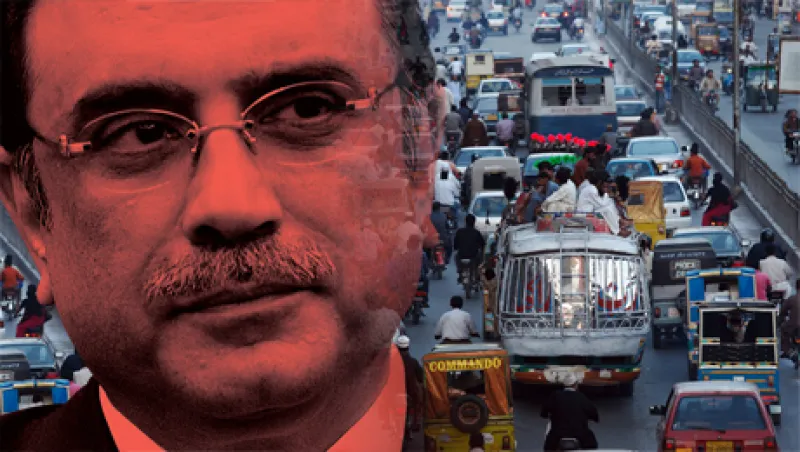

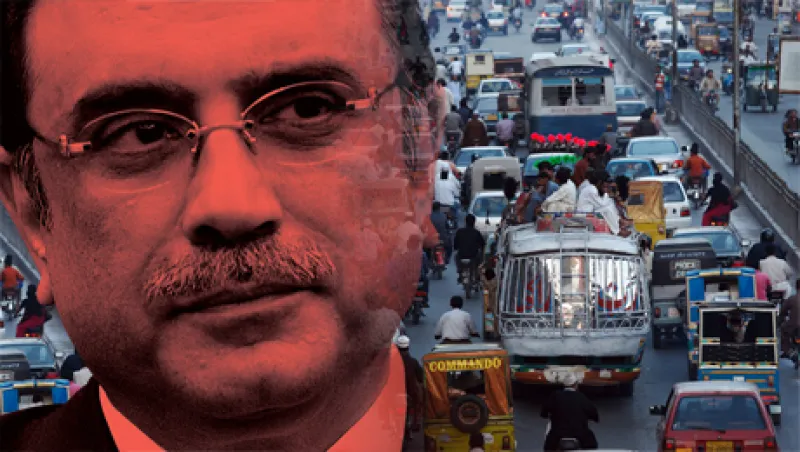

Why Pakistan Matters for Global Markets

A failing economy, Islamic radicalism and a growing nuclear arsenal make the country a potential hotbed of tail risk.

James Shinn

February 11, 2013