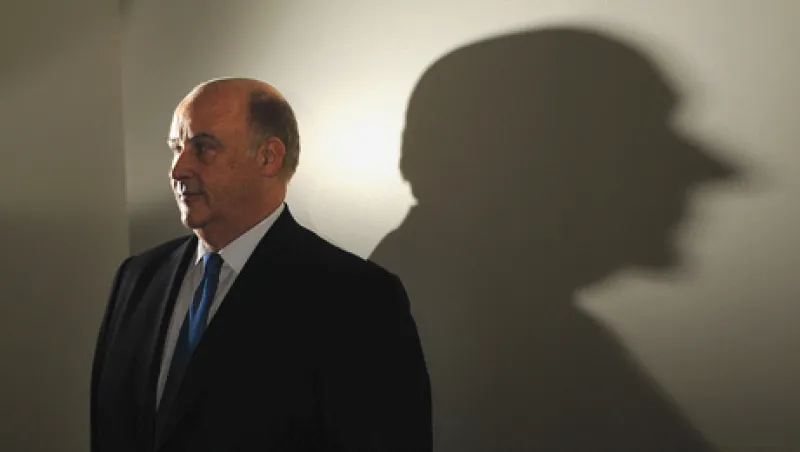

Don Robert is one of a dwindling band of business leaders in Europe who can look forward to 2012 with some confidence. CEO of Dublin-headquartered credit and business information group Experian, Robert has surging revenue and a buoyant share price on his side. In November, Standard & Poor’s upgraded the credit rating of wholly owned subsidiary Experian Finance to A– from BBB+, saying the unit will “continue to show resilient revenue growth, despite the soft economic conditions.”

The largest credit reporting firm by revenue after U.S. rivals Equifax and TransUnion, Experian emerged from the financial crisis of 2008–09 in good shape. The Dodd-Frank Wall Street Reform and Consumer Protection Act creates opportunities for Experian and its peers by forcing lenders to be more transparent. And a well-timed 2007 acquisition in Brazil, along with other moves to expand in Latin America, has boosted Experian’s revenue growth just as some mature economies have slowed.

In the six months ended September 30, revenue for London Stock Exchange-listed Experian was $2.3 billion, up 15 percent over the same period in 2010, while pretax profits climbed 20 percent, to $539 million. Having started 2011 below 700 pence ($11), the FTSE 100 company’s stock now hovers around 800 pence, giving it a market capitalization of nearly £8 billion.

Experian, where U.S. expat Robert has been CEO since April 2005, is perhaps best known for helping banks check consumers’ credit records. Founded in 1980 as CCN Systems by current chairman Sir John Peace, it was the first British company to develop credit scoring. CCN, which began as part of U.K. retailer Great Universal Stores, was renamed Experian in 1997. Experian demerged from GUS in 2006 and now employs some 15,500 people.

Roughly one third of the company’s $4 billion in fiscal 2010 revenue came from financial institutions, with consumers making up another third. In the U.K. and the U.S., Experian keeps records on about 45 million and 215 million adults, respectively, including electoral roll details and loan default and bankruptcy information. This data has many applications. For example, consumers use it to check their own credit ratings—a growing business these days. Meanwhile, the British government turns to Experian to help it detect housing and disability benefits fraud. The company also works with telecommunications businesses and other utilities to help assess their customers’ financial positions.

Robert, a native of Portland, Oregon, led Experian through the demerger and made the U.K. a smaller part of the business, although that market remains vital. His central strategic challenge: boosting revenue from sources other than financial institutions. Experian has made much progress. Only nine years ago it had no consumer business and about 70 percent of revenue came from financial institutions. Its digital marketing services business, linked to online advertising, is also increasingly important, bringing in $800 million in fiscal 2010.

Under Robert, 52, Experian has diversified geographically too. Latin America now accounts for 20 percent of revenue, up from zero in 2006. In November, Experian kept that market in focus by acquiring Bogotá–based credit bureau Computec, which operates in several Latin American countries. But Asia is proving tougher; it still accounts for only 5 percent of revenue.

Robert joined Experian in 2001 from real estate and insurance information company First American Corp., where he headed mortgage origination services. He had previously spent 15 years with U.S. Bancorp, becoming CEO of Credco, its San Diego–based credit reporting division, which First American acquired in 1995.

Colleagues say Robert, who has a bachelor of business administration degree from Oregon State University, has become increasingly Anglophile as the American CEO of a company with a mostly British board. “He’s good at managing international businesses and at dealing with different kinds of people from different cultures,” says Experian deputy chairman Sir Alan Rudge, who describes Robert’s management style as understated and quite British.

Robert had a difficult time in the years immediately after the demerger, Rudge recalls. Analysts were cautious about Experian, which lagged the FTSE 100 in 2007 because of worries surrounding the credit crunch. “Don didn’t get too worked up,” Rudge says. “He concentrated on the performance of the business, and he’s now won them over.”

In June and November, staff writer Neil Sen talked to Robert about Experian’s current challenges and its expansion plans.

