In late 2002 signs of a new flu pandemic emerged in Asia. The first reported case of the often-fatal virus occurred in China, spreading as doctors and other health care workers traveled throughout Asia and beyond. By early 2003 severe acute respiratory syndrome, or SARS, had infected hundreds of people in 37 countries.

At about that time, Peter Nakada received a call for help. Several global reinsurance companies asked Nakada, a risk management expert who specializes in catastrophic events, to create a computer model that would help them evaluate the transmission and lethal potential of the new virus.

Nakada, who heads the life risks and capital markets units of Risk Management Solutions (RMS) at the firm’s Hoboken, New Jersey, office, built and delivered the software to his reinsurance clients, then decided to shop it to the life insurance market. That was when Nakada, sitting across a table from the chief actuary of one of the largest U.K.-based life insurers, learned of a new catastrophe. Though the flu software was very interesting, the actuary said, SARS “isn’t what keeps me awake at night.”

What disturbed the actuary’s slumber was not death but life: catastrophic longevity. The risk that many more people would live a lot longer than anyone had imagined had become the scariest scenario in life insurance.

There is no doubt that over the past century life spans have increased — a trend that has accelerated in recent decades. But when it comes to planning for retirement income security, budgeting economic resources or even creating shareholder value in public companies, expanding life expectancy is wreaking havoc on balance sheets and heightening financial risk for governments and individuals alike. “It’s been recognized that mortality is improving,” says Zorast Wadia, principal and consulting actuary on the pension-risk management team in the New York office of actuarial consulting firm Milliman. “There’s no hiding that fact.”

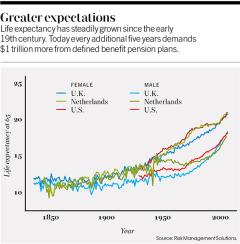

After his encounter with the actuary, Nakada returned to RMS with a new mission: to build a risk model that would project life expectancy for a given population. After two years of research and engineering, RMS released a program with 10,000 hypothetical paths that could influence longevity. One key finding revealed by the new model: There is a one-in-100 chance that the average pensioner in the U.S., Canada and 13 other developed countries will live five years longer than currently projected by actuarial tables. Though the families of these European, Australian and North American retirees will likely welcome having them around, this unanticipated decline in mortality will cost defined benefit plans a cool $1 trillion.

That’s a crisis that makes SARS look small. And it’s captured in the phrase “longevity risk.”

MANAGEMENT CONSULTANT PETER DRUCKER famously once wrote, “What gets measured gets managed.” Yet despite all the attention paid to various flavors of risk besetting public and private pension funds — credit risk, interest rate risk, market risk, currency risk — longevity risk has not been accurately measured, and it has not been managed well, either.

Investment risks have traditionally been the primary concern of pension sponsors who manage large portfolios. More recently, with the Federal Reserve’s quantitative easing program holding rates at historic lows, interest rate risk has become a greater concern. These low rates effectively increased the present value of future pension liabilities — known as the discount rate — thereby increasing the amount of assets needed to fully fund future pension obligations. Add to that the devastation to these portfolios wrought by the financial crisis, and it’s easy to see how once-ignored longevity risk became a big and growing problem.

The accuracy of the traditional mortality tables used to measure life expectancy has been the subject of controversy, particularly with the impending release of updated tables assembled by the Society of Actuaries (SOA), an educational, research and professional organization based in Schaumburg, Illinois; the tables were last published 14 years ago. “It’s a monumental task projecting future liabilities,” notes Amy Kessler, head of longevity reinsurance for Prudential Retirement, a unit of Newark, New Jersey–based Prudential Financial. When the new SOA tables are officially published, later this year or in early 2015, they will show that the median American is living 2.2 years longer than just a decade ago. That means the average 65-year-old will live 22.7 more years, to 87.7.

In actuarial terms the new SOA data means pension fund sponsors and individuals will need to set aside an additional 5 to 6 percent in assets, before factoring in inflation. “People are just coming to grips with this now,” Kessler says.

