In Tom Wolfe's iconic 1987 novel Bonfire of the Vanities, Master of the Universe Sherman McCoy isn't a stock picker; he's a very wealthy bond trader. Like McCoy, asset managers that have focused on fixed-income investing have gotten very rich over the last three decades as interest rates have steadily fallen.

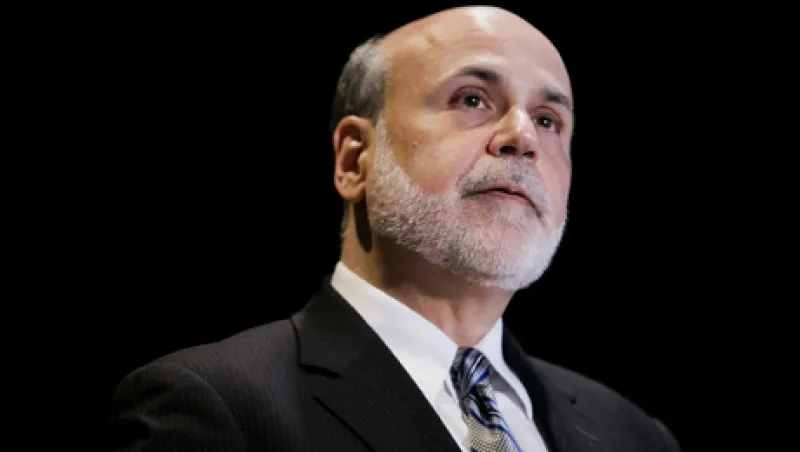

But things are about to get a lot harder for these asset managers. After an unprecedented five years of loose monetary policy in the U.S. and around the world that has pushed interest rates to historic lows, the returns investors can expect from fixed-income investments have changed dramatically. In May and June, investors got a taste of the damage that rising rates can do to bonds, whose prices fall as rates rise. In May, when Federal Reserve Board Chairman Ben Bernanke first hinted that the Fed could reduce its bond-buying program as early as this fall, prices of bonds tumbled; they fell again in June when Bernanke reiterated those comments rather than walking them back, as many in the market had been expecting. According to Cambridge, Massachusetts–based EPFR Global, which tracks individual and institutional fund flows, investors yanked $57.8 billion from global bond funds in the four weeks ending June 28. The largest mutual fund, Pacific Investment Management Co.'s Pimco Total Return fund, managed by Bill Gross, had $9.9 billion in outflows in June, after posting a negative return of 2.65 percent for the month.

The asset management industry has made a killing overseeing bond funds because of both a rise in the value of these assets as well as the scale efficiencies in managing bonds. In 2012, according to the Washington, D.C.–based Investment Company Institute, a trade group for mutual funds, investors put $304 billion into U.S. bond funds, up from $125 billion the year before. In 2009, bond funds saw a record $380 billion in net inflows. Global revenue from 2000 to 2012 for fixed-income managers grew 109 percent versus equity managers' growth of 73 percent in the same period. Among the top 10 firms on the II300, Institutional Investor's annual ranking of the 300 largest U.S. money managers, are such fixed-income behemoths as BlackRock, Pimco and Prudential Financial.

Now all fixed-income managers need to change their investment process, and that won't be easy, according to a new report from Casey Quirk & Associates, a Darien, Connecticut–based consultant for investment managers. Yariv Itah, a partner at Casey Quirk, says he expected that when rates rose, investors would dump their fixed-income investments. But his research showed something different happening. Even before rates started rising in May, investors were starting to move away from core investments into different types of bond strategies. "Among retail and institutional investors, there's not much appetite to decrease their overall allocation to fixed income. But there is a huge shift into other types of debt investments than they are in now," says Itah. Casey Quirk expects that as investors face uncertain bond markets they will shift $1 trillion of assets — about 15 percent of their portfolios — away from traditional fixed-income areas such as core, core plus, government bond and benchmark-oriented strategies tied to popular indices. Those funds will be directed toward what Itah calls next-generation debt investments, including global bonds, emerging market bonds, high-yield and bank loan investments, structured products and portfolios managed to protect investors' principal against the ravages of inflation.

There will be winners in the new landscape. Managers who can manage portfolios opportunistically and find returns from multiple sources will be in high demand. Itah expects revenue from these strategies to rise 60 percent by 2017, at which point they will represent 80 percent of the annual revenue from U.S. fixed income investors.

Winners in the new era of fixed income are often those whose investment strategies can't be easily categorized. William Eigen, who manages $30 billion in an absolute return, fixed-income strategy for J.P. Morgan Asset Management called the Strategic Income Opportunities Fund, says people thought he was crazy five years ago when he started talking about the need to decouple fixed-income portfolios from popular indices. The goal of Eigen's strategy is to beat the risk-free rate, typically U.S. Treasury yields, by a margin of two to eight percentage points a year, on average, regardless of the level of interest rates or spreads. But Eigen's fund doesn't fit neatly into a style box based on duration or credit quality.