Institutional Investor: How did you come to join Experian in 2001, when it was a U.K. company?

Robert: I was working for First American, which had a joint venture with Experian. I got to know Sir John Peace, who is now chairman of the company and was then CEO, and he persuaded me to join, initially as COO of Experian North America. I was intrigued by the company’s size and complexity, and its international reach.

It’s not easy to pin down Experian’s national identity. How would you describe it?

It can only be described as global. Our corporate head office, the venue for most of our board meetings, is in Dublin, yet we are incorporated in Jersey in the Channel Islands, our primary listing is in London, and our biggest source of revenues is North America—for now. We have operations in 44 countries. I spend about half my time in the U.K.—I live in Chelsea, London—about 20 to 25 percent in the U.S. and the rest mostly in Asia and Latin America.

Have you considered moving your primary listing away from London?

We did have concerns after the demerger in 2006 that London might not be a natural home for us because most of our peer group are in the U.S., and we now have more U.S. shareholders than we did then. But the London Stock Exchange has been great for us; we’ve found an excellent level of understanding and support from long-only funds, so I don’t think we’d benefit from a move to the U.S. Institutions in the U.K. still own about 46 percent of our stock, down from 50 percent in 2006, and U.S. institutions around 25 percent, up from 12 percent in 2006.

With revenue growing and the share price climbing, things are going well for Experian. But are there aspects of the business with which you’re not happy?

We’re no longer as dependent on financial services as we once were, with two thirds of our revenue coming from non-financial-services sources, but there is more we can do to develop our other businesses. We have a presence in the telecom and utilities sectors, where we can provide valuable services for corporate clients in assessing their customers, building market share and improving their collections and recoveries from customers.

Is slow growth in your North American businesses—only 2 percent in the six months through September 30—another problem?

Most of our North American businesses saw at least mid-single-digit growth, but our education lead-generation business saw a decline. We are seeking to reverse this decline, and we’ve had a measure of success in the second half.

What impact has Dodd-Frank had on your business?

Dodd-Frank imposes a big compliance burden on our clients because banks have to show how they reach their credit decisions. But this need for greater transparency is an opportunity for us, even if we can’t quantify its effect on revenues yet. An important example of this is what’s known as the fifth factor in credit decisions. Lenders previously had to disclose to consumers the four strongest factors for declining credit, but now it’s five. It sounds innocuous, but they have to overhaul their systems—for instance, how they send declination letters, how they choose to extract and disclose the score, how they describe the score and the score factors and variables. We help them to do that.

Why is Experian expanding so rapidly in Latin America?

The underlying reasons are that many Latin American banks are well regulated and that it is a large and growing market with an emerging middle class. But also important is that our acquisitions, especially in Brazil, have been successful and have given us an appetite for Latin American business. In 2007 we acquired a 65 percent, rising to 70 percent, stake in Brazilian credit bureau Serasa for $1.3 billion, and our revenues from the country have grown by 18 percent annually since then, to $722 million. That experience meant that we were keen to expand our presence, and this July we acquired the e-mail marketing company Virid Interatividade Digital. The second deal is much smaller—Virid has annual revenues of about $5 million—but it helps secure our position as the world’s leading e-mail marketer.

Will you be expanding elsewhere in Latin America?

We’re interested in the larger countries, such as Argentina and Chile, where we already have operations, although probably not Mexico because of its social problems. We recently acquired Computec, which has operations in Venezuela and Peru as well as its home market of Colombia.

Why has growth in Asia been so much slower?

It tends to be an organic growth story, as there are very few acquisition opportunities in Asia, and it’s been hard work starting businesses from scratch. Even so, we’ve only been there since 2005 and yet annual revenues are up to $250 million. I am personally responsible for the Indian business, from which I plan to drive more growth; it was awarded a full credit bureau license from the Reserve Bank of India in February 2010—the first credit information company to receive such a license. I can see India or China eclipsing North America as our biggest source of revenue, but that is a long way off.

Do you have any plans for expansion in the Asia-Pacific region?

We’re establishing a new credit bureau in Australia—a joint venture credit information services business with some local banks, such as National Australia Bank, and others such as GE Capital and Citibank. It should be up and running by summer 2012. And earlier [in 2011] we acquired a further 40 percent stake in Singapore’s DP Information Group, in which we now have a controlling share. Singapore is now the center of our Asia-Pacific operations, and our growing presence there shows how serious we are about expanding in the region.

Experian is an acquisitive company. Are external advisers important to you?

We do receive valuable advice from our corporate brokers UBS and Bank of America Merrill Lynch on matters relating to our London listing, but we rarely use investment banks as M&A advisers. We’re well aware of the most suitable acquisition targets from our own activities. We’d been talking to Computec, for instance, for more than two years before we did the deal, and I led the talks myself.

How do you spend your spare time?

I have four children, two of whom are still at home. But I still find time to shoot pheasants and partridges in England with friends; I play golf, and I collect wine. I’m particularly interested in Californian wine, but I’m increasingly interested in Spanish wines such as Vega Sicilia.