Every December the Royal Swedish Academy of Sciences concludes a 16-month nomination and selection process by awarding the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, founder of the Nobel Prize. The Nobel committee recently recognized work on the Efficient Market Hypothesis with a dramatic splitting of the prestigious prize between EMH pioneer Eugene Fama and EMH critic Robert Shiller. (University of Chicago economist Lars Hansen also shares the $1.2 million prize, but we only briefly had the math chops to understand his work back in the late 1980s; we’re told he is very deserving!) This makes now a great time to review EMH, its history, its controversies, where things stand today — and perhaps make our own small contribution to the discussion.

By way of background, we both got our Ph.D.s at the University of Chicago under Gene Fama and consider him one of the great mentors of our lives and an extraordinary man. This might reasonably worry a reader that we are very biased. But for the past 20 years, we’ve also pursued investment strategies we think are at least partly explained by market inefficiencies. We pursued these through the Asian crisis in 1997, the liquidity crisis of 1998, the tech bubble of 1999–2000, the quant crisis of August 2007, the real estate bubble and ensuing financial crisis culminating in 2008 and (for Cliff) the New York Rangers’ not making the National Hockey League playoffs for seven years in a row, starting in 1997. Throughout this experience we have more than once come face-to-face with John Maynard Keynes’s old adage that “markets can remain irrational longer than you can remain solvent,” a decidedly folksier and earlier version of what has come to be known as the limits of arbitrage — a concept we will return to in this article. We could arrogantly describe our investment strategies as a balanced and open-minded fusion of Fama and Shiller’s views but admit they could also be described uncharitably as “risk versus behavioral schizophrenia.”

All of this has put us somewhere between Fama and Shiller on EMH. We usually end up thinking the market is more efficient than do Shiller and most practitioners — especially, active stock pickers, whose livelihoods depend on a strong belief in inefficiency. As novelist Upton Sinclair, presumably not a fan of efficient markets, said, “It is difficult to get a man to understand something, when his salary depends upon his not understanding it!” However, we also likely think the market is less efficient than does Fama. Our background and how we’ve come to our current view make us, we hope, qualified — but perhaps, at the least, interesting — chroniclers of this debate.

Last, we seek to make a small contribution to the EMH conversation by offering what we think is a useful and very modest refinement of Fama’s thoughts on how to test whether markets are in fact efficient. We hope this refinement can help clarify and sharpen the debate around this important topic. Essentially, we strategically add the word “reasonable” and don’t allow a market to be declared efficient if it’s just efficiently reflecting totally irrational investor desires. If you thought that last line was confusing, good. Keep reading.

The concept of market efficiency has been confused with everything from the reason that you should hold stocks for the long run (and its mutated cousins, arguments like the tech bubble’s “Dow 36,000”) to predictions that stock returns should be normally distributed to even simply a belief in free enterprise. This last idea is the closest to reasonable. It is true that there is a strong correlation between those who believe in efficient markets and those who believe in a laissez-faire or free-market system; however, they are not the same thing. In fact, you do not have to believe markets are perfectly efficient or even particularly close to believe in a mostly laissez-faire system. Though it may have implications for many of these things, market efficiency is not directly about any of these ideas.

So what does it really mean for markets to be efficient? As Fama says, it’s “the simple statement that security prices fully reflect all available information.” Unfortunately, while intuitively meaningful, that statement doesn’t say what it means to reflect this information. If the information at hand is that a company just crushed its earnings target, how is the market supposed to reflect that? Are prices supposed to double? Triple? To be able to make any statement about market efficiency, you need to make some assertion of how the market should reflect information. In other words, you need what’s called an equilibrium model of how security prices are set. With such a model you can make predictions that you can actually observe and test. But it’s always a joint hypothesis. This is famously, in the narrow circles that care about such things, referred to as the joint hypothesis problem. You cannot say anything about market efficiency by itself. You can only say something about the coupling of market efficiency and some security pricing model.

For example, suppose your joint hypothesis is that EMH holds and the Capital Asset Pricing Model is how prices are set. CAPM says the expected return on any security is proportional to the risk of that security as measured by its market beta. Nothing else should matter. EMH says the market will get this right. Say you then turn to the data and find evidence against this pairing (as has been found). The problem is, you don’t know which of the two (or both) ideas you are rejecting. EMH may be true, but CAPM may be a poor model of how investors set prices. Perhaps prices indeed reflect all information, but there are other risk factors besides market risk that investors are getting compensated for bearing. Conversely, CAPM may precisely be how investors are trying to set prices, but they may be failing at it because of investors’ behavioral biases or errors. A third explanation could be that both EMH and CAPM are wrong. We will argue later that although the joint hypothesis is a serious impediment to making strong statements about market efficiency, this problem does not have to make us nihilistic. Within reason, we believe we can still make useful judgments about market efficiency.