In the U.S. alone, using only the current estimates of mortality, actuarial liabilities include $3.6 trillion in the 126 largest public pension funds (closer to $4 trillion when you fold in local and municipal funds), $3 trillion in private defined benefit pension funds and $24.3 trillion in unfunded obligations to current workers and retirees within the Social Security program. Factoring in universal social security systems in 170 other countries, Blackstone Group co-founder Peter Peterson used $30 trillion in total global retirement savings when he wrote Gray Dawn: How the Coming Age Wave Will Transform America — and the World in 1999. That number has grown a lot since then.

The International Monetary Fund argues that forecasters have consistently underestimated how long people will live, over time and across populations, regardless of the techniques they have used. A 2000 report, Beyond Six Billion: Forecasting the World’s Population, says that estimates have been too low in many countries, including Australia, Canada, Japan, New Zealand and the U.S., by an average of three years.

The British have led the way in acknowledging, quantifying and tackling longevity risk. The U.K. Pensions Regulator has pushed for trustees and sponsors to employ the latest available methods and techniques in setting demographic assumptions. British actuaries use socioeconomic factors that influence life spans, such as county of residence, type of employment, housing, health care, education and diet, to gauge life expectancy. The U.S. has not used these factors in a sophisticated way.

“Longevity risk has been much less visible in the U.S. market,” says Guy Coughlan, Pacific Global Advisors’ chief risk and analytics officer, based in the firm’s London office. “The pension mortality tables have been lagging behind the actual life expectancy.”

Part of the problem in gauging longevity risk has been that insurers, pension funds and others in the financial markets have always depended solely on actuarial data that extrapolates from the past. It has now become clear that actuarial tables do not include the classic fund industry warning label: “Past results do not guarantee future performance.” RMS was the first to build a multifactor longevity risk model, which is now used by life insurers, reinsurers and those developing longevity-risk products in the capital markets. Among the many factors that go into the design of a longevity-risk model are estimates about the pace and duration of improvement in life expectancy. As with climate change, the science encompasses extremes. One side believes the human life span can and will continue to grow. The other concludes there is an end point to human longevity, an age beyond which it will not be possible to survive.

But even if you do not believe longevity will extend indefinitely — no one is suggesting it isn’t improving, at least in the short run — the need to mitigate the future retirement income needs of a global population is critical.

To meet those needs, an increasing number of longevity-risk solutions and strategies are gaining steam, from human-capital solutions to specialty financial products designed by Wall Street, insurers and other purveyors of risk mitigation tools. In the latest round of creativity, new financial products are being packaged for sale to endowment, foundation and sovereign wealth investors as a way to profit from longevity risk. The question is, Will these efforts improve global retirement income security?

UNTIL THE MID-19TH CENTURY, HUMANS COULD expect to live fewer than 40 years. In about 1900 life expectancy began rising globally, reaching 48 years in 1950, 60 years in 1980 and close to 70 by 2010, according to data from the United Nations and the IMF.

The dramatic surge in life expectancy is mainly a result of the decline in infant mortality, which accounted for more than 70 percent of improved life expectancies in Canada and the U.S. from 1950 to 1970; other health care benefits aimed at people under 65 also contributed. Death from infections was reduced, while mortality as a result of chronic and degenerative diseases at advanced ages increased.

Then, starting in about 1970, a significant improvement in life expectancy for people over 65 began. It continues today, with the largest effect on the oldest, those aged 85 and over. The improvement in later life expectancy is the key factor in the more recent upswing in longevity risk.

Will rapid mortality gains continue indefinitely or taper off? On one side of the debate is Leonard Hayflick, a microbiologist and professor of anatomy at the University of California, San Francisco. He contends that science has not yet discovered the fundamental causes of aging. “The resolution of causes of death tells you zero about the cause of death,” says Hayflick, a founding member of the National Advisory Council of the National Institute on Aging, stressing that wiping out cancer or heart disease will not add many years to life expectancy. Patients cured of cancer in their 50s, 60s or 70s continue to age. “For the past 25 to 30 years, the cause of death in the U.S. and developed countries is essentially unknown for people over 80.” People don’t die from a disease; they die with it. To increase life expectancy, Hayflick concludes, “the only other thing you can do is tamper with the aging process.”

