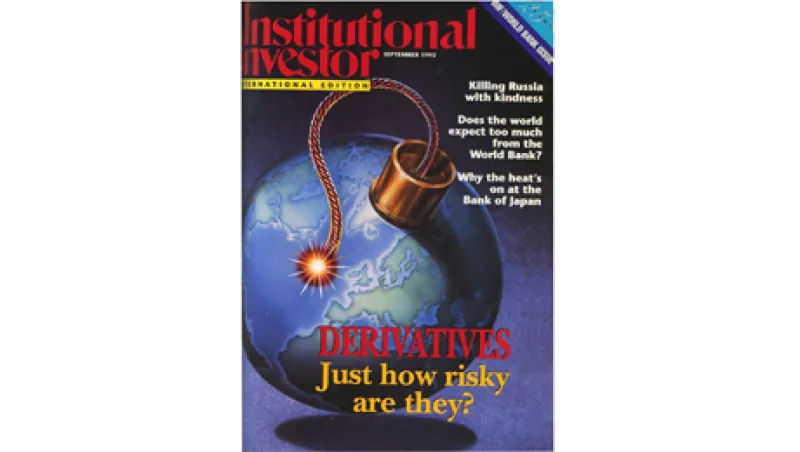

What's so dangerous about derivatives?" Institutional Investor asked back in September 1992. Quite a bit, as European Bureau Chief Kevin Muehring and Senior Writer Saul Hansell showed over the course of this cover story.

It's a classic Institutional Investor story, breaking down a complex and opaque topic and delivering it to the reader in a digestible format. But few II stories — few stories by any media outlets — have quite the prescience of this one. (See the section on nightmare scenarios, for example.)

Hansell and Muehring had been covering the topic for several years and wanted to highlight the dangers and the need for sensible regulation. Indeed, Muehring was so keen to pick the brains of then New York Federal Reserve Bank president E. Gerald Corrigan, the loudest voice on derivatives at the time, that he refused to be turned off by repeatedly declined interview requests and chased Corrigan around the world, eventually catching up with him in Basel and again in London.

This is the most recent in our ongoing series, From the Archive, which highlights the best of Institutional Investor's financial journalism over the course of the last four decades. See also International Editor Tom Buerkle's 2002 story, What's Wrong with the ECB?

----------------------

September 1992, Cover

|

The market for the highly technical, tailor-made instruments created through stand-alone or embedded interest rate and currency swaps, options and the complex combinations thereof, and known loosely as derivatives, has mushroomed eightfold in just five years. Its notional value is a whopping $4 trillion, according to the BIS, which works out to an estimated $250 billion in actual credit risk. For Corrigan, numbers like this in what has been a spottily regulated market -- one, moreover, that crisscrosses equity, fixed-income, foreign exchange and commodities markets -- are hard to ignore. Especially difficult to overlook is the fact that a mere dozen U.S. banks hold accumulated positions of $150 billion.

The responses he heard back from the bankers were not comforting. They admitted that they didn't really understand derivatives or how much money they could lose if something went haywire. To be helpful, they offered to introduce Corrigan to their head derivatives traders. Big blunder. The million-dollar-a-year swaps experts proceeded to brush off Corrigan's concerns as if he were some Luddite in a pin-striped suit: "Jerry, Jerry baby, you don't understand the business. We know what we're doing. Now don't go and spoil the party." Thus does one top banker, who was hastily deployed to placate Corrigan, characterize the swappers' condescending attitude.

It was no surprise when Corrigan decided to flex some regulatory muscle where derivatives were concerned. In a much-remarked speech before the New York State Bankers Association on January 30, Corrigan told his audience bluntly that they had better "take a very, very hard look at off-balance-sheet activities." In case anyone missed the point, he added, "I hope this sounds like a warning, because it is."