This framework has served as the foundation for much of the empirical work that has gone on within academic finance for the past 40 years. The early tests of market efficiency coupled efficiency with simple security pricing models like CAPM. The joint hypothesis initially held up well, especially in so-called event studies that showed information was rapidly incorporated into security prices in a way consistent with intuition (if not always with such a formal equilibrium model). However, over time some serious challenges have come up. These can be broadly grouped into two categories: microchallenges and macrochallenges.

The microchallenges center on what are called return anomalies. Of course, even the term “anomaly” is loaded, as it means an anomaly with respect to the joint hypothesis of EMH and some asset pricing model (like, but certainly not limited to, CAPM). Within this category of challenges, researchers have identified other factors that seem to explain differences in expected returns across securities in addition to a security’s market beta. Two of the biggest challenges to the joint hypothesis of EMH and CAPM are value and momentum strategies.

Starting in the mid-1980s, researchers began investigating simple value strategies. That’s not to say value investing was invented at that time. We fear the ghosts of Benjamin Graham and David Dodd too much to ever imply that. This was when researchers began formal, modern academic studies of these ideas. What they found was that Graham and Dodd had been on to something. Stocks with lower price multiples tended to produce higher average returns than stocks with higher price multiples. As a result, the simplest diversified value strategies seemed to work. Importantly, they worked after accounting for the effects of CAPM (that is, for the same beta, cheaper stocks still seemed to have higher expected returns than more expensive stocks). The statistical evidence was strong and clearly rejected the joint hypothesis of market efficiency and CAPM.

The reaction? Academics have split into two camps: risk versus behavior. The risk camp says the reason we are rejecting the joint hypothesis of market efficiency and CAPM is that CAPM is the wrong model of how prices are set. Market beta is not the only source of risk, and these price multiples are related to another dimension of risk for which investors must be compensated. In this case the higher expected return of cheaper stocks is rational, as it reflects higher risk.

The behaviorists don’t buy that. They say the reason we’re rejecting the joint hypothesis of market efficiency and CAPM is that markets aren’t efficient; behavioral biases exist, causing price multiples to represent not risk but mispricing. Prices don’t reflect all available information because these behavioral biases cause prices to get too high or too low. For instance, investors may overextrapolate both good and bad news and thus pay too much or too little for some stocks, and simple price multiples may capture these discrepancies. Another way to say this: The market is trying to price securities according to some rational model like CAPM but falling short because of human frailty. Thus the market is not efficient.

Very much along the same lines as the value research, in the late 1980s researchers such as Narasimhan Jegadeesh, Sheridan Titman and Cliff Asness (yes, the dissertation of one of the authors — bias alert) began empirical studies of diversified momentum strategies. The studies found that stocks with good momentum, as measured quite simply by returns over the previous six months to a year, tended to have higher average returns going forward than stocks with poor momentum, again fully adjusting for any return differences implied by CAPM or any other rational equilibrium model known at the time — more evidence against the joint hypothesis.

In contrast to value, this finding has been considerably harder to deal with for efficient-market proponents. Cheap stocks tend to stay cheap for a long time. They are usually crappy companies (we apologize for the technical term). Thus it is not a stretch to believe there is something risky about these stocks for which the willing holder gets compensated. As a result, we find it inherently plausible, even if hard to precisely define, that these may be riskier stocks to a rational investor. But price momentum changes radically from year to year. What kind of risk changes so quickly? Can a stock be risky one year and then safe the next? You can’t dismiss such a thing. Extreme performance in either direction may inherently change risk characteristics. But most researchers, including EMH fans, still find it quite hard to devise a story that reconciles the success (net of CAPM and value) of momentum with a risk factor story.

Last, value and momentum are negatively correlated factors. This observation adds to the challenge. Negative correlation means that a portfolio of the two reduces risk because when one is hurting your portfolio, the other tends to be helping. Because both value and momentum average positive long-term returns, this risk reduction creates a higher risk-adjusted return to the portfolio. Furthermore, value and momentum are not just useful for U.S. stock picking. Both of these effects are incredibly robust within stock markets around the world, as well as for a broad array of other asset classes, such as bonds, currencies and commodities. The larger the total risk-adjusted return generated by a market-neutral (no exposure to CAPM) strategy, the bigger the challenge. In this sense, value and momentum are more than the sum of their parts (see also “Money Masters, Part 5: The Five-Percent Solution”).

