Charles Ellis is a master story teller. When Ellis served on Yale University’s investment committee from 1992 to 2008, his colleagues, who included David Swensen, went so far as to call the advice and wisdom he imparted through his stories “Charley’s parables.” So when I decided to research whether alpha — investment returns above what a plain old index fund would give you — was just a fairy tale that the investment industry told itself at bedtime, Ellis was my guy. I asked the author of Winning the Loser’s Game and the man who wrote the foreword to Swensen’s landmark book on portfolio management to talk to me for a video series we were filming on the murky topic of why institutional investors rarely beat the market. It isn’t a new problem (Ellis first wrote about it in 1972), but it has been getting steadily worse, and I believed I might be writing alpha’s obituary — not good when your job is writing for a publication named Institutional Investor.

When the indefatigable Ellis called me back on a dreary day at the end of March, he graciously said no to the video, assuring me I would never want to interview him on film, as he doesn’t know how to speak concisely. We then spent an hour talking about what prompted him to write “Murder on the Orient Express: The Mystery of Underperformance,” a short, Agatha Christie–inspired piece in the Financial Analysts Journal last year in which he lays the blame for the inability of pension funds, endowments and others to invest well at the feet of the “usual suspects.” Everyone is guilty in Ellis’s estimation: money managers who overpromise, investment committees operating under bad governance structures, consultants who want to protect their franchises and poorly paid, thinly staffed institutional investors.

But the 75-year-old Ellis is polite, perhaps to a fault. He assures me that all these people sincerely believe they’re doing the right thing and that it’s hard to identify the “son of a bitch” (well, maybe not polite to a fault) who is truly responsible for the colossal failure to find alpha. To make his point, Ellis takes me on a long and often touching detour to explain how we can be part of the problem even as we are oblivious to the specifics of the role we are playing. He enlists the movie The Help, in which young, card-playing white women are blind to the tragic effects of segregation around them, to make his point that people in the investment industry are doing their best, even if inexorable forces are preventing them from delivering their promised product.

Watch Our 'Is Alpha Dead?' Video Series

- David Villa on The Price of Generating Alpha

- Michael Novogratz on The Tough Business of Financial Services

- Ash Williams on 4 Powerful Tools for Generating High Returns

- Roz Hewsenian on How the Investment Game Has Changed

- Robert Hunkeler on how Corporate Trends Are Making Alpha Harder to Find

- Mary Callahan Erdoes on how ETFs Are Changing the Dynamics of the Market

- Chris Hohn on how Activist Investing Creates Inefficiencies — and Opportunities

- Kris Jenner on The Essential Elements of Delivering Alpha

Ellis, who founded consulting firm Greenwich Associates in 1972 to provide strategic advice to financial services firms, warns me he is going to stop talking, tells me how much fun he is having and asks how he can be of help. I tell him I want to know why the aggregate amount of alpha — a measure of risk-adjusted excess return — seems to be drying up. Why is it that investors can collectively discover and then quickly wring out all the value from an investment idea? Ellis has pointed to a lot of mistakes that investors make, like dumping funds at the worst possible moment; I ask him why a small-cap stock manager might have a harder time today picking stocks that will beat the average than he or she did in the 1980s.

I had evidence that it was happening. A few months earlier, before he landed at Credit Suisse in New York as head of global financial strategies, Michael Mauboussin had shown me statistics he had prepared for a Columbia University class on security analysis that he was teaching, illustrating that the margin of outperformance — that is, alpha — of U.S. large-cap mutual funds has been steadily shrinking for 40 years. “The difference between the best and the average manager is narrowing, so the results get narrower,” says Mauboussin. “We saw it at the Olympics: The gold medalist wasn’t that much faster than the athletes who won the silver and the bronze. That’s also happened in investing.”

I became interested in how alpha had gotten harder to find during the 2007 quant crisis. Traditional asset managers, which I had been covering since 1998, always tell investors and reporters the same thing when markets fall: Markets can be irrational at times, so keep your head down, keep dollar-cost averaging, and your portfolio of equities and bonds will work in the long term.

In August 2007 investors discovered that a huge number of quantitative long-short hedge funds had been using the same supposed secret algorithms to trade a handful of big stocks. When all these hedge funds got a sell signal from their algos at the same time, the markets cratered. To Andrew Lo, a finance professor and head of the Laboratory for Financial Engineering at the MIT Sloan School of Management, the quant crisis was a surprise and the first sign that something was different. There were no new big investing ideas. Every trade was crowded, and alpha might be dead.

