New Research: Principles and Policies for In-House Asset Management

As repeat readers of this blog may recall, my Oxford colleague Gordon Clark and I have been working on a research project for some time that examines the challenges and constraints of managing assets internally at public pension funds and sovereign wealth funds.

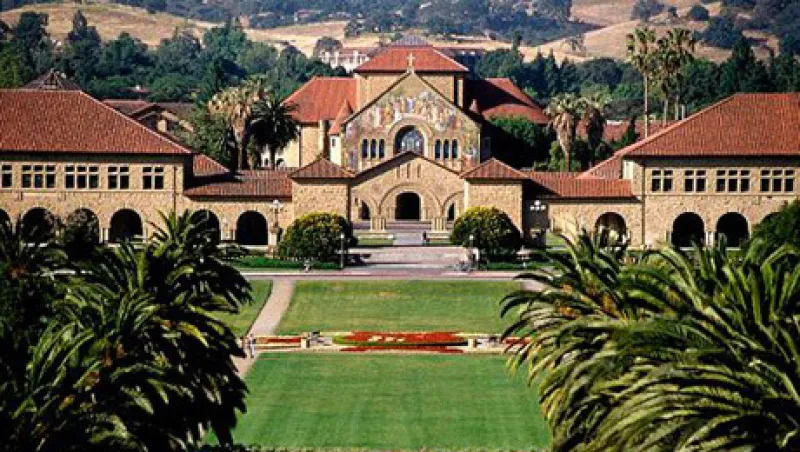

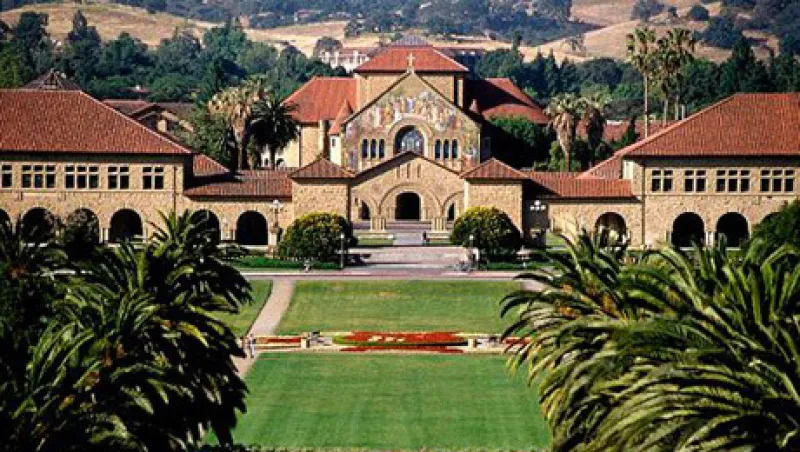

Ashby Monk

December 19, 2012