The bottom line is that there are some factors, like momentum, that at this point seem to pose a considerable challenge to EMH. The verdict is more mixed for value, but most would agree that it still presents an additional challenge. Add to that the power of combining value and momentum, and at the very least it is fair to say there are important microchallenges to EMH.

On the macro side — meaning, dealing with the whole markets, not relative value — one of the 2013 Nobel winners, longtime Yale University economist Bob Shiller, points out a puzzling observation in his now-famous 1981 paper, “Do Stock Prices Move Too Much to Be Justified by Subsequent Changes in Dividends?” Stock prices should be the present value of future dividends. So Shiller determines what he calls an ex post rational price for the stock market as a whole by computing the present value of actual future dividends. This is obviously cheating, because in real life you don’t know the value of future dividends. The market has to make forecasts. However, the cheating is for an interesting and honest purpose. It turns out that dividends are not very volatile and change smoothly through time; Shiller asserts that reasonable forecasts should reflect this characteristic. The striking observation is how much actual market prices swing around Shiller’s “cheating” rational price. Can reasonable forecast uncertainty justify such wildly changing market prices? Shiller, one of the central protagonists of our story, says no.

Proponents of efficient markets will point out that Shiller’s methodology uses a constant discount rate. Yet there can be times when people require a higher rate of return (or discount rate) to bear the risk of owning stocks, and there can be times when people require a lower rate. If discount rates vary over time, even without any change in expected future dividends, prices should change, and that can have a big impact on the level of market prices. Thus on first principles EMH fans say we would expect market prices to vary more than Shiller’s version of a “rational” price. Again we run into the joint hypothesis problem. Can reasonable equilibrium models produce such time-varying required rates of return on the stock market?

It’s clear that while insightful, original and thought-provoking, Shiller’s observation is not quite as damning as his original interpretation asserts. Rest assured, soon we will also level polite criticism of those supporters of EMH who put too much stock in this ability of changing discount rates to save their story. We aim to be relatively equal-opportunity offenders.

So Where Do We Stand? Spoiler alert: After a lot of discussion and 20 years of implementing much of what we have discussed, and a lot more than just value and momentum, we’re still confused. Putting on a more positive spin, perhaps this is why finance is such a live and interesting field.

We started our careers in the early 1990s, when as a young team in the asset management group at Goldman, Sachs & Co. we were asked to develop a set of quantitative trading models. Why they let a small group of 20-somethings trade these things we’ll never know, but we’re thankful that they did. Being newly minted University of Chicago Ph.D.s and students of Gene Fama and Ken French, the natural thing for us to do was develop models in which one of the key inputs was value. We also used momentum from the get-go (as Cliff had written his dissertation on it), but here we’ll focus on the simple value story, as it explains most of what happened in the early days (see also “We’re Not Dead Yet”).

(As an aside, one of Cliff’s favorite stories is asking Fama, no natural fan of momentum investing, if he could write his thesis on momentum, and Fama responding, “If it’s in the data, write the paper” and then fully supporting it. That kind of intellectual honesty doesn’t come along too often.)

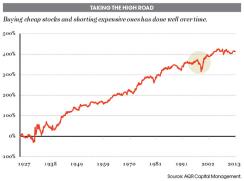

Above is a graph of the cumulative returns to something called HML (a creation of Fama and French’s). HML stands for “high minus low.” It’s a trading strategy that goes long a diversified portfolio of cheap U.S. stocks (as measured by their high book-to-price ratios) and goes short a portfolio of expensive U.S. stocks (measured by their low book-to-price ratios). The work of Fama and French shows that cheap stocks tend to outperform expensive stocks and therefore that HML produces positive returns over time (again, completely unexplained by the venerable CAPM). The graph above shows this over about 85 years.

If you notice the circled part, that’s when we started our careers. Standing at that time (before the big dip you see rather prominently), we found both the intuition and the 65 years of data behind this strategy pretty convincing. Obviously, it wasn’t perfect, but if you were a long-term investor, here was a simple strategy that produced positive average returns that weren’t correlated to the stock market. Who wouldn’t want some of this in their portfolio?

Fortunately for us, the first few years of our live experience with HML’s performance were decent, and that helped us establish a nice track record managing both Goldman’s proprietary capital, which we began with, and the capital of some of our early outside investors. This start also laid the groundwork for us to team up with a fellow Goldman colleague, David Kabiller, and set up our firm, AQR Capital Management.

As fate would have it, we launched our first AQR fund in August 1998. You may remember that as an uneventful little month containing the Russian debt crisis, a huge stock market drop and the beginning of the rapid end of hedge fund firm Long-Term Capital Management. It turned out that those really weren’t problems for us (that month we did fine; we truly were fully hedged long-short, which saved our bacon), but when this scary episode was over, the tech bubble began to inflate.