Enter Aubrey de Grey, chief science officer at the Mountain View, California–based SENS Research Foundation, which is funding research in more than a dozen laboratories that is aimed at extending the aging process. A former computer scientist who was working in artificial intelligence when the longevity bug bit him, in about 2000, de Grey believes that “the most feasible way to advance aging is to repair damage. We’re going to see the arrival of therapies that will restore the health of people whose mortality risk is already climbing.” De Grey stresses that this is going to happen sooner than people think. “It’s going to turn the pension market upside down,” he warns. His message to individuals: “You must not be complacent and wait until these therapies arrive.”

Although not a scientist, Stephen Goss stands closer to Hayflick in his view on mortality. “We should not expect the rate of improvement in mortality in the future to be quite as fast as it’s been in the past 50 years,” says the chief actuary of the Social Security Administration, who has worked there since graduating from the University of Virginia with a master’s degree in mathematics. The federal agency has produced its own mortality tables since its founding in 1935; Goss deems these superior to those of the SOA. He points to the positive impact Medicare and Medicaid have had on life expectancy, along with antibiotics and rapid economic growth. But he believes the rate of improvement has slowed for the foreseeable future. “We’re pretty confident that we have the best guess or estimate,” he says.

Although the debate over longevity expansion may be fascinating, those dealing with the here and now are worried. In its 2012 Global Financial Stability Report, the IMF found that the use of outdated mortality tables had exacerbated longevity risk. A study of the U.S. Department of Labor’s form 5500, which pension plan sponsors file annually, revealed that between 1995 and 2007 some plans continued to use SOA’s group annuity mortality table from 1983. Comparing life expectancies for 63-year-olds among mortality tables, the IMF found the differences between the most dated and the most current was 5.2 years. That’s a lot.

The data also shows that by controlling for liabilities resulting from differences in discount rates, benefit payments and the number of plan participants, U.S. pension funds’ longevity-risk liabilities would grow by about 3 percent for each additional year that retirees lived beyond 63, or 9 percent for the typical three-year longevity underestimation. De Grey disagrees with this conclusion. “Three years is picked out of the air, depending on how far in the future one is looking,” he says. “That kind of error is really bad for financial purposes, pension funds and insurance companies. It’s nothing compared to what we’ll see in the future.”

So why has there been a 14-year gap between mortality updates at the SOA? “Mortality doesn’t change all that much quickly,” insists Cynthia MacDonald, a senior-experience-studies actuary at the SOA. There is also a MP-2014 scale, a table dealing with possible mortality improvements, developed to keep the new RP-2014, the basic mortality tables, up to speed. But, she adds, “we’re looking at our processes. People want more data more quickly.”

The U.N. and the IMF have projected the assets retirees will need on a global basis and their effect on gross domestic product. With a 60 percent replacement rate — the assets needed by retirees as a percentage of their past working income — the aggregate expenses of elders in developed countries will double between 2010 and 2050. This translates to between 5.3 and 11.1 percent of GDP in developed economies and between 2.3 and 5.9 percent in emerging countries.

If everyone lives three years longer than currently expected — the average underestimation of longevity in the past — the present discounted value of the additional living expenses amounts to between 25 and 50 percent of 2010 GDP, or tens of trillions of dollars on a global scale. Put another way, if the risk of three more years of life fell on governments, debt-to-GDP ratios would rise to 150 percent in the U.S. and Germany, and 300 percent in Japan.

New York–based asset manager BlackRock produced a report in September 2013 titled “Addressing America’s Retirement Needs: Longevity Challenge Requires Action.” Noting that more than one third of U.S. retirees are getting at least 90 percent of their income from Social Security, the report underlined how increased longevity is affecting the federal safety net. When Social Security was launched in 1935, a 21-year-old had a 50 percent chance of living to age 65. Today that number is close to 80 years, with one in four 65-year-old Americans projected to live past 90.

Then there’s the problem of workers paying into the system to support the increasing population of elders. In 1960 five workers contributed to the system for every retiree. Today the ratio of workers to retirees is 3-to-1; in 2033 it will be 2-to-1. By then benefits will need to be reduced if changes haven’t already been made.

EARLY IN THE 21ST CENTURY, pension fund managers focused on making contributions on time, dealing with investment risks and matching assets to liabilities. Then came the financial crisis. Decimated portfolios and low interest rates that shrank liability present values — along with the more-stringent funding requirements mandated by the Pension Protection Act of 2006 — left corporate defined benefit plan sponsors with huge asset-liability mismatches. That was when the reality of an increasingly longer-lived retiree population, with the potential to outlast current actuarial assumptions, became a pressing concern.

