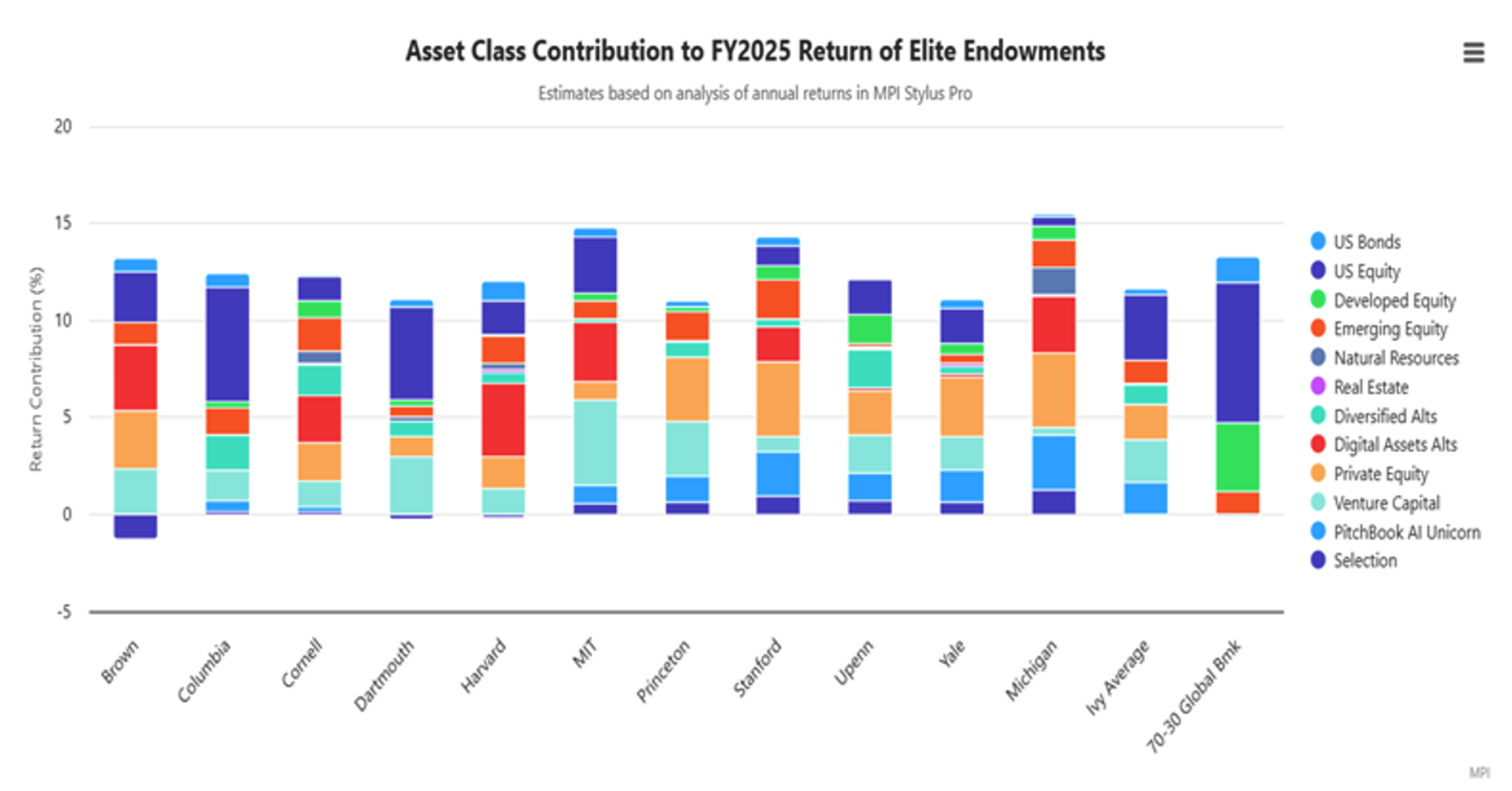

According to Markov’s firm, MPI, which conducted a top-down analysis of elite endowments’ fiscal 2025 returns, digital asset investments — along with AI bets — appear to have enhanced the already strong performance of top universities by as much as 200 to 300 basis points. Among the most impressive overall performers were Michigan, with a 15.5 percent annual return; MIT, with 14.8 percent; and Stanford, at 14.3 percent.

While none of the universities would comment directly on their digital holdings, MPI estimated in its analysis of Michigan that digital asset investments added 2.9 percent to the university’s annual return. It also noted that MIT and Stanford, which have been associated with crypto and blockchain venture capital investments, may have “steadily increased” them as of fiscal 2025.

MIT doesn’t publicly disclose digital asset investments, but it is open about its interest in crypto, with the university’s giving page advertising that it will accept “a minimum donation of $10,000” in Bitcoin, though emphasizes it will not accept other forms of cryptocurrency.