“No corner of the financial market was undiscovered country,” says the peripatetic Lo, talking to me on his cell phone from the back of a cab.

I wanted to know how that had happened and what institutional investors were doing about it. I examined how innovations like target date funds — which automatically divvy up investments among different types of equities and bonds — had fueled blind demand for small-cap stocks. The investment spigot had been turned on for these stocks regardless of perceived value and driven prices up and expected returns down. I talked to investors who were looking for untrammeled corners of the investing world that could provide additional diversification and new sources of alpha.

But when Lehman Brothers Holdings filed for bankruptcy a year later, exploring the concept of too many investors’ running good investment ideas into the ground seemed laughable. Once the financial crisis was unleashed in its full fury, I dropped the subject of whether alpha was dead and reported instead on how the financial services industry could survive.

The crisis turned out to be a watershed moment in investors’ struggles to find excess returns. What had become common wisdom and the science of markets suddenly didn’t work. One case in point was the endowment model, made famous by Swensen: It stresses diversification into all types of equities and employs huge allocations to alternative investments like private equity and hedge funds. The model, which had produced stellar long-term investment returns for Yale, failed during the crisis. The mix of all those asset classes did not provide any cover from the losses in the public equity markets, and investors had to scramble to access other sources of cash once they got a real taste of what it meant for their funds to be locked up in illiquid investments. The research that went into the endowment model looked threadbare in the face of postcrisis structural changes like global deleveraging and unprecedented monetary policy by central banks around the world, not to mention the demands of aging populations for their assets to work harder.

Hoping to make sense of what had happened, I recently reached out to Suzanne Duncan, the 40-year-old global head of research for State Street Corp.’s Boston-based Center for Applied Research. I first met Duncan seven years ago, when she was a rising star at the IBM Institute for Business Value. She always has a counterintuitive insight when I call her about an idea I want to explore. When asked about alpha, investors’ copying one another and the effect of the 2008–’09 meltdown, she tells me that the financial crisis has forced the industry to rethink basic assumptions of Modern Portfolio Theory, such as normal distributions, market efficiency and risk-free rates of return. “Investors and providers alike are recognizing inherent weaknesses in these assumptions, which they have come to realize are not so basic at all,” she adds.

Duncan is excited about my research on alpha. She cites a joint paper from the Center for Applied Research and the Fletcher School of Law and Diplomacy at Tufts University that found that less than 1 percent of 2,076 U.S. mutual funds tracked between 1976 and 2006 achieved superior returns after costs. She also refers to a working paper from the University of Maryland that reports that before 1990, 14.4 percent of equity mutual funds delivered alpha, whereas in 2006 only 0.6 percent of the managers could say the same thing. The authors define funds that produce alpha as those having stock-picking skills sufficient to provide a surplus beyond recovering trading costs and expenses.

Duncan relishes telling people what they don’t want to hear. When I met her in ’06, she was presenting the findings of her research on how transparency and speed would destroy the value of traders, at a time when Wall Street was still making record profits. Now she’s saying that transparency and speed have destroyed alpha.

In five decades the markets have gone from what could almost be described as sleepy, dominated by individual investors’ buying and holding stocks and bonds, to one wholly dominated by institutional investors, professional asset managers and Jetsons-like technology. These investment pros — lured by the possibility of unbelievable wealth and willing to work a lot harder than George Jetson’s typical two hours a week — have done everything they can to gain an edge over their rivals, hiring the best and the brightest to make use of innovations in everything from physics and engineering to biology and philosophy. This intense competititon for an edge has reduced the amount of aggregate alpha available in the market.

Unlike in other fields, such as medicine, where scientific advances have measurably improved lives, investors are not better off in this hypercompetitive world. In today’s investment industry alpha — a measure of a manager’s skill that arguably was always hard to find — is now rare. It’s the result of a phenomenon not exclusive to investments. As the skill of all the players in a game rises, luck increasingly influences who wins and who loses. In baseball, players are now uniformly better than they were a generation or two ago; that’s what happens when you start coaching kids in kindergarten. Whether ball meets bat can often depend on extraneous factors like wind speed. But baseball, in the end, is a game. The stakes are higher in investing, whether the savings are for retirement or for a college endowment.

