Traditionally the world looked to the United States for lessons on how to run a state-of-the-art stock market. But the decline of small-business listings suggests that America may do well to look for advice from some of its former students. Ironically, it may be the most antiquated exchange that offers the clearest guidance.

Of course, the United States is not the only global market to see a drying up of small-cap public offerings. Even exchanges that specialize in making life easy for such businesses have been struggling. By the end of 2011, the number of companies listed on London’s Alternative Investment Market was at its lowest level in seven years.

“There are tentative signs that this IPO disease has been spreading to Europe too,” says Colin Mason, a business professor at the University of Strathclyde in Glasgow and author of a report on the subject for the City of London. “Various mature markets look to be seeing this.”

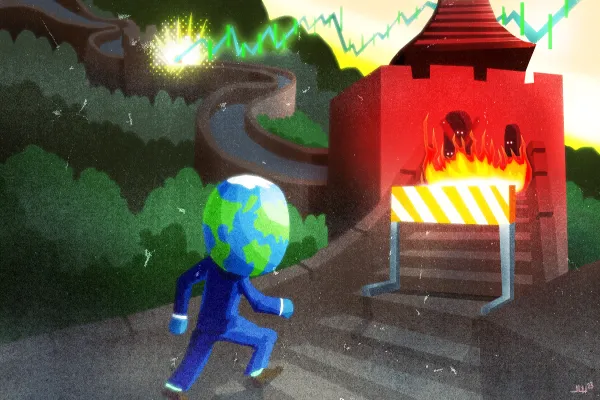

Yet this IPO atrophy has not occurred everywhere. Markets in China, Australia and Poland continued to help the little guy flourish. Still, it is Hong Kong that offers the best example of how old-fashioned practices may end up promoting microcap listings. Hong Kong has been among the most active exchanges for small public offerings in recent years.

The reason for this success is likely to be complicated. While giant institutional investors dominate stock trading in the United States, retail investors play a bigger part on the Hong Kong market, accounting for about 22 percent of trading by value in the Asian market compared to less than 5 percent on the New York Stock Exchange. These individual — and usually amateur — investors are typically more willing to take a flier on riskier small companies.

Hong Kong may also get a tailwind for IPOs from the faster economic growth in Asia and also from lower costs for listing. This second factor is the preferred explanation for the exchange itself. “We adhere to a principles-based regime rather than a prescriptive, or ‘black-letter law’ approach, which is in use in the United States,” says Lorraine Chan, a senior vice president for corporate communications at Hong Kong Exchanges and Clearing Limited. “We believe our system can be applied with some flexibility in practice, resulting in lower compliance costs for issuers than that in the United States, which has the Sarbanes-Oxley Law.”

But higher trading spreads and fees — which help support a flourishing network of brokers — may also foster small-company listings. A survey in 2011 by ITG, an independent global broker, showed investors pay up to 35 percent more on average to buy and sell stocks in Hong Kong than in the United States and 25 percent more than in the United Kingdom — even excluding the chunky tax on each trade levied in the first. Securities brokers in Hong Kong have resisted moves to encourage narrower spreads by lawmakers who have long sought to inject more competition into the market.

The resistance from Hong Kong’s brokers may turn out to be a good thing. The wider spreads in Hong Kong support a flourishing ecosystem of institutions that support microcap listings — including large numbers of retail brokers, boutique fund houses and financial services firms. A mass extinction might result if the exchange were to be fully modernized.

“To really revive small-company listings in the United States we might need to look to the past,” says David Weild, the former Nasdaq executive. “If we keep focusing exclusively on low-cost trading and the fetish for liquidity, we simply won’t have enough brokers and research to support small companies.” Weild would like to establish a parallel exchange in which companies could set minimum spreads, offering a greater incentive to trade in their shares. The example of Hong Kong appears to support this idea.

Of course, proving beyond doubt why small-company public offerings have declined in the United States is impossible. This makes forging policies to reverse the decline a tricky task. Still, looking at successful exchanges overseas may offer valuable clues. Giving up on small IPOs could be a costly mistake. When Weild wants to highlight the importance of small public offerings he relates the tale of a diminutive technology company that listed in 1971 with an IPO value of just $8 million — around $44 million in today’s money. “A tiny firm like this almost certainly wouldn’t have been able to go public today,” he says. The company was Intel, the hugely successful chipmaker, which now has a market capitalization of $142 billion.