Nightmares

Corrigan's speech hit the bankers like a billy club, putting a whole new spin on discussions of derivatives. Soon, in press reports, in political speeches, even in cocktail party chatter, derivatives were being talked about in worried tones as the possible cause of a financial melt-down. Derivatives are "a time bomb that could explode just like the LDC crisis did, threatening the world financial system," warned Royal Bank of Canada chairman Allan Taylor at the International Monetary Conference in May. And Lazard Freres & Co. senior partner Felix Rohatyn was quoted in this magazine's 25th Anniversary issue in July as worrying that "26-year-olds with computers are creating financial hydrogen bombs."

What awful potential disasters have these people so frightened?

The scenarios fall into two categories. The Worst Derivatives Nightmare I is that derivatives trading itself could cause a major bank to fail. It would take some doing, but a bank conceivably could wipe out its capital this way. The regulators' Worst Derivatives Nightmare II is in some ways a lot more hair-curling, because it is less predictable and therefore would be harder to cope with. That is the prospect that derivatives, simply because they now invisibly permeate the entire financial system, could turn an ordinarily containable situation -- one that isn't even caused by them -- into a full-blown financial crisis. Says Federal Reserve Board vice chairman David Mullins Jr., "As a central bank, we think a lot about small-probability, high-stress events."

Before everyone heads for the fallout shelter, it's worth considering whether the biggest problem raised by derivatives is not the products themselves but the challenge they pose for the patchwork of regulations intended to safeguard the world's finances. Sure, derivatives give institutions new ways to lose money or even fail, and they create a network of interbank transactions that could change the character of the financial system. And since most governments explicitly or implicitly commit themselves to bailing out commercial banks that get in trouble, supervisors have every reason to insist in the strongest way that these new risks be understood and handled prudently.

Yet a close examination of the derivatives business shows that, while it is hardly risk-free, it is far less precarious than traditional financial activities. Lending money to shopping mall developers or trading mortgage-backed bonds -- to take just two examples -- are actually more dangerous than dealing in derivatives. What makes derivatives different is that, neither loans nor securities, they are largely unaccounted for in the current legal structure of finance. This makes the regulators feel, with some justification, helpless.

Over-the-counter derivatives will eventually force the world to rethink how it supervises finance, accounting for the blurred roles of banks, securities firms and other players. Risk will ultimately have to be managed not with government supervision but with capital and strong firewalls between institutions and their affiliates. And government safety nets for banks will have to shrink.

So far, so good

The dealers, of course, are quick to point out that derivatives, to date, have caused far fewer losses and other market disruptions than run-of-the-mill financial products. And there are no warning tremors of systemic risk similar to the volatile triple-witching-hour days that prefigured the 1987 crash of the U.S. stock market. Not even all the regulators are frightened. "There is too much alarmist rhetoric involving these products," argues U.S. Securities and Exchange Commission chairman Richard Breeden. "We've seen 2,500 banks fail because of credit risk. We have a long way to go before the swaps market is as threatening."

Derivatives dealers have been known to suggest -- sometimes with a smugness that's said to so infuriate Corrigan -- that generational factors are at work in the dread of derivatives. Older regulators and bankers, they say, fear things that they haven't taken the time to understand. Though derivatives are no more incomprehensible than VCR programming instructions, they are based on theories that have been included in business school curricula for only a decade. And they do require a certain amount of college-level math to value.

Political motives may also underlie the official scare stories, dealers imply. Competitors of derivatives dealers -- such as futures exchanges -- have reason to cast doubt on this upstart market. Cynics note that Corrigan himself might have felt he needed a holy crusade to counter criticism for having been slow on the uptake concerning the scandals at Bank of Credit & Commerce International and Salomon Brothers. "Jerry wants to be the chairman of the Fed," says one senior American regulator. "He wants to be out front on this and look tough."