Cornell doesn’t publicly disclose crypto investments either, but has confirmed that it holds a stake in blockchain technology startup Ava Labs, developed as part of the university’s business incubation program.

On average, large university and Ivy endowments have reported returns of around 11 percent to 12 percent in the latest fiscal year, with digital assets as a key driver, according to MPI, helping to offset more lackluster results in fixed income, hedge funds and real estate.

Markov told Institutional Investor that this year was the first time he’d seen a visible impact from digital assets on university endowments’ headline numbers. MPI’s report cited Harvard’s “crypto tailwind inside a comparatively conservative overall risk profile,” countering “sizeable allocations to lower-return sleeves” and sealing the endowment’s 12 percent fiscal year return.

It was just over seven years ago when the late David Swensen, legendary chief investment officer of Yale University’s endowment, led some of the earliest well-known digital asset ventures — touching off a landslide of crypto investments across the endowment landscape.

In June 2018, Yale invested in a fund dedicated to developing crypto start-ups and blockchain technology run by Silicon Valley behemoth Andreessen Horowitz. At the time, Bitcoin was languishing below $10,000 and Jamie Dimon, Warren Buffett, and Ray Dalio were all gleefully denouncing cryptocurrencies. The fund, called a16z crypto, went on to manage multiples of billions, and other university endowments piled in.

Around the same time in 2018, Swensen’s protégé, Matthew S.T. Mendelsohn — who now leads Yale’s $44.1 billion fund — orchestrated an investment in a crypto-focused venture capital firm called Paradigm, founded by former Sequoia Capital partner Matt Huang and Coinbase co-founder Fred Ehrsam. That fund also went on to raise billions of dollars based on the thesis that cryptocurrencies and blockchain technology had the potential to transform finance and the internet. Mendelsohn was not available to comment.

“Yale has played the role of trend-setter from the time David Swensen was there,” says University of Colorado Denver’s Ely. “Yale is looked at as an innovator in this space and continues to be at the vanguard of endowment practices.”

In the days and months after Yale’s investments were announced, a smattering of other university endowments let it be known that they, too, would be investing in crypto, among them Harvard, Stanford, and MIT.

While Harvard has been tight-lipped about its outsized crypto play in recent months, one of the endowment’s highest-paid managing directors, Charlie Saravia, led one of Harvard’s most daring digital asset investments. The university’s latest annual report showed he earned a salary of more than $3.4 million, surpassing Harvard’s president.

Saravia spearheaded an $11.5 million investment by Harvard alongside other participants in the initial coin offering of Blockstack Inc. in 2019. At the time, Saravia sat on the advisory board tasked to oversee the sale of the Blockstack tokens, according to an SEC filing. It is unclear what became of that investment. Harvard’s spokesperson declined to comment. The tokens now trade for cents on the dollar.

Other universities reportedly investing directly in cryptocurrencies through exchanges like Coinbase include Brown, Yale, Harvard and Michigan. All either declined to comment or did not respond to requests for comment. Meanwhile, the University of Texas, which holds a large, physical gold bullion position valued at around $1 billion, recently expressed an interest in crypto as part of its commitment to investing in real assets.

In 2021, Columbia University’s Kim Lew said she believed cryptocurrencies were “here to stay.” Though she wasn't sure what the future held, she said for Columbia’s $15.9 billion endowment, “it’s important to dabble a little, just to make sure that we follow, make sure that we have relationships with people who are going to develop expertise, and we can leverage that expertise to decide which way to go.”

Some universities are also finding themselves in possession of cryptocurrency via generous benefactors. In 2021, the University of Pennsylvania’s Wharton School received $5 million in Bitcoin, and in 2022, Princeton University received a $20 million donation from its alumni to launch a blockchain research project.

Anthony Rosario, major gifts officer at the University of Austin, founded a few years ago, says professional networks and interpersonal relationships have played a crucial role in getting the school’s $5 million Bitcoin endowment fund off the ground. The university was thrilled when a Bitcoin financial services company, Unchained, also based in Austin, donated two bitcoins. It cemented a relationship of shared values, he says.

“We’re not chasing shiny objects; we are enthusiastic about these new technologies and there’s an entrepreneurial spirit motivating innovations like crypto,” Rosario says. “It is not just opportunistic, but principled and good for humanity. That’s the spirit we want to tap into. Even if you don’t understand or disagree with Bitcoin, these are entrepreneurial people, and they are movers and shakers.”

Dartmouth’s Gerard, who went on to co-found a health technology startup in Chicago, acknowledges that while there is certainly a youthful exuberance and idealism to crypto that some people may never fully appreciate, he thinks there’s room for everyone. “I’m not a Bitcoin maximalist,” he says, “but I think money should be free. Letting people freely and democratically access money — I think that’s beautiful.”