Strategies like liability-driven investing (LDI), which matches bond portfolios to future pension liabilities, and cash-balance pension plans that transferred longevity risk from sponsor to participant through lump-sum payments or retirement annuities were already in the works. As plans rebuilt their assets and were able to sell equities to purchase bonds, LDI became increasingly popular. According to a 2013 survey of 180 U.S. companies by Towers Watson & Co., three quarters of respondents said they cared more about lowering the risk of their defined benefit plans than getting higher returns over the next two to three years. Seventy-one percent had implemented an LDI plan or were seriously considering doing so by 2014.

But faced by increasing pressure to off-load liabilities, these tools were not sufficient for everyone. “It turns out that if you hedge the interest rate risk and don’t hedge the longevity risk of the liabilities, your hedge will be much less effective over the long term,” says Pacific Global Advisors’ Coughlan.

For some plan sponsors that meant making a bigger effort to mitigate liabilities. Large, one-time lump-sum payments, such as the one Ford Motor Co. offered to 90,000 employees in 2012, began to alter the landscape. Then came an even more breathtaking set of actions by pension sponsors.

Increased longevity among participants, combined with outsize pension liabilities, was at the heart of the 2012 megabuyout deals engineered by Verizon Communications and General Motors Co. GM transferred $29 billion in assets from its pension plan to Prudential Financial, which assumed a $26 billion pension obligation on behalf of 110,000 retirees. Verizon followed, transferring $7.5 billion of its pension assets to Prudential. Verizon stressed how the plan would protect worker benefits, but some workers and pension rights groups protested the asset transfer, particularly because it meant the plans would no longer be insured by the Pension Benefit Guaranty Corp.

Although risk transfers to insurers had occurred at smaller companies, these two set records that may never be beaten, says Caitlin Long, head of corporate strategies and pension solutions at Morgan Stanley’s global capital markets unit in New York; she advised both companies. “I never thought GM and Verizon would open the floodgates,” Long says. “Those deals were unique. The stars have to align for this to happen.”

Michael Hall, a consultant in Towers Watson’s Seattle office, agrees. “Equity risk and interest rate risk swamp longevity risk given the asset allocation structures pension plans had historically,” says Hall, who builds quantitative models for asset-liability studies at both U.S. corporate and public pension funds. If the first two risks shrink, as they will when interest rates rise along with investment performance, longevity risk will appear larger, he cautions. “We’re not at a place where longevity risk is a big enough piece of the pie where you decide you want to leave the other risks [equity and interest rate] alone and just concentrate on getting rid of longevity risk.”

But for companies comfortable annuitizing their longevity risk, these deals will continue. In yet another groundbreaking transaction, BT Group (the former British Telecom) announced in July that it would create its own insurance subsidiary to run £16 billion ($26.9 billion) of its £40 billion pension scheme and write annuities. BT borrowed the strategy, which took nearly three years to develop, from property/casualty insurers that create their own “captives.” BT then reinsured its longevity risk with Prudential Financial. “Until BT created its own insurance company and sought reinsurance, it wasn’t clear that a very large pension fund was going to keep a lot of its liabilities on the balance sheet,” says Prudential Retirement’s Kessler. “This was a watershed moment: Longevity risk can be managed.”

Prudential has now taken on nearly $30 billion in U.K. pension liabilities from some 15 other pension funds. How much more pension risk can the insurer handle?

From Prudential’s perspective, buying longevity risk balances life insurance risks. “It’s a wildly attractive financial transaction for a life insurer with a big life book. It lowers their mortality risk,” says RMS’s Nakada, the editor for Institutional Investor Journals’ annual Pension & Longevity Risk Transfer for Institutional Investors.

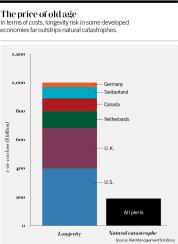

Despite the fervor with which insurers are pursuing this new business, there are constraints. The global insurance industry had an estimated $3.66 trillion in assets at the end of 2013, and reinsurance and insurance-linked securities firms held an additional $540 billion of capital.