Although there may be some truth to the dealers' self-serving observations, they unfairly undercut the real challenge derivatives represent to the existing structure of financial regulation. For a start, it's hard even to figure out where derivatives fit into the usual scheme of rulemaking by types of institution; they're used by every conceivable kind of organization, from banks and brokers to insurers and pension funds to corporations and governments. Within most countries no single agency oversees derivatives.

Of course, the business is dominated by multinational institutions that operate in dozens of countries. What's more, because over-the-counter derivatives aren't loans or deposits or stocks or bonds or exchange-listed futures and options, they tend to fall outside the usual regulations governing financial instruments.

Complicating matters still further, many derivatives are types of options, so their value at any given moment is a function of a complex calculation of the probability that they will eventually be exercised. Such high math is not exactly compatible with the prosaic methods of conventional accounting, making it troublesome for regulators to set meaningful capital rules. Derivatives, notes Richard Farrant, the Bank of England's deputy director of banking supervision, are "at the frontiers of the accounting system."

Regulators have thus found it difficult to take action to address the real, if exaggerated, risks of derivatives. To start with, they've discovered that they must hire new people or completely retrain their staffs to be able to conduct routine examinations of derivatives dealers. For any new rules to be both effective and fair, moreover, they must be applied evenly to banks and securities firms in all the countries in which they do business.

The forum for discussing these regulatory dilemmas is the BIS's high-level committee of bank supervisors, which Corrigan chairs, and the International Organization of Securities Commissions. As part of a broader move to create uniform capital standards, a joint BIS-IOSCO committee is working on ways to account for derivatives and require that capital be held against them. This seemingly technical process is in fact fraught with political agendas, as various countries jockey for competitive advantage.

As many in the industry see it, they face a prospect worse than just more regulations: muddled and contradictory ones. "Some regulators are quite sophisticated," says David Gelber, Hongkong & Shanghai Banking Corp.'s head of global swaps, "and in that category I would put the Americans and the British. Some are sophisticated but won't admit it, and are downright obstinate -- the Germans and the Swiss. And some are not nearly as involved -- the Italians and all the others. Now, trying to get an agreement between bank regulators and between securities supervisors, and then between the two lots of them, means a consensus only on the lowest common denominator."

One of the regulators' biggest qualms is that, while they're still getting up to speed on derivatives, a bank will brashly expand into uncharted areas and run up a substantial loss. "You have to continually ask yourself, 'Where is the weak link in the chain?' "says Alexandre Lamfalussy, the soft-spoken general manager of the BIS. "I do believe most major houses have very carefully controlled risks and that much of the derivatives activity entails a hedging that reduces risks. There might never be a problem. But -- and it is a big but -- if there were, it would be a very big problem."

Derivatives dealers, of course, claim they know the risks well -- it is their business to manage them, after all. And, they add, just because regulators can conjure up derivatives disasters (see box, below), that doesn't mean they'll happen. "Swaps guys may be clever characters, but we haven't been able to invent new kinds of risk," says J.P. Morgan & Co. vice president Mark Brickell, the intense former chairman of the International Swap Dealers Association. "What swaps have allowed us to do is tear apart different sorts of risk, isolate them and manage them independently."

Moreover, Brickell points out, even the most esoteric derivatives involve risks that banks have had to deal with for years. "When you think about it, any bank that makes a fixed-rate mortgage that can be prepaid is shorting an option," he notes. "Any bank that makes an oil-production loan is exposed to oil-price risk big time. What we do is create ways to hedge that exposure." Market participants, he explains, are working to reduce their credit exposures through master swaps agreements, collateral and even the formation of credit-enhanced swaps units.

Some bankers are getting downright testy at what they see as grandstanding by government officials. "They seemed to suggest that top management doesn't know what derivatives are and that the place is out of control," complains Deutsche Bank's executive vice president for treasury operations, Alexander von Ungarn-Sternberg. "It was a little hard to stomach." Central bankers do in fact charge that in many banks, top management just shrugs its shoulders and hopes the kids know what they're doing.