An e-mail in January from Robert Willis, the 58-year-old CEO of an investment management firm in Gainesville, Georgia, reopened my research into what happened to alpha. Willis, an earnest Southerner who loves to debate the reasons investors fail in their pursuit of alpha, was responding to an article I had written on Duncan’s research that found institutional investors were flocking to alternatives despite admitting that they worried about how well they understood the complexity of these products. That made no sense to Willis, who keeps a three-ring binder of photocopied articles and research on mistakes that investors make, and in his estimation was further evidence that investors just blindly copy what others are doing — hoping and praying for success.

Investing has become increasingly professionalized since the 1970s. Once the historic bull market kicked off in 1982, managers aggressively expanded and targeted would-be clients with one promise: phenomenal returns. It then became a furious race to get those returns. Add in dramatic improvements in computer technology, with pocket-size devices with the processing power of mainframes that once filled buildings and an Internet communications system that can relay information in nanoseconds, and the markets have become hypercompetitive, where few brilliant professionals can get an edge. The word “edge” itself has taken on an insidious tone now that hedge fund firm SAC Capital Advisors is facing criminal charges for failing to supervise traders who profited from insider information.

Just because alpha has gotten harder to find, we shouldn’t let investment managers off the hook, says Clifford Asness, managing principal of Greenwich, Connecticut–based AQR Capital Management, which runs $84 billion in traditional and alternative strategies. “Where I’m sensitive is that people use this as a bit of an excuse,” he adds. The 46-year-old Asness, who was head of quantitative research at Goldman Sachs Asset Management before co-founding AQR in 1998, is one of the funniest people in finance and can find humor even when talking about a subject as esoteric as alpha. He wants to make sure I know that alpha has always been difficult to locate. “Predicting the future is harder than misremembering the past,” he says. “When I hear some market strategist say, ‘It’s hard to forecast the market right now,’ I always want to scream, ‘When was it easy?’”

It’s easy to see why institutions are desperate for alpha. U.S. corporate pension plans face an almost $700 billion hole in making good on their promises to retirees, while U.S. public pension plans confront a $4.4 trillion deficit, according to a 2012 study by Harvard University’s John F. Kennedy School of Government. And those numbers don’t include individuals saving on their own. According to the Employee Benefit Research Institute, baby boomers, born between 1948 and 1964, need an additional $4.3 trillion to retire.

Any story about alpha would be incomplete without Peter Lynch, the legendary manager of Fidelity Investments’ Magellan Fund from 1977 to 1990. Lynch, who now invests his own money and that of the Lynch Foundation from an office at Fidelity after driving Magellan to a 2,700 percent return during his tenure, retired at 46, leaving finance before technology and a new generation of professionals and academics would transform the markets. A Boston Red Sox fan, Lynch became synonymous with the terms “four-bagger,” “five-bagger” and, of course, the Holy Grail of investing: the “ten-bagger” — making ten times your money.

Although he is almost synonymous with the word “alpha” in academic circles, Lynch starts out our conversation asking me to remind him what it is. Clearly, he doesn’t think, and never has thought, in terms of alpha and beta (market performance). Lynch’s secret was to buy a lot of stocks based on fundamental research, knowing that most would be mediocre, some would do “okay,” and a few would do really well. He didn’t feel he needed to own every winning stock to be successful overall, and he eschewed thinking of investing as a science that somehow could provide foolproof answers. “For the math to work, you only have to be right six times out of ten,” he says. Lynch also had a good sense of behavioral mistakes; he held on to winners, letting them run, but was very willing to cut loose his mistakes, even if that led to losses. And he acted contrary to the crowd, investing in stocks when “things were going from crummy to semicrummy,” he explains. “By the time things are great, it’s usually too late.”

For Lynch alpha was easier to get in the beginning than at the end. Mauboussin points me to the work of finance professors Jonathan Berk and Richard Green, which shows that between 1977 and 1982, when the market was still below its 1966 high, Lynch produced a mind-boggling 2 percentage points of gross alpha a month. During his last five years managing Magellan, Lynch delivered 0.2 percent monthly in gross alpha, as the fund had grown from about $40 million when he started to $10 billion in assets.

Alpha didn’t matter as much in the 1980s and ’90s because there was so much beta. The S&P 500 returned more than 17 percent a year, on average, during the ’90s. If you were making double-digit returns, you weren’t very concerned about whether your fund manager was adding much — or anything — over the index.

Rosalind Hewsenian, CIO of the Leona M. and Harry B. Helmsley Charitable Trust, remembers those days well. “Most of my career was dominated by the twin rallies of the stock and bond markets,” says Hewsenian, who was an investment consultant at Wilshire Associates in Santa Monica, California, from 1985 to 2006. “Alpha was achieved by simply tilting risk a little higher than the markets generally, and you could outperform.”

