For decades, diversification strategies focused on the two traditional asset classes: stocks and bonds. The use of these assets evolved significantly, but they remained core building blocks. Two critical factors had to remain in place, however, for this strategy to keep working: a low correlation between the two asset classes and limited volatility for bonds, given the reliance on them as a source of stability. Among other structural market changes, these two factors are no longer in place.

As a result, an era of simplistic portfolio construction – with its reliance upon asset class assumptions that no longer hold true – is over. Creating resilience within portfolios requires a new approach and a new asset mix.

Asset allocation: what worked in the past, and why it’s not working now

In the “safety first” period after World War II, investors considered capital preservation their top priority, and portfolios were weighted heavily toward fixed income.

As the long-term growth that equities could deliver became increasingly apparent in subsequent decades, the 60/40 approach to diversification emerged. Even as investors pursued the higher long-term gains stocks offered with a 60% allocation, keeping portfolios 40% invested in fixed income proved a reliable means to achieve stability. Some investors even sought exposures beyond 100% limits of their portfolios by deploying leverage.

By the late 1980s, many large institutions began to add alternative investments, including private markets, to their allocations. By the early 2000s, the allocation to “alts” among large institutional investors often reached 15%-20%.

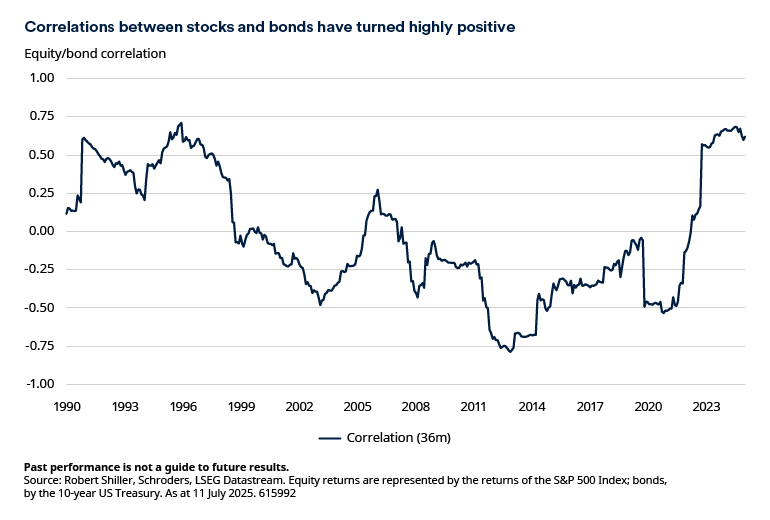

But for most individual investors, small institutional investors, and many defined contribution retirement plans, the 60/40 portfolio remained the trusted approach to diversification. Markets helped: from the mid-1990s to 2021, a low, often negative, correlation between stocks and bonds contributed to the effectiveness of the 60/40 approach.

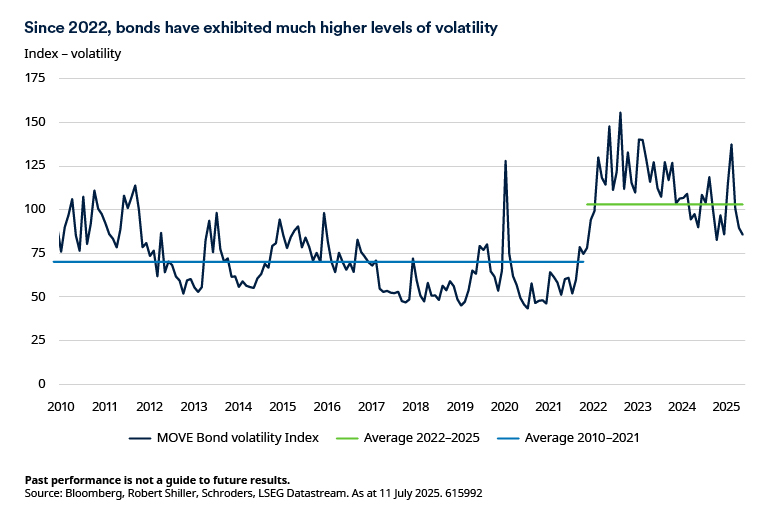

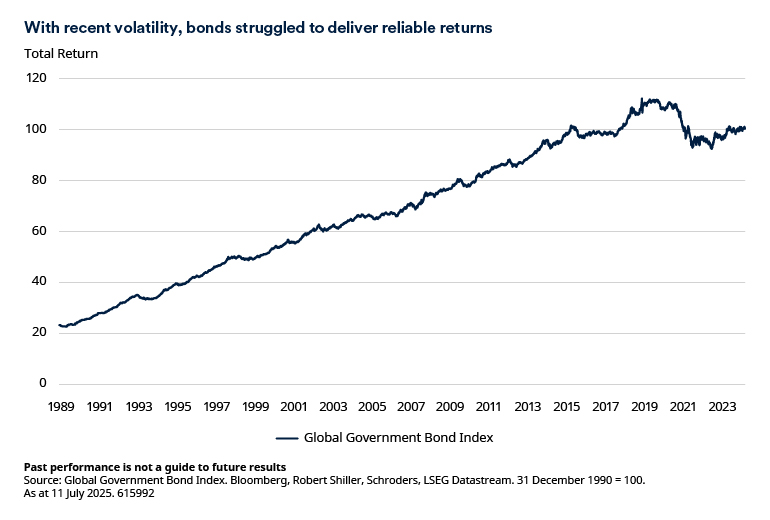

Recent years have confounded those expectations. Since 2022, global bond markets have been much more volatile (Chart 1) and that has made bonds a less dependable source of returns (Chart 2).