Nothing makes a bank examiner angrier than such an attitude. Chester Feldberg, the New York Fed's executive vice president in charge of bank supervision, underscored this point in a sharply worded letter sent to all New York-region bank CEOs. Noting that the Fed's examiners had uncovered "basic internal-control weaknesses" in the cash-market and derivatives trading operations of domestic and non-U.S. banks operating in its jurisdiction, Feldberg cautioned that "sophisticated trading strategies and complex instruments by their very nature require robust risk management and controls."

Bankers, however, may be less concerned with maintaining control than with becoming competitive. The pressure on them to plunge into derivatives -- which can return 40, 60, even 100 percent on equity -- is immense. That's all the more true for European and Japanese banks racing to catch up with such pioneers as Bankers Trust Co., Citibank, Credit Suisse Financial Products, J.P. Morgan, Societe Generale and Swiss Bank Corp.

Deutsche Bank speaker Hilmar Kopper sternly insists that his bank has "a careful lid on this [derivatives business], and we do not want to expand very much." Nonetheless, Deutsche seems to have every other headhunter in Europe working the phones to scrounge up more derivatives experts for its burgeoning operation.

Reckless drivers?

Regulators fear that as more players pile into the market, the neophytes may try to cut corners to grab market share, setting themselves up to stumble. Vicky Fitt, head of risk analysis at Britain's Securities and Futures Authority, sees a worrisome two-tier market emerging. "In general those financial firms that are most heavily involved in the OTC derivatives market tend to be the most cautious," she says. "They have the most trading expertise, and they control their risks using the most advanced risk-management systems and techniques. [But] behind these big guns is a rapidly growing number of smaller outfits anxious not to miss the boat, who cobble together OTC derivatives capabilities in an attempt to keep up with the play and get their share of the market with limited regard to the dangers."

Their naive recklessness, moreover, raises the risk quotient for everybody. "In manufacturing, market price is set by the smartest guy with the best, cheapest production process," says William Heyman, the SEC's head of market regulation. "In securities markets the price is set by the dumbest guy with the most money to lose."

What regulators find equally disturbing is that banks feel compelled to venture further and further into a derivatives terra incognita to find a proprietary product that they can peddle at a high price before the rest of the market comes thundering after them. But should the maximum speed limit be reduced to 35 miles per hour just because a few drivers aren't altogether safe at 55? Marcel Ospel, head of Swiss Bank's derivatives unit, says the newcomers to the market are "a problem that worries me as well." Yet he argues that "to use them as a benchmark to regulate a market that by volume is dominated by the major houses is unjustified."

Bank of England director of banking supervision Brian Quinn, however, contends that the considerable risk management skills of the leading institutions may tempt them to take on excessive risk. "The growth of this market has been not only in volume but in density as well," says Quinn. "It pricks up your ears and raises an eyebrow because it brings up the question of controls."

Quinn and other regulators are concerned that this heaping on of extra risk by individual banks active in derivatives could lead to systemic risk. Suppose more competition prompts several large dealers to build huge books of derivatives on a particular market. And suppose they all make the same mistaken assumption in their kindred hedging models, counting on liquidity that isn't there. Presumably this would send derivatives prices and the underlying market into turmoil. Then if a bank actually defaulted on its counterparty obligations, those defaults would go ripping across countless banks' balance sheets. Who knows what financial chaos would result? regulators worry.

Financial crises of the past have all followed a similar pattern, according to a 1989 Bank of England study. First there is intense competition, product innovation, declining capital ratios and shrinking prices. And, in a classic case of the calm before the storm, the markets are relatively tranquil just before all hell breaks loose. The catalyst in many cases is an unexpected shift of monetary policy, resulting in a run or panic, the deflation of asset values and a surge in the price of credit. However, the study concludes that a crisis in one market "does not have to lead to a strong contagion between markets, further monetary tightening or economic recession, provided the authorities intervene firmly and decisively."