Where will more liquidity come from? Jeff Mulholland, head of insurance and pension solutions at Société Générale’s New York office, says, “It becomes painfully obvious that vast sums of additional risk capital must be dedicated to adequately manage longevity risk.” He points to global capital markets, which at the end of 2012 held combined assets managed by institutional investors of $97.6 trillion, about the same amount as global bond markets’ $97.5 trillion. Longevity risk is very capital-intensive; regulators require insurers to cover the cost of their longevity liabilities at a 99 percent confidence level.

“The capital markets provide a large pool of capital against which to spread this risk, and investors benefit from the lack of correlation between longevity and traditional markets, which pushes out the efficient frontier for investors’ portfolios,” Mulholland says.

The timing may be right for capital markets to offset longevity risk. A confluence of events — the search by endowment, foundation and sovereign wealth funds for variations on now-traditional alternative-asset classes, and the global search for longevity-risk mitigation — offers a potentially vast market for new products. Established insurance-linked securities like catastrophe bonds are paving the way for acceptance of longevity-risk swaps and bonds.

The features of each type of pension-risk transfer contract differ, says Mulholland, who ran sales and trading for Goldman Sachs Group’s insurance-linked securities business in the mid-1990s, when the firm developed the catastrophe bond. Who manages the dedicated pool of assets? Who bears investment risks? Who administers the payments? Pension-risk transfers are designed to cover any increases in liabilities on a dollar-for-dollar basis above baseline assumptions.

Mulholland lays out what he calls the value chain of longevity-risk transfer. In his scenario a pension fund transfers risk to a company like Prudential that provides insurance and reinsurance. The insurer, for its part, wants to minimize its exposure to tail longevity outcomes and reduce the capital it needs. In one type of longevity hedge, the insurer buys a population-indexed option. Then SocGen or Deutsche Bank syndicates the back end in the capital markets. The target buyers for these insurance-linked securities are endowments, foundations and sovereign wealth funds looking for new investments with correlation benefits, like other types of insurance-linked securities.

Though there have been only three indexed longevity-option hedges, Mulholland says several more are in the pipeline. The 2012 IMF report supports his scenario by urging governments to facilitate the development of an efficient market for longevity-risk transfer by providing more-detailed data, enhancing regulation and supervision, and educating market participants.

Still, Towers Watson’s Hall does not foresee big swap deals migrating to the U.S. any time soon. “The unfunded liability as a percentage of the market cap for 70 to 80 percent of plan sponsors is less than 5 percent,” he says. “To enter into an exotic longevity swap to fix longevity risk is a pretty sophisticated transaction to manage a rounding error.”

“DEFINED BENEFIT PENSIONS ARE a great benefit,” declares Pacific Global’s Coughlan. But, speaking in his role as an adviser to mostly U.S. pension sponsors seeking to de-risk their plans, he says, “History and the way plans have been managed, combined with the weight of opinions on perceived cost and risks, have had such a negative impact that they are now seen as legacy instruments that will be packaged up and sold.”

The slow decline of employer-sponsored retirement benefits, combined with increases in life expectancy, is cooking up a lethal stew. True, companies now have the means to transfer some risks associated with defined benefit pensions. But where does that leave millions of American workers who, if they retire at 65, may well need retirement income for 30 years or more?

To that end, there are a growing number of solutions, summed up in the IMF’s April 2012 report: “First, governments should acknowledge the significant longevity risk they face through defined-benefit plans for their employees and through old-age social security schemes. Second, risk should be appropriately shared between individuals, pension plan sponsors and the government. An essential reform measure would allow retirement ages to increase along with expected longevity. This could be mandated by governments, but individuals could also be encouraged to delay retirement voluntarily. Better education about longevity and its financial impact would help make the consequences clearer.”

The report cautioned that allowing for flexibility for pension providers is important. When it is not feasible to increase contributions or retirement ages, benefits may have to be trimmed. The report endorsed the use of risk transfer to the capital markets.

When it comes to governments helping to mitigate national longevity risks, global role models include countries like Denmark, the Netherlands and Sweden, which overhauled its system in 2001. The U.K. now is trying to auto-enroll all of its working citizens, and the Australians have increased contribution rates to their superannuation funds.