We were long cheap stocks and short expensive stocks, right in front of the worst period for value strategies since the Great Depression. Imagine a brand-new business getting that kind of result right from the get-go. Not long cheap stocks alone, which simply languished, but long cheap and short expensive! We remember a lot of long-only value managers whining at the time that they weren’t making money while all the crazy stocks soared. They didn’t know how easy they had it. At the nadir of our performance, a typical comment from our clients after hearing our case was something along the lines of “I hear what you guys are saying, and I agree: These prices seem crazy. But you guys have to understand, I report to a board, and if this keeps going on, it doesn’t matter what I think, I’m going to have to fire you.” Fortunately for us, value strategies turned around, but few know the limits of arbitrage like we do (there are some who are probably tied with us).

With this experience in mind, let’s go back to the debate over whether the value premium is the result of a value-related risk premium or behavioral biases. What does it feel like sitting in our seats as practitioners who have traded on value for the past 20 years? To us, it feels like some of both at work.

The risk story is actually quite compelling. One prerequisite for this story is that for risks to command a risk premium, they must not be diversifiable. What we saw in the tech bubble was an extreme version of exactly that. Cheap stocks would get cheaper across the board at the same time. It didn’t matter if the stock was an automaker or an insurance company. When value was losing, it was losing everywhere. We saw the same phenomenon on the expensive side. Furthermore, though very pronounced in the tech bubble, this seems to be the norm. There is a strong factor structure to value. In other words, cheap assets and expensive assets tend to covary, or move together. (This is true not only for value in stocks but for value within most asset classes we’ve looked at.) This doesn’t prove that value is a risk factor — you could imagine it occurring in a model based on irrationality — but it is a very direct implication of a rational risk-based model.

However, if you’re looking for us to make a final decision, we, as promised, offer you disappointment. There are reasons to believe some or even a lot of the efficacy of value strategies (at times) is behavioral. In addition to the long list of reasons that behaviorists put forth, we’ll offer a couple of thoughts.

Throughout our experience managing money, we’ve seen that a lot of individuals and groups (particularly committees) have a strong tendency to rely on three- to five-year performance evaluation horizons. Of course, looking at the data, this is exactly the horizon over which securities most commonly become cheap and expensive. Put these two observations together and you get a large set of investors acting anticontrarian. One of our favorite sayings is that these investors act like momentum traders over a value time horizon. To the extent the real world is subject to price pressure, and of course it is, you’d expect this behavior to lead to at least some mispricing (inefficiency) in the direction of value.

Also, many practitioners offer value-tilted products and long-short products that go long value stocks and short growth stocks. But if value works because of risk, there should be a market for people who want the opposite. That is, real risk has to hurt. People should want insurance against things like that. Some should desire to give up return to lower their exposure to this risk. However, we know of nobody offering the systematic opposite product (long expensive, short cheap). Although this is far from a proof, we find the complete lack of such products a bit vexing for the pure rational risk-based story.

Last, one thing often ignored in the EMH-versus-behaviorist debate is that there is not necessarily a clear winner in reality. Life, and the large subset of our lives (perhaps sadly) revolving around security prices, can be driven by a mix of rational and behavioral forces. Researchers looking for a clean answer don’t tend to love this fact. They all seem to want to be the declarers of a clear winner (and possibly the next Nobel laureate to come out of these studies). But the real world does not exist to make financial researchers happy, and both rational and irrational forces may be at work.

Furthermore, if value works because of a mix of rational and irrational forces, there is absolutely no reason to believe this mix is constant through time (in fact, that would be very odd). In our view, it’s likely that at most times risk plays a significant role in value’s effectiveness as a strategy (the EMH story). However, there are times when value’s expected return advantage seems like it is driven more by irrational behavioral reasons. We believe that even the most ardent EMH supporters will admit, if only when they are alone at night, that in February 2000 they thought the world had gone at least somewhat mad. (We are tempted to say there are no pure EMH believers in foxholes.)

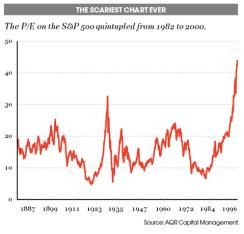

The tech bubble wasn’t just a cross-sectional “micro” phenomenon (value versus growth within the stock market), but the whole market itself was priced to extremely high levels (versus any measure of fundamentals). This brings us to Shiller’s macro critique of EMH. How is it possible that prices rationally vary so much given the relative stability of dividends? EMH supporters’ argument about time-varying discount rates is plausible, at least in direction. However, periods like 1999–2000 present a challenge for these explanations. Take a look at the chart below, which we called “The Scariest Chart Ever!” in our first-quarter 2000 letter to investors (in which we also pleaded with them not to fire us). It’s a graph of the Shiller P/E from 1881 to the end of March 2000.