"If some people don't like our process, it's because it's non-conventional," says Eigen, who headed Highbridge Capital Management's fixed-income group until he joined JPMAM in 2008. "If all you do is vary your investments based on various forms of spread product or interest-rate-sensitive product, then guess what? You will be vulnerable to those two factors all the time," says Eigen, who is based in Boston. "So if interest rates go the wrong way or risk premiums go the wrong way, then you'll lose your investors a lot of money." In 2008, the fund's performance was positive, even though most bond funds had negative returns, some losing as much as 30 percent. In 2011, the fund had flat performance, while some other funds were up significantly because they had bet that rates would move from record lows to even lower record lows.

J.P. Morgan's Strategic Income Opportunities Fund has three separate portfolios: Opportunistic beta, which invests in sectors such as high yield and emerging markets; alpha, which includes synthetics, correlation trades and relative value; and a hedged portion that can include taking short positions. Since the launch of the fund, as well as an offshore version, performance has been negatively correlated to the Barclays Aggregate bond index.

Jeffrey Gundlach, CEO and CIO of Los Angeles–based DoubleLine Capital, which has amassed $60 billion in largely fixed-income assets since its debut in 2009, was a pioneer in getting away from benchmarks and actively moving money among different bond asset classes depending on market outlook. Benchmark hugging "is the wrong way to look at fixed income," says Gregory Uythoven, director of marketing at DoubleLine, who has a background in quantitative analysis and sits on DoubleLine's fixed-income asset allocation committee. "Inherently it's flawed. You own the largest issuers and, unlike in an equity index, the largest issuers in debt are the ones with largest amount of debt. Then in a crisis, those guys are compromised."

Uythoven says closed-end funds are another way to manage unconstrained fixed-income portfolios because they are a permanent capital pool, can use leverage and do short selling. In April, DoubleLine raised $2.3 billion for a closed-end best ideas fund called Income Solutions, which can invest in everything from emerging market debt to high-yield bonds to bank loans. But Uythoven stresses that these type of funds require a lot of labor, analyzing sectors and individual issues. "It's not like the old core-plus fixed income where you just sector allocate based on macro views," he adds. DoubleLine also opened a floating-rate strategy to the public on July 1.

Casey Quirk's Itah says this next generation of debt investments will blur the line between active management and alternatives. Traditional asset managers should expect a significant amount of competition from alternatives firms in developing products that dump benchmarks, invest across the capital structure, use derivatives, shift to dynamic risk management and even invest money directly in deals.

Nick Gartside, JPMAM's London-based international chief investment officer for fixed income, echoes this view. "We're transitioning away from a time when fixed-income investors had the luxury of thinking only in one dimension. Now they need to think in multiple dimensions," including different geographies, sectors and currencies.

The new world of fixed income will require big changes on the part of asset managers, including bond giants like Pimco, TIAA-CREF and the Vanguard Group. Rick Rieder, BlackRock's chief investment officer of fundamental fixed income and co-head of Americas fixed income, says, "We are reaching an inflection point where people are thinking about managing fixed income differently." He adds that BlackRock investors are expressing interest in diversifying their core fixed-income portfolios. BlackRock's Strategic Income Opportunities Fund, which like the similarly named J.P.Morgan fund has the flexibility to invest in everything from government bonds to high yield to macro and absolute return strategies, has seen significant inflows over the past two to three months. Rieder emphasizes, however, "This is not going to be a rotation out of core and into tactical unconstrained strategies, but rather a move toward diversification."

Not everyone is ditching benchmarks for an unconstrained approach to fixed income, though. Insurance companies and pension funds are just two examples of investors that will want to continue to use benchmark-oriented strategies for reasons such as matching assets to long dated liabilities, managers say. Even in BlackRock's traditional core fixed income, the firm is being tactical, keeping its interest rate exposure lower than the benchmark would suggest.

Michael Gitlin, head of fixed income at Baltimore, Maryland–based T. Rowe Price, says clients will increasingly want more customization, including global multi-sector strategies and funds that offer protection against rising interest rates and inflation. But he is skeptical of claims that investors will rapidly shift 15 percent of their allocations from traditional fixed-income areas to so-called next generation investments. "There will be plenty of people who want benchmark-oriented strategies even if the benchmark is dominated by Treasuries, agencies, mortgages and investment-grade credit that is lower yielding," says Gitlin. He explains that many investors will want to use part of their fixed-income allocation as an alpha generator, while others will use bonds and credit for traditional reasons like principal preservation, reasonable income and liquidity.

Gitlin adds that the recent popularity of unconstrained investments in fixed income is partly the result of investors searching for yield and taking on more risk in the process. These investments have done extraordinarily well, but those results have been achieved in a very strong credit cycle that is not likely to repeat anytime soon, he says. "If people are thinking that the next five years will look anything like the past five years, they're probably wrong," he says.

A generation of bond managers has grown up in a world defined by falling interest rates. The future will be different, if uncertain. "Asset managers with traditional bond portfolios have a legacy challenge and risk missing out on this shift in demand," says Casey Quirk's Itah.