One reason alpha has become more difficult is that the pioneers grabbed the good land. Investors benefited from the profits to be had in whole new categories of investments, such as high-yield bonds and the ability to tap international markets. “Some of the low-hanging fruit has been plucked,” says Robert Hunkeler, who has overseen International Paper Co.’s pension fund for more than 16 years. “When I think back to the ’80s and early ’90s, it wasn’t uncommon that a large allocation to international equities would have given you a big leg up over your competition. High-yield bonds were still called junk bonds, and many people didn’t invest in them because of that. Those were what I call cakewalks.”

The investment management industry is built on the premise of picking winners — alpha generators like Peter Lynch. That’s why I called Mauboussin early this year to talk about The Success Equation, a book he had just published on the role that luck plays in a variety of activities, including investing and sports. Mauboussin, who had recently left Legg Mason, and I compared notes about such things as the role that luck played in how we got our first jobs. I asked him what surprised him the most in his research, and he said it was the paradox of skill, a concept developed by the late biologist Stephen Jay Gould to explain that in many fields, as people become more skilled, luck ironically becomes more important in determining outcomes. “Absolute skill rises, but relative skill declines, leaving more to luck,” Mauboussin explains.

The charismatic Mauboussin, whose fully formed thoughts pour out of him with barely an “um,” asked me rhetorically how that could work. Gould wrote a book to explain the paradox, focusing on why the last baseball player to hit above .400 was Ted Williams in 1941. The answer, Mauboussin explained, was that the quality of the players was uniformly better than in the past, so all those great batters were hitting against equally talented pitchers. That meant the difference between the best players and the average players had narrowed.

“The standard deviation of batting averages has gone down,” says Mauboussin. “If Ted Williams was a 4-standard-deviation event in 1941, then he would have hit .380 in 2011. Awesome, but still less.”

In investing the paradox of skill means that many managers are producing similar results. In other words, alpha is going down. Mauboussin refers to the writings of Charley Ellis: “He said that before the 1970s we institutions competed against mom and pop. You can get the money from them all day; my positive alpha is an individual’s negative alpha.” If Ellis was starting to see the paradox of skill play out five decades ago, I was convinced that alpha might barely be kicking in 2013.

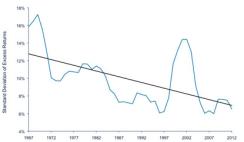

Mauboussin says that from 1967 to 2012 the standard deviation of excess returns for U.S. large-cap mutual funds has declined from about 16 percent to less than 8 percent (see chart). He explains that investors should go after areas of the market in which they can be the most skillful (remember all those institutions playing against individuals in the middle of the last century). If standard deviation declines — meaning many managers’ investment results are about the same — the game is over.

“There has been a steady decline in standard deviation in excess returns exactly as Stephen Jay Gould predicted for baseball,” Mauboussin says. “People will grind toward peak performance, and the difference between the best and the average is narrowing, so the results get really clustered.”

The elusiveness of alpha cuts to the core of capitalism itself. Good ideas — whether the iPhone’s touch screen or convertible bond arbitrage — get copied. “It’s creative destruction,” says AQR’s Asness, adding that good ideas actually remain good ideas for far longer in finance than in other industries. In part, that’s because it is harder to tell whether the good idea is the result of a brilliant insight or just luck.

There was a lot less creative destruction of good investment strategies when individual investors still ruled the markets. In the past 50 years, Ellis says, volume on the New York Stock Exchange has increased more than 2,000 times, with exchanges around the world experiencing similar growth. At the same time, the balance of trading in the U.S. has gone from 90 percent individuals to about 90 percent institutions, according to Ellis. And not just any institutions: professional mutual fund companies, hedge fund firms and others earning high fees that could then be plowed into technology, research and expensive analysts to follow companies and trends. The U.S. mutual fund industry alone went from $3 trillion in assets in 1995 to $15 trillion at the end of 2012. Foreign investors also have entered markets as cross-border capital flows have been encouraged and investors diversified out of their home countries. These investors have been able to arbitrage away inefficiencies that existed among markets that previously were entirely separate. Stock picking itself has become professionalized. In 1987, 15,500 people held the designation of chartered financial analyst from the CFA Institute; both Ellis and Duncan point me to the fact that there are now 110,000 CFA holders worldwide.