What terrifies regulators is that a panic involving derivatives, because they crisscross borders and financial markets, could consist of an interbank payment crisis, a stock market crash and a huge interest rate leap -- combined. The links derivatives form between markets are subtle and outside the regulators' regular purview. "We do not know the web of interconnections between banks that has been established through derivatives," concedes the BIS's Lamfalussy. "The market is losing transparency, and we do not know who is dependent on whom anymore. Now we will only know after the fact, and by then it could be too late."

Contrast the regulators' groping approach toward derivatives with their ready and detailed knowledge of interbank deposits. During the Mexican debt crisis in 1982, for example, Mexican banks in London found that they suddenly couldn't fund themselves and were not going to be able to meet the next day's obligations, raising the specter of a broader banking crisis. By looking at its up-to-date interbank deposit records, the Bank of England knew exactly what the Mexican banks' positions were and was able to deal with their predicament literally overnight, averting a crisis. As Lamfalussy says: "At least with the LDC crisis we had an indication of the order of magnitude [of the problem]. You had a photograph at any one time of the relationships."

Another concern stressed by Lamfalussy and other regulators is the settlement risk posed by derivatives. The ISDA is quick to note that the flow of cash payments through the derivatives settlement system on any given day is unlikely to exceed $2 billion, compared with the $640 billion of daily clearing of foreign exchange transactions. Nevertheless, derivatives positions could conceivably trigger an immense and sudden surge of settlements, which might overload the settlement systems in any one market and choke the flow of counter-party obligations being settled.

Scare stories notwithstanding, many bankers argue that derivatives are substantially reducing the overall risks in the financial system. As for the "strong contagion" notion of derivatives as agents of financial infection market-to-market, Jonathan Asquith, a director at Morgan Grenfell & Co., turns it around: "The capital markets are separate pools linked together by derivatives, which allows for an overflow in one market to flow into another via arbitrage. This makes the overall sea calmer."

That may be so, but derivatives still make regulators queasy. For one thing, they undercut regulators' ability to carry out their nonsupervisory duties, from preventing excess volatility to stopping insider trading to controlling monetary policy. The chimerical nature of derivatives makes them all too handy for regulatory arbitrage -- accomplishing things that would otherwise be illegal under tax, disclosure, accounting and investment rules.

Gorillas in the dark

Derivatives revolutionized finance, but have yet to revolutionize regulation. "Regulators and senior bank management everywhere woke up to the fact that a massive change has occurred, one that has fundamentally altered the structure of finance and the interactions of the markets," says Alan Woods, head of global swaps and options at Barclays de Zoete Wedd. "And their first reaction seems to have been one of panic." Adds CSFB-Effectenbank CEO Friedrich von Hoyos, who sympathizes with the regulators' plight, "It is the kind of fear you might have when you enter a dark room and you suspect there might be a big gorilla in there about to get you."

So how do you deal with this big gorilla? You can try to sedate the beast, but, as with proposed rules to slow down derivatives trading, this is a temporary solution at best. You could snap on the lights. Then at least you could see what you were up against and perhaps take refuge behind a couch -- disclosure standards and capital cushions are the defenses that regulators are trying to use the most against derivatives.

Ultimately, though, you could try to train the ape to behave and then learn to live with it, however nervously -- for all the threats that regulators are going to crack down on derivatives, there's little they can actually do about them.

Stopping or even significantly slowing down the derivatives revolution is impossible. So the Japanese discovered when they tried to restrict both listed futures and over-the-counter derivatives tied to the Tokyo Stock Exchange. The futures business simply moved to Singapore, and the OTC deals were struck in New York and London. Japan's Ministry of Finance found that it was not able even to observe firsthand the derivatives market based on Japanese stocks. As for Japanese firms, they were put at a competitive disadvantage until the MoF grudgingly gave them permission to trade derivatives overseas.