Is it possible that a rational market could ever be priced so high that it simply could not deliver an acceptable long-term risk premium without making absolutely incredible assumptions about future dividends? We think not. In other words, we think the discount rate would have to be implausibly low to save EMH from Shiller this time. We think this one was a bubble.

Efficient marketers often point to the fact that it seems to be very difficult for active managers to consistently beat the market. But does this mean the market is efficient? Not necessarily. You can have an inefficient market that is hard to beat because of the limits of arbitrage. Even if markets are wrong, taking advantage of them is still risky. Further, given human biases — of money managers, their clients and whomever their clients report to — additional effective limits to arbitrage can be imposed, making even an inefficient market difficult to beat. We, of course, have firsthand experience with this. John says that before and after the tech bubble Cliff aged like Lincoln before and after the Civil War. (No, we are not elevating sticking with a value strategy to ending slavery and preserving the union — though perhaps it’s on a par with the Battle of Vicksburg.)

Along these lines, as much deserved recognition as Shiller has gotten for calling the stock market bubble, remember that he was saying very similar things at least as far back as 1996. In fact, the famous term “irrational exuberance” was Federal Reserve chairman Alan Greenspan’s statement, inspired by the analysis of Shiller and his colleague John Campbell. Note: Unlike near the peak of 2000, in 1996 we did not assert we were in a bubble and wouldn’t change that view now even with hindsight. Only near the peak in early 2000 did we think the word “bubble” could be applied. Other times, like 1996, or today, seem to us to be periods where the stock market offers lower expected returns than average, but is still perhaps rational.

Thankfully for us, our value strategies, when combined with all else we did, only began hurting a year or so before the bubble burst. We doubt we could have survived losing for significantly longer than that. Someone listening to Shiller starting in 1996 likely would have lost money without much recovery, as few if any investors could have stuck with this recommendation to reap the ultimate reward so far down the road.

Although failure to beat the market doesn’t mean markets are efficient, the opposite would have clear implications. If we found the market was easy to beat with great regularity, it would be a blow to efficiency as well as to most equilibrium models. It’s asymmetric. Nobody said this was fair.

Along these lines, some critics of EMH get a lot of joy pointing to the handful of long-term successful money managers, like Warren Buffett, and, less well known outside the hedge fund world, the amazing returns of James Simons’ Renaissance Technologies. Taking billions of dollars out of the market at low risk for a handful of people is a big deal to the manager in question (call that a mastery of the blindingly obvious). But, as perhaps the exceptions that prove the rule, even this is not much of a blow against EMH in general. The idea that markets are perfectly efficient was always an extreme and unlikely hypothesis. (Fama told us this in class in the 1980s.) The amazing success of a relatively few is, of course, very interesting. However, as rich as these few have become, they are still very small versus the size of markets and much easier to identify after the fact than before. Thus it’s less of a blow to EMH than some behaviorists would make it. We told you we’d be equal-opportunity offenders!

Let’s go back to the joint hypothesis. It says you can only test the combination of some equilibrium model and market efficiency together. Does that mean you can propose any model of market equilibrium? And if that model’s predictions are consistent with the data, can you declare success? We think not — at least, not with just any equilibrium model.

Suppose you imagine some investors get joy from owning particular stocks (for example, being able to brag at a cocktail party about the growth stocks they own that have done well over the past five years). One way to describe this: Some investors have a “taste” for growth stocks beyond simply their effect on their portfolios. It certainly can be rational to them to accept somewhat lower returns for this pleasure. But even if rational to the individuals who have this taste, if some investors are willing to give up return to others because they care about cocktail party bragging, can we really call that a rational market and feel this statement is useful? If so, what would we call irrational? One clear critique we have for EMH fans is that it seems some at times take the joint hypothesis too far and allow for unreasonable equilibrium models. In our view, this simply shouldn’t count (see also “Using Derivatives and Leverage to Improve Portfolio Performance”).

