Friday may have been a great day for long-short managers loaded up on tech and Internet stocks. But at least two managers were big losers on two separate stocks, one long and one short.

Shares of Pandora Media plummeted 35 percent after the music streaming company reduced guidance. Investors might have been disappointed in the number of activist investors disclosed by the company. Credit Suisse reduced its estimates for the next two fiscal years on Friday morning but only trimmed its price target from $24 to $23. The biggest hedge fund loser in the stock was possibly Ricky Sandler’s New York-based Eminence Capital, the third-largest shareholder as of the end of the second quarter. Sandler most likely lost a lot the previous day too, when another of his stocks, GNC Holdings, plummeted more than 14 percent after the Oregon Attorney General claimed the health products retail chain is selling supplements with unlabeled and unapproved ingredients. That stock rebounded by 6 percent on Friday, however.

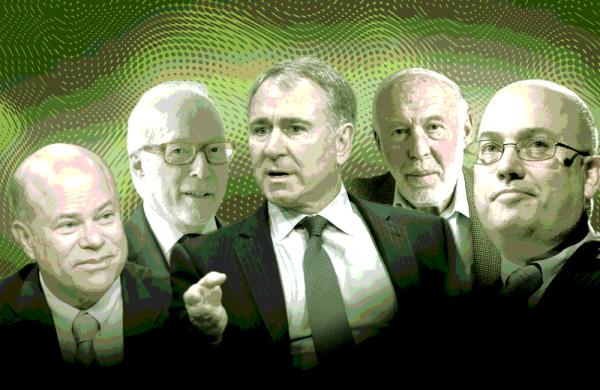

Meanwhile, Athenahealth, a high profile short position for David Einhorn’s Greenlight Capital, surged 27.5 percent on Friday, to close at $163.37, just pennies shy of its 52-week high, after the billing and medical practice management software company reported much better than expected earnings in the third quarter. The shares are up more than 22 percent this month alone. It was a big loser for the New York hedge fund manager in the third quarter.

___

New York-based D. E. Shaw trimmed its stake in Tesoro Corporation to about 6.7 million shares, or 5.4 percent of the refining and marketing company.

___

New York-based Glenview Capital Management boosted its stake in FMC Corporation by nearly 40 percent, to nearly 6.7 million shares, or 5.01 percent of the chemicals company.