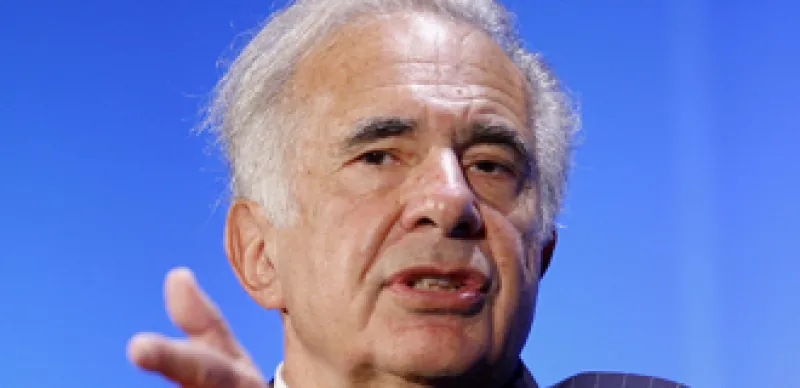

Carl Icahn is betting on casinos again. In March the peripatetic, 74-year-old corporate raider, activist and hedge fund manager — who is busier than ever these days — bought the Tropicana Casino and Resort in Atlantic City out of bankruptcy for $200 million. Earlier in the year he took control of nine additional Tropicana casinos in four other states in a separate bankruptcy deal. This is Icahn’s second foray into Atlantic City, the nation’s second-largest gaming market; in 1990, he bought a controlling interest in the Sands Casino Hotel and sold it in 2006 to Pinnacle Atlantic City.

On the same theme, Icahn is locked in a battle with billionaire real estate mogul and TV personality Donald Trump after paying $500 million to scoop up the entire mortgage debt of three casino properties owned by bankrupt Trump Entertainment Resorts in Atlantic City. Icahn, whose $5.8 billion hedge fund Icahn Capital surged 31.9 percent in 2009, made large gains on investments in two other gaming companies — Harrah’s Entertainment and MGM Mirage. The hedge funds are part of Icahn Enterprises, a Big Board–traded limited partnership of which Icahn owns roughly 92 percent of the stock.

Gaming isn’t his only obsession these days — Icahn is also bullish on the movie business. He recently picked up 18.9 percent of Lions Gate Entertainment, which rejected his offer to buy the rest of the stock for $6 a share in a battle that is far from over. Icahn recently spoke with II Senior Contributing Writer Stephen Taub about his battle with Trump and his take on the best investment opportunities in 2010.

1 Clearly you are bullish on Atlantic City even though it’s having a tough time. Why?

There is still fierce competition and it will be tough sledding. There are still going to be some tough times. I’m not saying it will turn around tomorrow, but in the long run we believe Atlantic City will become a resort destination again. We are prepared to put capital in and wait.

2 What enticed you to go after Trump?

We like to buy distressed debt. We believe in the long run it is a good property. We are prepared to invest capital in it. I believe the Trump property has been plagued not only by the competition but also by having way too much debt. Hopefully, this will be rectified.

3 What are the best bets going forward?

The opportunities are in bankruptcies, but you must be an activist. The risk-reward is best here. It is an art. There are so many arcane rules. It is not the same as analyzing distressed debt. Your analysts also must be knowledgeable about the arcane rules in bankruptcy. You can’t leave it to the lawyers or the analysts. At the risk of being immodest, over the years on a return basis, we probably are No. 1 or close to No. 1 on investment returns in this area.

4 How long are you prepared to hold on to companies you buy?

If you look at the record, we hold a lot of companies for long periods. For example, we have the railcar business from the 1980s, Icahn Enterprises from the early 1990s, and in 2000 out of bankruptcy we bought casinos and energy companies and held them for seven or eight years, and only sold them because we got what we thought were very high prices.

5 You are also bullish on biotech? Why?

For an activist, there are a few compelling things. Biotech is one of them. The industry has invested a great deal of money over the past 20 years. CEOs are not generally anxious to sell their companies. But big pharma has the capital needed to fully realize the value of biotech’s large-molecule drug pipelines. It’s a marriage made in heaven.