Alpha has fallen victim to technology. In the 1990s the growth of personal computers, telecommunications networks and the Internet drove stock market returns as investors flocked to companies in those sectors. But the still-nascent technologies had a much more permanent impact on the way investors discovered information about securities. The Internet made once-arcane sources of data available to everyone. The rate at which valuable information could be found, disseminated and acted upon rose exponentially. An analyst could no longer look smart simply by watching Wal-Mart Stores’ parking lots for clues about trends in discount retail sales.

In 1996 the stage was being set for high frequency trading, another dangerous thief of alpha. That year regulators enacted order-handling rules designed to introduce fairness after the Nasdaq Stock Market price-fixing scandal. The rules created electronic communications networks (ECNs) that could publish stock prices alongside exchanges. In 1999, Regulation of Exchanges and Alternative Trading Systems went live, allowing ECNs to act as markets without having to register as exchanges. Two years later high frequency traders got their shot when the exchanges began quoting prices in decimals rather than fractions. Bid-offer spreads shrank, and competition increased dramatically, as lightning-speed traders moved in and out of transactions, picking off tenths of pennies.

“The more integrated — fewer trade restrictions and capital controls, supportive technology, to name a few — the greater the efficiency of the local market,” says State Street’s Duncan. High frequency traders have forced money managers to implement expensive trading operations to protect the alpha in their good investment ideas from being picked off by more-nimble computer algorithms.

In 2000, Yale’s Swensen published Pioneering Portfolio Management, which laid out his thesis for a portfolio that looked entirely different from the general template — 60 percent equities, 40 percent bonds — traditionally used by institutional investors. Swensen extended diversification to include private equity, hedge funds, real estate and commodities.

The time was ripe for Swensen’s method. The dot-com bubble had burst, and investors were feeling the effects of real-time information on alpha in the public markets. Regulation Fair Disclosure was enacted in 2000, prohibiting public companies from releasing information to select groups like Wall Street analysts. By then Harvard, Princeton University and Stanford University were using Swensen’s model; soon other big investors were copying it. Allocations to alternatives, as well as for investments in emerging and frontier markets, grew. According to State Street and Tufts’ Fletcher School, pension funds in Organization for Economic Cooperation and Development countries raised their allocations to alternatives from 6 percent to 19 percent of total assets under management between 2000 and 2012.

Investors using the endowment model didn’t fare well in the credit crisis. Correlations went to 1, meaning every asset class dropped at the same time. Many endowments that had jumped on the Swensen bandwagon had to issue bonds to generate cash even as the public markets were reeling. But the troubles with the endowment model had little to do with the validity of Swensen’s thinking on portfolio diversification. “It’s an idea thousands of years old,” says André Perold, co-founder and CIO of HighVista Strategies, a Boston-based firm that manages $3.6 billion in endowment assets for institutions and private investors. “Chinese merchants famously divided cargo among several vessels when traveling dangerous rivers.”

But now there are more vessels traveling the same dangerous river. During the five years since the financial crisis, the vast majority of endowments have lagged the performance of a simple, traditional 60-40 portfolio. Perold, a professor emeritus of finance and banking at Harvard Business School, says diversifying into foreign equities, real estate and commodities didn’t reduce volatility; it actually increased it.

The problems had everything to do with the fact that everyone had been copying Swensen’s investment moves in hopes of achieving a similar outcome. But everybody dancing the same dance was merely a symptom of something larger going on in the investment world. Alpha was dying, and investors were hot for an edge. Ellis cheekily alleges that most of the copycats jumped right to the end of Swensen’s 2000 book — the “how to” section — skipping the first ten chapters on ways to protect principal and build an approach suitable to their institutions.

Perold takes me through his thinking on correlations-as-1-risk. Alpha can exist in a highly correlated world, but active investors need to hedge out the macro risks to reduce the correlations. “If you weren’t able to hedge your macro risk, it made alpha generation hard,” he explains. “Most active investors aren’t that good at that.” So when hedge funds make a bet in a world where correlation is high, they are just taking on more risk than they otherwise would. Their results then are much more random. Perold argues that alpha isn’t really dead, but if investors can’t identify managers with the skill to find it, it might as well be.

Looking back at the numbers, market return — beta, not alpha — has been declining in certain asset classes for some time. According to State Street and the Fletcher School, the mean return for both U.S. and non-U.S. equities was more than 11 percent between 1973 and 2010. For government and nongovernment global bonds, the mean return was 8 percent. But the story is different for the period between 1998 and 2012: Average annual returns for the S&P 500 and World Equity indexes, proxies for U.S. and global stocks, were 2.6 percent and 2 percent, respectively.