In the U.S. progress toward retirement income security has been slower. But if necessity is truly the mother of invention, Tim Driver is doing his part to get there. For the past eight years, as CEO of Waltham, Massachusetts–based Retirementjobs.com, Driver has annually served 2 million unique visitors older than 50 — half of them registered users in search of employment. “We’re a financial site,” Driver says. “I view retirement jobs as the fourth leg of the retirement stool, with Social Security, pensions and personal savings/401(k)s. It’s another form of annuity.” His newest site, Mature Caregivers — people over 50 who provide aid to seniors — is “exploding,” he says.

A big need: access to so-called retirement jobs. A survey of 980 defined-contribution-plan participants older than 30 conducted earlier this year by State Street Global Advisors (SSgA) found that half expected to work in retirement, a percentage consistent across age, gender, income and education.

Some 10,000 of a total 78 million baby boomers turn 65 every day. “We’re retiring the model of retirement in which you reach a set age, drop out and become a couch potato,” says Netherlands-based Dick Hokenson, a global demographer at research and brokerage firm ISI Group.

Anna Rappaport, chair of the SOA’s postretirement needs and risks committee and principal of an eponymous consulting firm in Chicago, supports the idea of a longer working life. But, she cautions, “in the U.S. we’ve made a lot of jobs more demanding. It’s not as simple as saying, ‘Everybody work longer.’” Companies need to make adjustments to ensure success. Rappaport points to pension funds that have adjusted to changing economic conditions, like those in New Brunswick, Canada, and the Netherlands, and the Wisconsin Retirement System.

But she warns: “By going to defined contribution plans, we duck the discussion. From a societal view this is a problem. People don’t want to talk about this. One of the reasons is they’re afraid.” Her message to companies: Those are your customers too. “If they don’t have jobs and money, they’re not going to buy your products.”

Like Rappaport, who spent many years at Mercer, Steve Vernon had his own career as an investment consultant, with Watson Wyatt Worldwide (now Towers Watson) before joining the Stanford Center on Longevity, a think tank studying the social consequences of longer life spans. Vernon is exploring viable ways to pool longevity risk for the average person. He urges employers that “have bailed out on employees” to do the due diligence required to offer retirement income products in their 401(k) plans.

In the near term Vernon envisions employees rolling over plan assets to individual retirement accounts at retirement. Part would go into very low-cost annuities, and part would be invested and drawn down to comply with U.S. Internal Revenue Service minimum distribution requirements. Down the road, Vernon would like to explore the use of defined ambition pensions, a hybrid pension in which employees and employers share risk, and tontines, a method of grouping people to share longevity risk with no risk to employers. “There’s nothing to prevent Vanguard or Fidelity from offering these,” he says. “Particularly for multiemployer plans, they’re a natural.”

In the defined-contribution-plan arena, where much of the retirement income burden has been shifted, there are glimmers of hope that these saving vehicles can be adjusted to provide something approximating a real pension. The company that has come closest to achieving this is United Technologies Corp. in Hartford, Connecticut. After converting its traditional pension to a cash-balance plan in 2003, UTC closed that plan in 2010. Led by chief investment officer Robin Diamonte, UTC instituted an insured withdrawal annuity benefit embedded in the company’s 401(k) plan.

AllianceBernstein designed the investment option, which is guaranteed by three insurers for added protection, and works with target-date funds in which employees are auto-enrolled. “You have to have senior leadership behind this,” says Diamonte.

Meanwhile, at SSgA, head of defined contribution plans Fredrik Axsater is trying to close the retirement gap created by the financial crisis. In 2007 there was a 69.5 percent expected wage replacement in retirement for participants who saved 11 percent of their salaries and invested in a well-diversified portfolio. Today, with lower bond yields and long-term growth expectations, that falls to 45.5 percent. This gap can be bridged, Axsater says, with a three-pronged formula: Retire two years later, for 5 percent more income replacement; aim to earn a 0.5 percent higher annual return, for 6 percent more; save 3 percent more annually, for an additional 12 percent. This formula is more likely to work for younger investors. Older investors may retire later, but the improvement will be less dramatic.

“I don’t see this as a negative story,” Axsater says. “There are a lot of opportunities out there. We can make it work.” • •

Follow Frances Denmark on Twitter at @francesdenmark.