Still, a number of current regulatory initiatives are meant to slow derivatives activity. The Fed is requiring the banks it supervises to apply for its permission to transact equity and commodity swaps. "Our concern wasn't to stop these activities, it was to make sure the banks are managing them prudently," says a Fed official. "Those are manageable risks, but that is not to say they will always be managed properly." And banking regulators in the U.S. and Europe are coming up with rules to limit the exposure of a bank to a single counterparty.

What price risk?

The first line of regulatory defense, however, is capital. The more of it a bank or firm has, the greater its protection against catastrophe. Capital rules, and their enforcement, moreover, are one of the primary levers the regulators have to guide firms. "Capital is how we price risk," notes the SEC's Breeden.

Yet setting capital rules for derivatives is a lot more complicated than simply requiring a bank to reserve 8 percent against its corporate loans. One must first come up with a value for the derivatives against which to charge capital. That varies by market conditions, and it may also be affected by hedges.

At first regulators tried to fit swaps to the model of corporate loans and set capital rules based on the notional principal amount of the transactions, which has little relation to actual risk. Now regulators agree that it's more accurate to use the net present value of a swap -- its marked-to-market value -- as the benchmark, adding on a certain amount to account for a potential increase in the exposure. But the net-present-value approach is not "bulletproof," cautions one regulator, because it is based on what many believe to be the dubious assumption that there will in fact be market liquidity at the exact moment in a crisis when it is needed most.

The process of updating global capital standards is a broad effort dealing with many issues, including a more sophisticated treatment of derivatives. Predictably, it has gotten mired in political wrangling. Early this year the BIS and IOSCO promised new proposals for joint bank--securities firm rules by this summer. Now that project is on hold until key IOSCO members, particularly the Americans and the Japanese, come to terms with the European Community's much further advanced investment-services and capital-adequacy directives.

"The EC rules, particularly the capital requirement for equity, are far too low and create very dangerous exposures with inadequate capital," says Breeden, who as chair of IOSCO's technical committee was the prime mover of the talks with the BIS. "When our colleagues from around the world suggest we cut our capital rules by 80 to 90 percent, we're not interested."

Most Europeans counter that Breeden is being conveniently myopic, ignoring the fact that his hard-line approach simply pushes all the activity into unsupervised affiliates or offshore into their domain. Others suggest that Breeden's expectations for the BIS-IOSCO meetings were too ambitious. "Breeden's desire was to be the statesman of Western finance," says one Washington regulator. "He tried to turn IOSCO from a social organization that threw a couple of parties into something like the BIS. It wasn't up to that."

All of this bureaucratic infighting has had little impact on derivatives dealers. In the U.K. the rules imposed by the EC are likely to be similar to the Securities and Futures Authority's existing requirements. Notes Credit Suisse Financial Products had trader Christopher Goekjian: "The capital reserving might be slightly higher, but I don't think it will be a problem for us. The ones that will suffer will be the specialist shops."

What's important to swappers is whether derivatives dealers have to hold capital against their gross or their net credit exposure with a counterparty. Major dealers tend to have dozens of deals on their books with each of the other large players. Most of these transactions offset each other, and the ISDA master agreement says that in the case of default, all of these transactions would be collapsed into one net payment.

The ISDA calculates that if the capital rules were applied to the net rather than gross amounts, it would reduce capital charges by 30 to 50 percent. The main obstacle to this approach, according to the Bank of England's Farrant, is whether netting can "withstand all the legal challenges." In effect, the netting provisions will have to be upheld in an actual bankruptcy case before regulators will be willing to give the full break for the net exposure.

"We have a favorable attitude toward netting, as long as it is done on a solid legal basis," Lamfalussy offers. "But the legal question is not solved, and to allow netting with a false sentiment of its legal footing would be dangerous." He suggests legislative changes in the bankruptcy codes. The U.S. went a long way toward recognizing netting within swap agreements in 1990. But this little change in U.S. bankruptcy law took a solid two years of intensive lobbying of Congress, and the thought of doing the same across the G-10 countries is a bit daunting for even the most fervent swaps proponent.