Investing in a low-return environment is extremely difficult. Returns for both stocks and bonds are expected to be in the single digits, at best, for the next several years, if not for the rest of the decade. Even a great alpha generator will deliver less if the pie is smaller. “A bull market covers a lot of sins,” says AQR’s Asness, whose firm’s view is that equity markets are expensive and bond markets are “wildly” expensive, leading to paltry returns going forward: “Whether it’s alpha or not, investors will feel like it’s tougher.”

The financial meltdown, which reached its nadir in March 2009, kicked off the worst recession since the 1930s. In response, the U.S. Federal Reserve, led by chairman Ben Bernanke, and central banks around the world prescribed strong monetary medicine to spur growth and raise asset prices, including a quantitative easing program and a near-zero interest rate policy. With the risk-free rate at a record low, it’s more difficult than ever to produce alpha. But it’s a great time to be writing about how difficult it is to find alpha, because investors rarely think about the increased risk that low interest rates present, Marc Lasry insists. “It’s just mathematically harder to find alpha because the risk-free rate is now essentially zero,” says Lasry, co-founder of New York–based Avenue Capital Group, a $12.3 billion alternative-investment firm that specializes in distressed investing.

Asset managers like Lasry measure potential investments against what they could be earning by taking no risk, such as sitting on cash. At the start of 2008, the three-month Libor rate was 5 percent. Investors were paid 5 percent to sit on cash, or Lasry could take two times the risk-free rate to make a 10 percent return. Now, with three-month Libor at 25 basis points, he has to take 40 times that risk to earn the same 10 percent return, which is what investors are demanding today. Lasry also makes the point that fiercer competition has made it harder to deliver returns. He says debt that he buys at 65 or 70 cents on the dollar today might have been purchased for 60 or even 50 cents years earlier. “As people understand what we do, sellers hold out for higher prices,” he says, emphasizing that current high yields on debt issued a few years ago also keep prices higher.

Many investors assumed that financial theories were as immutable as scientific ones. But MIT’s Lo points out that academic research on finance has been written over a fairly calm period that also created an unprecedented level of wealth. Lo points out that the incredible population growth of the past 100 years, which has pushed the planet’s citizens to about 7 billion, virtually guarantees a complex and huge financial system with unrelenting competition for alpha. “We now have incredible systems and methods to move money around to the highest-yielding opportunities,” says Lo. “Ultimately, we’re depleting these opportunities by investing more than the capacity of each opportunity to take on.” Lo, 53, is also chairman and chief investment strategist of AlphaSimplex Group, a Cambridge, Massachusetts–based quantitative investment firm he founded in 1999.

Lo is right that investing success is subject to simple laws of supply and demand, but I still had hope that alpha exists. I had spent significant time during the past year with Bennett Goodman and the other founders of credit investor GSO Capital Partners, who had previously built Donaldson, Lufkin & Jenrette’s leveraged finance business. They have shown an uncanny ability to consistently produce alpha by investing in a niche part of the markets — analyzing the credit needs of struggling companies and then devising complex one-off solutions so these companies could survive, for which GSO charged a handsome rate. But the question remained: Do alpha generators need this big of an upper hand to succeed?

If Alpha wasn’t just a ghost from markets past, I thought I might be able to uncover a few insights into how to find it at Delivering Alpha, a one-day conference co-hosted by Institutional Investor and CNBC that brings together many of the world’s top asset managers and investors to discuss key financial and economic issues. This year’s conference, on July 17, follows a tradition of taking place on the hottest day of the year, as master of ceremonies Tyler Mathisen jokingly points out from a stage in the Grand Ballroom at New York’s Pierre hotel. Not that I ever see the inside of the Grand Ballroom. I spend most of my day in a sprawling room in the Pierre’s basement, where we had brought a camera crew to film a video series addressing the current state of alpha.

Over the course of the day, I start each of my interviews with the same question: Is alpha dead?

Ashbel (Ash) Williams Jr., the 58-year-old CIO of the Florida State Board of Administration, chuckles at the question. “As long as human beings can perceive the same information differently and as long as people can disagree, there will be opportunities for alpha,” he tells me. But Williams, who at the SBA oversees $162 billion in assets, including Florida’s $82 billion state pension plan, agrees that investing has gotten much more competitive. “There are more units of stored wealth chasing opportunities perhaps than at any time in history,” he concedes.

