Got a new technology to innovate the workings of Wall Street?

If you’re an entrepreneur hoping to target the financial services sector with something new, get ready for major challenges, like dealing with longer-than-average sales cycles and knocking on a lot of doors. Without the proper contacts or guidance on how to adapt your technology to the Street’s regulatory and structural requirements, a good idea might never see the light of day.

That’s often the harsh reality, venture capitalists say, for entrepreneurs trying to bring fresh ideas to the financial technology arena.

“Wall Street is famous for just wearing down these entrepreneurs,” says Steve Brotman, a managing partner with Silicon Alley Venture Partners and an investor in the sector. He says that many of the larger banks still prefer to innovate from within. They tend to shun new technology from smaller firms, and when they do seriously consider bringing in new technology from outside the corporate firewall, the vetting and assessment process can take forever.

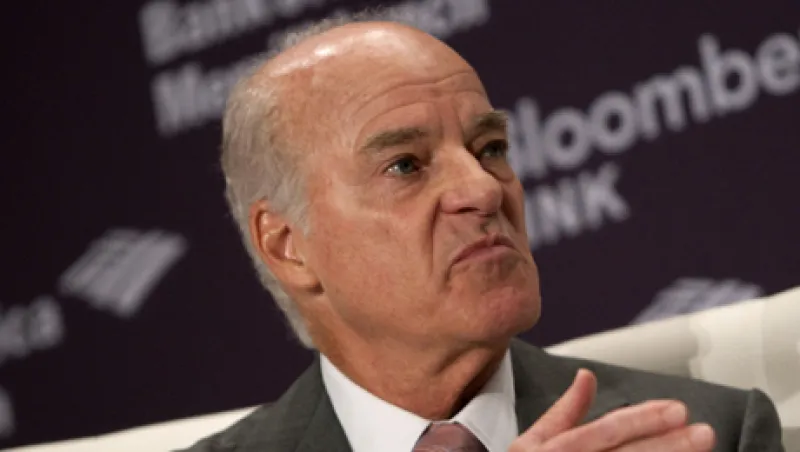

The FinTech Innovation Lab aims to change all that. The program, now in its second year, is overseen by Accenture and the New York City Investment Fund, a fund backed by KKR co-founder Henry Kravis and other business leaders to help grow local jobs. The lab program, however, is more specific: It aims to prepare financial technology start-ups for the often arduous vetting and sales challenges ahead and speed up the process, while also introducing them to potential venture capital investors in the New York area.

“One of the key goals of the program is to ensure that if someone has a good idea for a new technology that can be used by financial service firms, we help them to pursue that idea in New York, as opposed to having to go to the West Coast to raise money and realize their dreams,” says Robert Gach, global managing director of Accenture’s capital markets practice. Start-ups that participate in the FinTech Innovation Lab receive a $25,000 stipend.

But there’s more than funding involved for firms in the program. The lab provides mentoring by CTOs, CIOs and venture capitalists who are active investors in financial technology firms. “The real value of the program is in the mentoring part,” says Maria Gotsch, president and CEO of the New York City Investment Fund.

Each entrepreneur is assigned to work with not only at least three bank executives but also former and current entrepreneurs who know the industry inside out, such as Sunil Hirani, CEO and founder of Creditex Group, which was acquired by the IntercontinentalExchange for $625 million in 2008.

The program aims to improve the entrepreneurs’ ability to connect with Wall Street firms and to reduce the sales cycles, sometimes by six months to a year. “It’s so hard to get to see anyone at a large investment bank,” says Doug Atkin, a mentor to the FinTech Lab program, who oversees a fund at Guggenheim Partners run in partnership with Thomson Reuters that invests in financial technology and digital-media start-ups. “For these entrepreneurs in the program, the real benefit is in getting in the door, meeting with and being able to talk to someone at a large bank about their product and having them in the mind-set of mentoring and helping you out.”

In mid-July, in a basement auditorium at Credit Suisse’s New York offices, six graduates of the FinTech Innovation Lab gave ten-minute presentations about their start-ups’ services and technologies. This year’s firms, winnowed down from an applicant pool of 70, include BillGuard, a company that provides an online bill monitoring service that identifies and prevents fraud and provides remediation tools; Centrifuge Systems, a company with a platform for detecting patterns in very large, industry-scale data sets that can be used to assist in security efforts; Digital Reasoning, a software and services company that helps large organizations monitor and make sense of unstructured data, such as e-mail information; EidoSearch, a search engine company with the ability to conduct time-series queries, useful to traders and quants; Visible Market, a company that creates easy-to-read, visual displays of market trends and large-scale portfolio activity on mobile devices; and True Office, a firm that offers online gaming formats to improve and jazz up compliance training.

Recently, FinTech mentor Cristóbal Conde, formerly CEO of SunGard, a provider of diverse software platforms and services to financial firms, joined the executive ranks of True Office—a move that exemplifies the benefits of the FinTech program.

The presenters were selected partly because of their relevance to current Wall Street technology concerns at firms such as American Express, Bank of America, Deutsche Bank, Goldman Sachs, JPMorgan Chase, Morgan Stanley and UBS. They also worked with venture capital firms familiar with the sector that are either based in New York or with offices there, including Contour Venture Partners, Guggenheim Partners, Rho Ventures, RRE Ventures, Village Ventures and Warburg Pincus.

Although none of the firms in the program are required to be New York–based, three of the firms were founded in New York, and three were not, but as a result of the program, they currently have or are planning to open an office in New York. The technologies selected highlight Wall Street’s interest in data analysis and management, compliance applications, fraud prevention and the growing use of visualization tools to better manage growing quantities of financial information.

According to Matthew Harris, currently a managing director at Bain Capital Ventures in New York and previously with Village Ventures, all six firms selected were chosen because they were deemed to be able to attract VC funds, likely to have good commercial prospects and have viable, experienced management teams with relevant domain experience. “By the time the start-ups go through the screening and mentoring process, they have already been able to hone their proposition,” said Stephen Sparkes, CIO in the investment banking division at Morgan Stanley and another program mentor.

But attendees at the celebratory “demo day” at Credit Suisse said that challenging times of varying degrees lie ahead for the FinTech graduates. “The way to raise the likelihood of a sale is to offer a mission-critical product that offers a hard return on investment and have domain expertise or individuals on staff with industry-specific experience,” says Silicon Alley Venture Partners’ Brotman. He points out that because so many financial institutions have gotten so large, growing from several thousand employees to hundreds of thousands over the past 20 years, that small, start-up firms can waste a great deal of time just knocking on doors.

Venture capitalist Harris says he believes that the lab program takes the sales process for these start-ups from impossible to challenging. “Firms that don’t go through the process like this and just show up at the door of banks have no chance these days,” he says.

Harris says he’s optimistic about the market for FinTech innovation. “The fact that banks and large financial firms have customers using iPads and iPhones in their everyday life means that the demands for more-elegant technology have fundamentally changed,” he says. “If you are selling things that are consistent with those themes, it’s a great time to be selling to financial services.”