During recent weeks, gyrations in the Treasury market have become increasingly driven by gyrations in the presidential election polls. Investors generally believe a victory by former Massachusetts governor Mitt Romney is Treasury bond bearish and will lead to higher Treasury yields than would prevail if President Barack Obama wins a second term. This is partly driven by perceptions of how the two candidates’ respective policies may impact growth, taxation and fiscal deficits. However, the linkage between the election outcome and expected Treasury yields is bound most tightly by their potentially divergent approaches to the Federal Reserve.

Regardless of the election outcome, the president will most likely need to nominate a new Fed chairman when Ben Bernanke’s term expires in January 2014. While Bernanke has not made public his intentions, it is widely believed that he is not interested in serving a third term even if given the opportunity. The Fed nomination could very well be the most important one the next president makes due to the controversial nature of current Fed policy and the extraordinary influence it is having on financial markets. Under normal circumstances, the Federal Reserve acts like a pit crew — incrementally adjusting the federal funds rate higher or lower to provide more or less speed to the race car that is the U.S. economy, ensuring that it neither stalls nor overheats. In the current environment, though, the Federal Reserve is more like a tow truck, with the economy tethered to its back, trying to haul the race car across the finish line. The Fed has expanded its balance sheet by $2 trillion since the onset of the financial crisis, engaged in “QE Continuous” whereby that balance sheet will continue expanding for an indefinite period of time, indicated that rates will likely be near zero until at least mid-2015, and in its most recent statement pledged to continue to provide support for “a considerable time after the economic recovery strengthens.” The Fed’s actions have been extraordinary, and its influence on markets unprecedented, making the choice of the next Fed chairman extremely consequential.

If President Obama is elected to a second term, the most likely candidate to replace Bernanke is Janet Yellen, current Vice Chair of the Federal Reserve. From a monetary policy standpoint and a financial markets standpoint, a Yellen-led Fed presages more of the same. Yellen has supported recent Fed decisions and has seemed to take more of a leadership role in recent months. In her June 2012 speech, which introduced the concept of an “optimal control model,” Yellen suggested the appropriate path of monetary policy was perhaps to continue to provide accommodation even as the economy recovers and inflation ticks higher. This approach is strikingly consistent with the recent Fed language committing to remain accommodative long after the economy expands. Yellen is a driving force behind the Fed’s move towards more of a rules-based policy approach, and as chair she would likely continue Bernanke’s work and perhaps even express more of an inclination to expand on innovative Fed programs. Markets should expect continued low interest rates under an Obama second term.

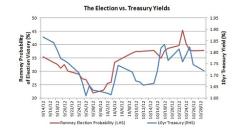

The more interesting election scenario for the Federal Reserve is under a Romney presidency. During the Republican primaries, governor Romney was vocally critical of the Federal Reserve, going on the record in opposition to continued quantitative easing and suggesting that he would not renominate chairman Bernanke if elected. If the Fed were to suddenly shift gears from its current ultra-dovish stance to a hawkish stance, the near-term impact on financial markets would likely be violent and volatile, with a negative impact on both stocks and bonds, which have been buoyed by Fed accommodation. Indeed, interest rates climbed following Romney’s surge after the first presidential debate on October 3.

While a drastic change in Fed leadership would roil markets, there are four reasons it is likely that Romney would not engineer nearly as drastic a change in Fed policy as his rhetoric indicates. First of all, Romney was most vocal about Fed policy during the Republican primaries. Since winning his party’s nomination, monetary policy has fallen off of his talking points. It is likely that some of the tough talk on the Federal Reserve was aimed at garnering support from the more conservative faction of the Republican Party. Second, many of the names mentioned as potential Romney nominees for the Fed’s top job are moderate economists and not particularly hawkish in their views. Glenn Hubbard, the dean of Columbia Business School and an economic adviser to governor Romney, is considered rather mainstream in his approach. While not as convinced of the merits of quantitative easing as chairman Bernanke, he has generally been supportive of Bernanke and even suggested that the chairman should be offered another term. Harvard economics professor Greg Mankiw, another Romney adviser and potential Fed candidate, is considered more dovish than Hubbard and more willing to use the Federal Reserve’s unconventional tools to promote employment. Third, the more hawkish candidates that Romney may consider for appointment are unlikely to be confirmed by the Senate. Economist and Stanford University professor John Taylor is one adviser who has consistently been on the record in opposition to the current Fed policy path. However, even if the Republicans regain a majority in the Senate, Taylor would face an uphill battle in confirmation — and the violent market reaction as the markets digest the prospect of a Taylor-led Fed would likely ensure failure in Taylor’s confirmation hearings. Fourth and perhaps most importantly, Romney’s advisers are unlikely to recommend that he follow through with a drastic change in the Fed’s direction quite simply because it would not be in the best interest of his own chances of reelection. Regardless of one’s views on the efficacy of monetary policy, regardless of whether or not the Fed is creating more long-term inflation potential than is justified, regardless of whether or not the Fed is enabling irresponsible fiscal policy by creating artificially low interest rates — over the short-run, reversing monetary policy is not a politically appealing solution. Right or wrong, monetary policy has been supporting asset markets across the globe and its sudden withdrawal would create short-run tumult and wealth destruction.

Between now and the election expect markets to continue to reflect the changing election probabilities. Expect Treasury yields to climb if Romney’s probability of victory increases due to fear of what he will do when it comes to Fed nominations. However, any substantial rise in Treasury yields based upon a Romney victory is likely to be a buying opportunity, because Fed policy will be accommodative regardless of who controls the White House. Josh Timons is an executive vice president and portfolio manager at Pimco.

This article contains the current opinions of the author but not necessarily those of Pimco. Such opinions are subject to change without notice. This article has been distributed for educational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.