The correlation between bond and equity returns rose significantly in the aftermath of the Covid-19 pandemic from a combination of factors that adversely affected both markets, including a spike in inflation driven by supply-chain challenges, soaring interest rates, a surge in commodity prices and geopolitical turmoil (Chart 3). The correlation has remained at elevated levels.

As a result of all this, the 60/40 portfolio experienced severely negative returns, as exemplified by a US-focused portfolio. With its exposure to the S&P 500 Index and US Treasury bonds, the 60/40 portfolio was down nearly 18% in 2023, posting its worst year since 1937.1

Recognizing structural external changes…

To understand why the old assumptions no longer work, it’s important to consider how the environment has changed and whether current circumstances will persist. We identify several long-term trends and resulting market conditions that we believe will extend into 2026 and beyond.

Increasing government debt

Government debt levels continue to soar, particularly in developed economies. Politicians have shown an unwillingness to address the underlying issues, creating uncertainty in bond markets which were previously considered creditworthy.

Aging populations

In most developed and several emerging markets, aging populations result in shrinking workforces and are likely to exacerbate government debt challenges.

Interest rates to remain higher

Even without the potentially inflationary US tariff proposals laid out by the Trump administration, several factors look set to keep inflation high. These include tight labor markets, lingering supply chain constraints, ongoing deglobalization and the longer-term costs associated with decarbonization. The period of near-zero interest rates is squarely behind us.

…and distilling what they mean for financial markets

The comparatively benign years that followed the financial crisis of 2008-2009, when equities soared amid a backdrop of near-zero interest rates and low inflation, are over.

Slower growth and persistent inflation raise concerns for both bond and equity markets and suggest consistently higher volatility. Along with this volatility, the correlation between stocks and bonds is likely to remain high.

In this changed scenario although bonds may be less reliable as diversifiers, the return of higher yields makes them potentially attractive sources of income.

Shifts in market composition are also a factor, and that means investors need to look to a broader range of assets to meet their needs. The universe of equities quoted on the world’s major public stock markets continues to shrink. More companies are now raising finance via private market channels. Today private equity and debt form a combined $13 trillion market, up from less than $1 trillion two decades ago.

Within the sphere of public equities market composition has also changed. The post-financial crisis period saw the emergence of mega-cap US stocks as a dominating force in global indices. By the start of 2025, US equities comprised over 70% of the MSCI World index and much of this dominance was due to fewer than 10 stocks.

Finding a new portfolio approach for a different reality

These changed circumstances demand a new strategy for achieving portfolio resilience. In our view, that approach must rely on three foundational principles.

- Income: the role of bonds changes.

Bonds still have a vital portfolio role, but their purpose has altered. They can no longer be counted on for downside protection during volatile equity markets. Bonds should now be viewed primarily as an income-generating asset, alongside other income sources.

- Active investing is critical.

Pursuing the broad market exposure that passive strategies provide is no longer a sound approach. During periods of heightened uncertainty, the dispersion of returns within asset classes increases. Only active managers can differentiate between securities and sectors with promising return potential and those whose upside might be severely limited.

- Wider diversification across both public and private markets.

Incorporating alternative asset classes across both public and private markets is essential. Equity and bond markets are often influenced by the same return drivers. By contrast, alternative investments—such as commodities, hedge funds, private equity and private debt—can provide valuable diversification because the drivers of their performance are so different. The same is true for credit alternatives beyond the traditional debt markets of government and corporate bonds. A broad spectrum of alternative and non-traditional asset classes can provide degrees of diversification that are not possible with an exclusive focus on traditional investments.

To find out more about Schroders and the Active Edge, click here

1Source: “The Trusted 60-40 Investing Strategy Just Had Its Worst Year in Generations,” The Wall Street Journal, 10/19/23

Important information

Marketing material for financial professionals only. All investments involve risk, including loss of principal.

The views and opinions contained herein are those of Schroders and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. Such opinions are subject to change without notice. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations.

Any reference to regions/ countries/ sectors/ stocks/ securities is for illustrative purposes only and not a recommendation to buy or sell any financial instruments or adopt a specific investment strategy. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested. Diversification cannot ensure profits or protect against loss of principal.

This information is a marketing communication

Information herein is believed to be reliable but Schroders Capital does not warrant its completeness or accuracy. The data contained in this document has been sourced by Schroders Capital and should be independently verified. Third party data is owned or licenced by the data provider and may not be reproduced, extracted or used for any other purpose without the data provider’s consent. Neither Schroders Capital, nor the data provider, will have any liability in connection with the third-party data.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realized.

Schroder Investment Management North America Inc. (“SIMNA Inc.”) is registered as an investment adviser, CRD Number 105820, with the US Securities and Exchange Commission and as a Portfolio Manager, NRD Number 12130, with the securities regulatory authorities in Alberta, British Columbia, Manitoba, Nova Scotia, Ontario, Quebec and Saskatchewan. It provides asset management products and services to clients in the United States and Canada. Schroder Fund Advisors LLC (“SFA”) markets certain investment vehicles for which SIMNA Inc. is an investment adviser. SFA is a wholly-owned subsidiary of SIMNA Inc. and is registered as a limited purpose broker-dealer with the Financial Industry Regulatory Authority and as an Exempt Market Dealer with the securities regulatory authorities in Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Quebec, and Saskatchewan.