In constructing law (yes, we are borrowing from lawyers, arguably a more suspicious lot than economists), often you need to interject the word “reasonable” to make it work. We think this applies to the joint hypothesis problem as well. That is, for the purposes of making statements about market efficiency, we should examine only combinations of a reasonable model of market equilibrium and EMH. Reasonable in this case should mean a model based on clearly rational behavior, as that is the point. Suppose the only models that save EMH are unreasonable (like a model that just asserts people don’t mind losing on growth versus value, as it’s fun!). In that case — though you can never prove a theory but only fail to reject it (and this includes evolution, relativity and the theory that eventually, if they are successful enough, quants will finally get the girls) — we would have to say EMH has been dealt a serious blow. To save EMH from any particular attack, in our view, you must produce not just any model of market equilibrium that bails it out, but a reasonable one.

Under the reasonable joint hypothesis, to make statements about market efficiency we should consider only the combination of market efficiency and reasonable models of how equilibrium prices are set, with “reasonable” meaning passing some intuitive tests. You cannot endogenize irrationality into the model itself.

The price of our critique is subjectivity about what is reasonable, but we believe that has always been unavoidable, if unstated. In other words, we believe our modification is just making de jure what always has been de facto. For instance, in event studies, though simple risk adjustment is often undertaken using some equilibrium model, it rarely if ever is focused on or seems to matter. Implicitly, researchers believe that no reasonable equilibrium model could explain consistent short-term profits if such are found.

Without the above modification, codified as we do by adding and interpreting the extra word “reasonable,” there is always a potential way to save efficient markets, by contending that irrational models might drive equilibrium but markets still are efficient (that is, reflect all information). That might literally fit the classic definition, but it is not what has come to be meant by efficient markets and in our view violates much of the spirit and much of the point of the debate. EMH has come to mean some type of generally rational market. If all we mean by efficiency is that the market is bat-sh*t nuts but that bat-sh*t nuts is being accurately reflected in prices, we find that empty.

As concrete examples, we do believe some EMH proponents have proposed explaining things like the 1999–2000 bubble with tastes, as we described earlier, or discount rates that vary beyond a plausible amount. Can a market that efficiently reflects these irrational things in prices save EMH? Our mildly stronger version of the joint hypothesis above would rule out these defenses. To us they miss the point and create an untestable hypothesis. Again we ask: If irrational tastes are allowed in EMH, what can we ever find that we’d call inefficient? If that is the empty set, then what is EMH really saying? We believe it is saying a lot, but only if such defenses are out of bounds.

Does the above make us behaviorists? Maybe, but we still think most declared behaviorists go too far. Reading the behaviorist literature, you might get the impression that anomalies are everywhere and easily profited from. We’ve spent many years both studying and trading on these anomalies. Our experience, though certainly a net positive, is that many of these are out-of-sample failures. That is, it’s relatively easy to find something that looks like it predicts return on paper, and it’s also relatively easy to come up with a seemingly plausible behavioral rationale for why markets might be missing something. But when you actually try to trade on the anomaly (the best kind of out-of-sample test if done for long enough in a consistent manner), in our experience most of these things don’t work. (Value, momentum and a few other strategies have in fact stood the test of time, but many others have not.) Taken too far, the behaviorist literature may be potentially harmful in that it encourages the idea that beating the market is easy, and its stories are readily adaptable to almost any empirical finding. Obviously, the flexibility of behavioral finance is both its strength and its weakness.

So, going the other way, are we proponents of efficient markets? Generally, yes, at least as the base case. We believe the concept of efficient markets is a healthier and more correct beginning point for thinking about markets and investing. But having said that, we don’t fully buy some of the arguments that the defenders of efficient markets sometimes trot out, as we’ve detailed above. And, as Fama himself says, we don’t believe markets are perfectly efficient, and there’s room for some factors (for example, part of the value return and probably much of the momentum return) to survive and thrive in the limited amount of inefficiency out there.

As we stated early on, risk versus behavioral schizophrenia describes us well. It’s fair to say that some major bubbles have pushed us down the spectrum toward the behaviorist view. It’s also fair to say that some of the micro anomalies have pushed us the same way, but maybe less so (momentum more than value). But although it’s not a necessary condition of inefficient markets that markets be easily beatable, we still believe that if markets were gigantically, obviously and often inefficient, people could come in and take advantage of all these inefficiencies in a far easier manner than seems to play out in real life. Our experience suggests you can do it (over the long haul), but it ages you rapidly. (Cliff has been told he has the spleen and Golgi apparatus of a 75-year-old coal miner.) If we’re schizophrenic on this issue, we are at least consciously so, and it’s because we believe the middle is the closest to the right answer.

So if markets are not perfectly efficient but not grossly inefficient either — though occasionally pretty darn wacky — what should investors do? We believe the vast majority would be better off acting like the market was perfectly efficient than acting like it was easily beatable. Active management is hard.