Williams says investors need to think hard about how they can differentiate themselves. The SBA’s inherent advantages are its large size and long-term investment horizon. I want to hear more about how this differentiation fits into the quest for alpha. Though it’s an old example, Williams walks me through an investment from the early ’90s that brings the point home. At the time, many California vineyards succumbed to phylloxera, a fatal disease that gave winemakers only one option: to burn their grapevines, sterilize the soil, replant and wait. Unfortunately, 15 years can pass before grapes are suitable for wine making again. In California the long wait knocked out a lot of interest, allowing the state of Florida to buy at distressed prices some of the U.S.’s best land for grape growing.

In the early afternoon we film Hewsenian. “Oh, God. I hope not,” the Helmsley Charitable Trust’s CIO answers when I ask her if alpha is dead. She keeps her interview with me even though there’s a small crisis brewing at her office that prevents her from attending the conference that day. Like Williams, Hewsenian believes alpha is potentially plentiful when capital is scarce. Despite the intense pressure on alpha, it can still be found in what she calls “capital gaps.” But filling those gaps takes resolve, and the risks are higher than in the past. “It’s a scary thing to do, particularly when most people have spent their careers riding the beta wave,” Hewsenian says. Now, instead of allocating to traditional asset classes, she identifies broad themes, such as the growing middle class in emerging markets, and looks for ways to invest in them, going deal by deal, figuring out if the trust will be compensated for the risk involved.

Christopher Hohn, the soft-spoken head of The Children’s Investment Fund Management (UK), arrives next, clearly wanting me to stick to the ten minutes I promised him it would take for the video. When I ask him exactly how he delivers alpha (he does not think it’s dead), he offers up activist investing as one example, and he describes it as plugging a capital gap. Few investors, Hohn says, want to deal with any company that is facing a corporate governance issue, nor do they want to take on the risks, including the possible public relations gaffes, of activist investing. As an example, he points to TCI’s investment in News Corp. following its phone-hacking scandal in 2011, when most investors were fleeing the media giant.

Hohn offers an interesting way to think about activist investing. When I was reporting on Ontario Teachers’ Pension Plan last year, James Leech, its CEO, was launching a new strategy to partner with activist hedge funds and lobby for change at some of the plan’s big holdings. As many of its strategies have been copied over the years, OTPP was looking for new and creative ways to generate returns.

I was eager to talk to Fortress Investment Group principal Michael Novogratz, my final interview of the day. But it was 5:10 p.m., Novogratz had to leave the Pierre in exactly 20 minutes to make his flight out of New York, and he was nowhere to be seen.

I charged up three flights of stairs to the ballroom and grabbed the blue-eyed, green-tied hedge fund manager out of his not-so-hushed conversation at the back of the room. I asked Novogratz, co-CIO of Fortress Macro Funds, if he could walk a little faster to the basement where we were filming, because I didn’t want to miss my opportunity to talk to a macro trader who bets on the fluctuations of the global economy about whether alpha was dead.

Alpha should be available to managers who can make sense of an investment hairball. Though many investing techniques have been codified, overprocessed and laid bare in the academic literature for others to try to copy, macro investing relies in part on intuition and hard-to-document insights. The complexity offers the opportunity for alpha, even if there’s also plenty of risk to go along with that chance for outperformance.

“Macro investing is an interesting sport,” says Novogratz, laughing. He explains that he analyzes tons of data points and political and cultural influences and watches the ballet of the financial charts. “Your alpha is how you process that information.”

As an example, Novogratz points to his group’s “Abenomics” trade earlier this year, which was based on the fact that two key Japanese policymakers — Prime Minister Shinzo Abe and Haruhiko Kuroda, governor of the Bank of Japan — were willing to take a radical stance in a society that encourages conformity. The same stance in Canada would not have caught his attention. Novogratz was betting that after Abenomics was put into play, an entire generation of Japanese traders who had grown up with a stagnant bond market and an underinvested stock market would be completely unprepared for the ensuing volatility. He was right.

In our interview Novogratz suggests what institutional investors hate to hear and what many managers I spoke to for this story wouldn’t say on the record: He’s smart.

“It’s hard to teach young traders this,” he says, referring to macro investing. “You’re either good at it or you’re not.” Most asset managers won’t say they’re smart — at least, not in public — because their investors want to hear about a formal investment process that can be taught and repeated. They want alpha to be sustainable. Of course, if the process of delivering alpha can be easily documented, others can — and will — copy it, and returns should go down over time.