The use of marked-to-market positions as the basis for capital rules causes more conundrums for regulators. They need considerable sophistication to check whether firms are pricing their books accurately. The SFA actually certifies every firm's computerized pricing models -- something U.S. regulators have shied away from. "For $112,000 a year [the top U.S. federal bureaucrat's salary], we can't hire someone who can check the models of kids making ten times that," gripes the SEC's Heyman.

U.S. bank regulators content themselves with making sure there is an independent process in place to value the book. "The trader can't do his own mark to market. The system can't have bias in it," says the Fed's Mullins. Indeed, the Fed has been making banks pay outside experts to value their derivatives portfolios.

Despite all the talk in the U.S. of harmonizing capital requirements between banks and brokerage firms, there are still substantial differences in how the various types of organizations are regulated, and it's an important distinction to consider when it comes to the future of derivatives and other financial products. Banks -- including European universal banks -- are not meant to fail. So supervisors inspect banks' activities closely, making detailed recommendations for changes, and if such oversight is ineffective (as it often is), the government provides liquidity or even a bailout of a failed bank.

By contrast, regulators simply assume that some brokerage firms will fail. Securities regulators merely enforce capital rules meant to guarantee that if a firm does collapse, there will be enough money left to pay off its customers.

Darwinian solution

The SEC has taken an extreme version of this approach in dealing with derivatives. Through a very restrictive capital rule, it virtually forced brokerage firms to conduct their swaps activity through subsidiaries separate from the broker-dealer. And until this year the SEC had no authority to regulate those affiliates at all; now it can gather data to make sure that the unregulated unit doesn't bring down the one with the customer accounts.

Breeden is considering whether to force derivatives activity into regulated subsidiaries through special capital rules. Still, he defends the current lack of regulation: "If the public isn't asked to commit in advance to a bailout, having a particular type of trading activity in an entity with no public funding isn't necessarily bad."

Indeed, many trading-oriented bankers, as well as U.S. regulators who have had to confront the horror of the $250 billion thrift bailout, think this Darwinian securities model, rather than the paternalistic central banker approach, is the way to regulate derivatives. "Look around the world. Banks are always finding more ways to arbitrage and sell the government safety net," says the Fed's Mullins, who at the U.S. Treasury was one of the architects of the Bush administration's proposal to let banks into the securities business. "We support the notion of having affiliates that can be cut off and allowed to burn without affecting the main part."

Mullins goes on, however, to argue that the derivatives industry must take action to police itself, just as the New York Stock Exchange and the Association of International Bond Dealers do as legally constituted self-regulatory organizations. "The swaps dealers are a big adult market now," he says. "They have responsibilities they can't ignore. Either they create an SRO with teeth and submit to its discipline, or, if there are problems, they might not like the alternatives that could be produced for them here in Washington. I'm not especially impressed by the ability of the regulators and Congress to design optimum rules for new and evolving financial markets."

Such comments would not be welcome at the BIS. The more traditional central bankers, who gather there every month, do not want to abandon their mission of safeguarding the confidence that is the bedrock of the financial system. In fact, there is an unmistakable air of regret, especially among European and Japanese regulators, that the stream of financial innovation, in which the derivatives revolution was spawned, has probably done more to destabilize the banking system than to benefit it. "With a process of deregulation as abrupt and rapid as that in the second half of the 1980s, the risk is always that you will see something of a regulatory backlash," suggested BIS chairman Bengt Denis at a June press conference.

Yet in derivatives the central bankers may have met their match. There are few regulatory sticks with which they can lash back. Indeed, it is this helplessness that ultimately explains Jerry Corrigan's ominous speech last January. If central bankers have fewer tools than ever to stem financial crises -- in part because of derivatives -- their first and best hope is to implore, cajole and frighten bankers into not getting into trouble in the first place. • •