That’s not to say we think it’s impossible. Take, for instance, our favorite example, briefly mentioned earlier, of people who seem to be able to consistently beat the market: Renaissance Technologies. It’s really hard to reconcile their results long-term with market efficiency (and any reasonable equilibrium model). But here’s how it’s still pretty efficient to us: We’re not allowed to invest with them (don’t gloat; you’re not either). They invest only their own money. In fact, in our years of managing money, it seems like whenever we have found instances of individuals or firms that seem to have something so special (you never really know for sure, of course), the more certain we are that they are on to something, the more likely it is that either they are not taking money or they take out so much in either compensation or fees that investors are left with what seems like a pretty normal expected rate of return. (Any abnormally wonderful rate of return for risk can be rendered normal or worse with a sufficiently high fee.)

Does this mean we should all go to Vanguard Group, buy their index funds and be done forever? While not at all a bad idea, we wouldn’t go quite that far. For instance — another self-serving alert — we vote with our feet (and wallets) on this every day. Many of our own investments are based on strategies rooted in the academic work of testing EMH. Again, these strategies, like value and momentum (and others), can be interpreted as working over time because they are taking advantage of behavioral biases or they are compensation for bearing different types of risk. If an investor starts with a portfolio that is dominated by equity market risk, as most are, we believe that adding these strategies makes sense. You don’t have to take a stand on whether markets are efficient. If you believe markets are inefficient, obviously you want to take advantage of these. If you believe markets are efficient and these strategies work because they are compensating you for taking risk, you still should want to own some of them (unless you fear that risk more than the average).

In our experience, actually running these strategies can be a bit trickier than what you see in the academic literature. Implementation details matter. Take value as an example. Does the measurement of value end at book-to-price ratios? In our research we find that there are many things you can do to (mildly) improve on a sole reliance on the academic version of book-to-price ratios. Does that mean we are moving away from efficient markets to being inefficiency guys trying to come up with some secret sauce to add value without risk? Not necessarily. It might simply be that in real life there is a value risk factor, but simple academic book-to-price isn’t the best or only way to measure it. (We know of no theory that argues that book-to-price is perfect.) By improving on your signals, you may get a cleaner read on the underlying risk factor.

Also, it is most certainly the case that with sloppy trading you can easily throw away any expected return premium — whatever its source — that might exist around these strategies by paying too much to execute them (and sloppy can include overpaying in a slavish, high-turnover attempt to own precisely the portfolios from the academic papers). Clearly, the line between active and passive management starts to blur with these types of investment strategies.

What does this mean the government, including quasigovernment and self-regulatory institutions, should do? If we accept that markets are not perfect, then let’s help them be as good as they can be. If they are perfectly efficient, then things like good versus bad accounting rules, or any rules for that matter, aren’t important, as the market will always figure it out. But again, perfect efficiency is a chimera nobody believes in. However, if they are mostly close to efficient but not perfectly efficient (and occasionally perhaps even crazy), then everything matters to some degree. So here’s an admittedly incomplete list of suggestions:

- The government should recognize that bubbles can happen. However, there are two important issues to consider. One, officials should recognize the difficulty in identifying bubbles, and, two, they should recognize the potential harm in acting on them wrongly or way too early (remember, Shiller was about half a decade too early). Unfortunately, most of us have fairly weak powers to identify bubbles as they are going on — identifying them after they have popped is a lot easier — and it is our belief that even the existence of bubbles does not for one second mean that a government panel will have any success in identifying them and, more important, acting at the right time. Central planning still runs face-first into Austrian economist Friedrich Hayek’s fatal conceit. In addition, fostering a belief that someone is out there diligently preventing all bubbles can have the paradoxical effect of making bubbles they don’t catch and expertly prick far more dangerous.

- The government should not subsidize or penalize some activities over others. These actions classically induce all kinds of unintended consequences and distortions. The most glaring example is government subsidies’ contributing to the recent housing bubble (though we think this is a different question from whether government or business helped convert the housing bubble to a financial crisis).

- The government should not promise to eliminate the downside. “Too big to fail” is an efficient market’s enemy. Admittedly, this advice is far easier given than taken, but recognizing this fact is quite important. Markets may be close to efficient if left alone, but markets with the downside banned are hamstrung and have little hope of being efficient.

- The government should encourage disciplining mechanisms like short-selling (and conversely, it shouldn’t ban or penalize them). Markets should have the chance to reflect all information, not just positive or optimistic information. Short-selling is rarely popular, but its free and unfettered activity makes us safer. Discouraging, penalizing or banning short-selling is “too big to fail” applied at the micro level (too micro to fail?).

