First, here are today's top stories:

- Qatar's big crisis-era bet on Barclays pays off. Big time.

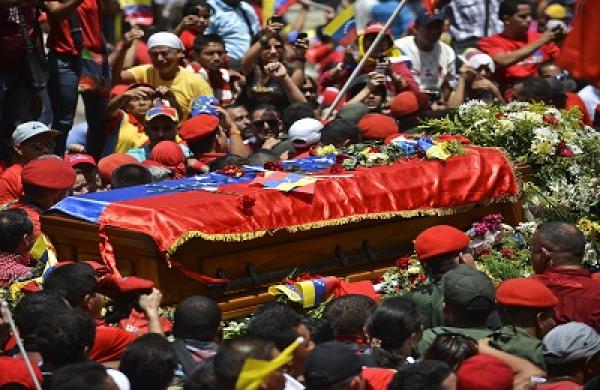

- What's Chavez done with all of Venezuela's resource wealth? Read on...

- It isn't often you see a pension fund praising modern portfolio theory these days.

- The Korea Investment Corporation is looking for more infrastructure opportunities in developed markets.

- Singapore's SWF (Temasek) buys into State-Owned Turkish Bank (Turkiye Halk Bankasi).

- China's EXIM bank far outpaces The World Bank in loans to Africa. In fact, EXIM loans in 2011 were more than double the WB.

- OMERS is getting ready to come to your front door. They're selling Borealis via the GSIA. Again.

- Cue the smallest violin in the world... the PE industry is struggling.

- Wanna see my face every day in your inbox? No? Ok. Well sign up for the daily email anyway.

- Sorry I missed this last week: Alaska's PFC is building out its co-investment capabilities for infra.

Second, here's some weekend reading for you:

- This paper by Christopher Kennedy and Jan Corfee-Morlot (entitled “Mobilising Investment in Low Carbon, Climate Resilient Infrastructure”) looks quite good. It basically studies how to help encourage private investment in clean energy infrastructure. Not easy to do, which is why research projects like this one are so important.

- Asim Ali and Shatha Al-Aswad have a new paper entitled, “Sovereign Wealth Funds and Social Finance: The Case for Islamic Finance and Impact Investing”. Here’s a blurb: “Islamic Finance presents an alternative to traditional finance by offering both financial return, as well as a theoretical foundation for ethical investing, which, we argue, extends logically to investments that directly impact social and economic development.” I’ve argued something similar in the past - see this in fact. So, I'd love to see more research on this. Watch this space... ;)

- Finally, some very smart gentlemen... and then me... co-authored a short note on AIMCo’s GTAA. We hope it’s of use to the broader community of investors looking at tilts or overlays or TAAs.

Enjoy your weekend!