After the conference I chase down Cliff Asness again. It took me some time to fully understand his wavering between agreeing with me that alpha is tougher to find and asserting that it’s always been hard. Then it came to me that Asness has survived in the hypercompetitive world of investment management by redefining alpha altogether. As head of quant research at GSAM in the early ’90s, he had a front-row seat on the decline of alpha. He was among the first to commercially exploit the then-new ideas on value and momentum investing written up in academic literature, and he watched as others copied the strategy. But Asness has invested heavily over the years to keep AQR ahead of fierce competitors. In some ways, for AQR, alpha hasn’t gotten harder to find, but that’s deceiving given the scope of research and development efforts designed to give it an edge.

AQR offers an enhanced version of the strategy Asness pioneered at GSAM, but the firm is transparent with clients about that and charges far less for it than would have been the case 20 years ago. Asness explains that the strategy improves portfolios’ risk-return characteristics, even if it’s not technically alpha in the sense of a secret sauce that no one knows about. “We use the phrase ‘It’s alpha to you,’” he says.

Asness emphasizes that systematic risk premiums that look like alpha — owning cheap stocks and shorting expensive ones, for example — still work. “I mean ‘work’ like a statistician means ‘work’ — more often than not,” he says. “If your car worked this way, you would fire your mechanic.” For those strategies AQR has separated alpha from beta and offers cheaper beta solutions for clients.

Even as alpha has been weakened by trading advances, managers can add some of that back. J.P. Morgan Asset Management considers its buy-side trading prowess a big part of how it delivers alpha. Being able to skillfully trade and implement a strategy efficiently has become more difficult. But managers can either watch some of their alpha erode from a lack of an investment in this area or they can make sure they have trading skill that adds to returns.

Even with all the examples of excess returns still being available, State Street’s Duncan is done with alpha. “For the investment industry to make money going forward, performance has to be redefined,” she says. “Performance is personal.” Duncan, who along with her team has conducted several hundred face-to-face interviews with investors, believes that portfolios should be designed based on an individual client’s unique set of risks, benchmarks need to be customized, and comparisons to major indexes should be eliminated. Bills can’t be paid with excess returns, she explains; alpha is extraneous.

Georgia investor Willis, who bet me dinner he could persuade me to drop this story altogether, says it doesn’t matter if alpha is dead — investors of all stripes are just too impatient to stick with any strategy long term. He’s convinced that complexity is the enemy of alpha by introducing new risks and a lack of understanding as to what is actually in a given portfolio.

So I go back to Ellis. He too has been advocating that investment managers return to the business of providing tailored advice. He says it’s the one service they can consistently deliver. Managers who promise steady outperformance can’t make good on the pledge. “But what about David Swensen,” I say, trying to speak softly as my voice booms in a cavernous room on the second floor of the Yale Club in Midtown Manhattan. “How can you so staunchly believe that investment managers can’t outperform, when you watched David do it for so many years?” (Even with the losses of 2008, Yale’s endowment returned 13.7 percent a year over the two decades ended June 30, 2012.)

Ellis is undeterred, making the case that Swensen’s skill is not unlike that of a Picasso or a Renoir. “He’s the most rigorous thinker about investments in the world,” says Ellis. He starts to go on, then pauses. The great thing about Ellis is that he doesn’t just tell one story to illustrate his point; he tells many.

He says that when he learned how to race sailboats when he was a kid, he was taught never to follow the leader. “He’s already beaten you,” he explains. “You have to do something different.”

Ellis notes that only after reading Swensen’s Pioneering Portfolio Management a couple of times do you realize how the Yale CIO thought through the entire investment process, from protecting his portfolio to assessing the characters of the investment managers he hired. Then Ellis takes me back to his first job after graduating from Yale in 1959, when he managed WGBH-FM in Boston. Julia Child, the woman who brought French cooking to the U.S., was just getting her career started with WGBH’s TV station. Child became an icon as Americans fell in love with dishes like coq au vin, trying to emulate her complex and time-consuming techniques in a world that was getting its first taste of TV dinners. Ellis smiles and says, “After watching her, people always wondered why their creations weren’t as marvelous.”

Chefs can’t learn their craft from the couch by simply imitating the steps of Julia Child any more than investors will uncover the secret to finding alpha by mimicking the moves of a Peter Lynch or David Swensen. • •