- The government should encourage, not tax, liquidity provision. The way prices get “fixed” generally involves someone trading. Poor liquidity makes this difficult. Obviously, more liquidity means lower costs to reflecting information in market prices. This is simply better for everyone. Some attribute bubbles to too much liquidity (we refer to trading liquidity, not the money supply, here) and too much trading. That is hard to believe. Bubbles — to the extent that we are right, and they are rare but real — come from people believing they are going to make ten times their money, not trade the next share cheaply. On the other hand, systematic diversified traders who may be willing to trade against bubbles are in dire need of reasonably priced liquidity, as they, if they aren’t crazy, run very diversified portfolios with real but narrow spreads (like the returns to value investing) and transactions costs — the cost of liquidity — matter a lot. We want them running these portfolios.

- The government should punish true fraud harshly. However, we should also recognize that regulating to create an all-but-fraud-free world is too costly and getting all the way there is impossible.

- The government should have consistent laws consistently applied (for example, when it comes to bankruptcy). If markets are not perfect, we must help them, and arbitrary rules, and ill-defined property rights that change through time, are among the easiest ways to hinder rather than help.

- The government and self-regulatory bodies should encourage consistent and reasonable accounting. Once we give up on perfect efficiency, we recognize we’re at some point on the market efficiency spectrum. That is, markets may be mostly but not entirely efficient. Giving up perfect efficiency, you can no longer argue, “Who cares, the market will see through it” as an excuse not to have reasonable accounting rules (as some EMH proponents did after the tech bubble in regard to expensive executive stock options).

- The government should encourage that financial institutions mark more things to market. Some argue that “if you marked to market, no bank would survive.” In that case, change the capital rules around survival, but don’t disseminate false information by using prices you know are wrong or stale. If we had to prioritize, “too big to fail” and not marking things to market are our personal two choices for the original sins behind the financial contagion in 2007–’08 that followed the real estate bubble.

The broad point is that we believe markets are wonderful. They’re the best system for allocating resources and the spread of freedom and prosperity that the world has ever seen. But they are not magic. As we, and again even Gene Fama, have said many times, they are not perfectly efficient. How efficient they are is partly a function of the care and thought we put into designing them and the rules around them. Many of the actions we collectively take actually hamstring markets, making them less efficient, and then the cry invariably goes out: See, blame the believers in markets! That needs to change.

At the end of the day, we think the Nobel committee did fine splitting the baby that is the prize in economic sciences. EMH has contributed more to our understanding of finance and even general economics than any other single idea we can think of in the past 50 years. One way to assess the impact of this idea is to ask whether we know more as a result of the introduction and testing of, and the debate about, the Efficient Market Hypothesis. Most certainly, the answer is an ear-splitting yes. As such, Fama’s introduction of this hypothesis and his active (incredibly active) study of it all this time make him our clear pick as the MVP of modern finance and perhaps economics as a whole for the past almost half century. Shiller, as a major EMH gadfly, has also earned his place on this shared podium, as his is a significant and important case against EMH and Shiller has led that charge admirably. The study of EMH has made our thinking far more precise. (Again, we do not mean to understate Hansen’s contribution to the analysis of asset prices. More than its mathematical nature, it’s simply on a different spectrum from the EMH debate we focus on here.)

Moreover, the impact of the Efficient Market Hypothesis has gone well beyond academia. It’s hard to remember what finance was like before EMH, but it was not a science; it was barely even abstract art. Markets might not be perfect, but before EMH they were thought to be wildly inefficient. It was assumed that a smart corporate treasurer added lots of value by carefully choosing among debt and equity for his capital structure. It was assumed that a diligent, hardworking portfolio manager could beat the market. Anything else was un-American! At a minimum, index funds and the general focus on cost and diversification are perhaps the most direct practical result of EMH thinking, and we’d argue the most investor-welfare-enhancing financial innovation of the past 50 years. Not bad.

So where does that leave us as students of Professor Fama and practitioners for the past 20 years of much of what he taught us? Simply put, we’d have nothing without EMH. It is our North Star even if we often or always veer 15 degrees left or right of it. But despite this incredible importance, the idea that markets are literally perfect is extreme and silly, and thankfully (at least for us), there’s plenty of room to prosper in the middle. Apparently, the Nobel committee agrees. • •

Clifford Asness is managing and founding principal of AQR Capital Management, a Greenwich, Connecticut–based global investment management firm employing a disciplined multiasset research process. John Liew is a founding principal of AQR. Both Asness and Liew earned MBAs and Ph.D.s in finance from the University of Chicago. The views and opinions expressed herein are those of the authors and do not necessarily reflect the views of AQR Capital Management, its affiliates or its employees.