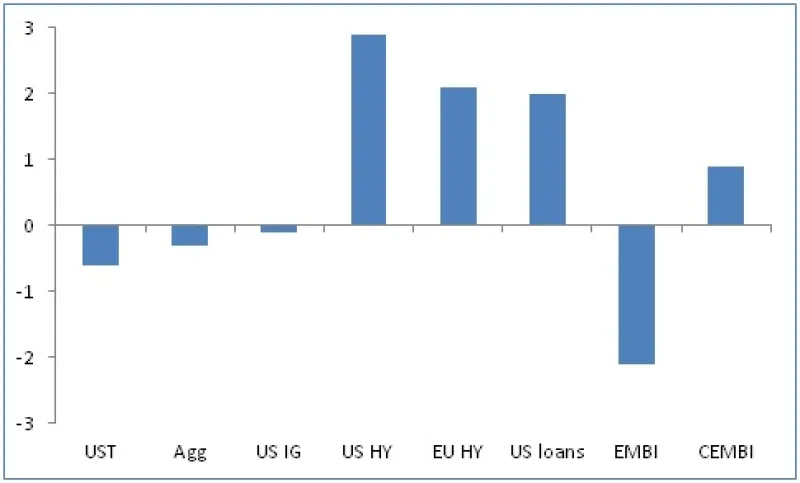

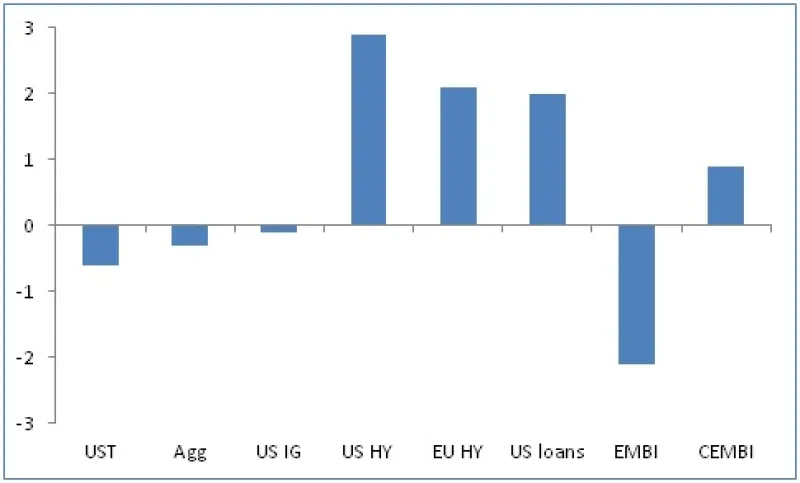

Is Emerging Market Debt Undervalued?

With no obvious explanation for emerging markets debt’s recent stumble, investors may be looking at an attractive entry point.

Michael Hood

March 22, 2013