Will Wall Street get it right?

The last few years have given the big banks that underwrite major U.S. public share sales plenty of practice in the art of pricing, not that it’s helped. All too often things have gone awry. Facebook’s initial public offering, in May 2012, was famously bedeviled by technology glitches that damaged sentiment in the opening hours of trading and set the tone for the sharp drop in the social networking company’s share price in the three months that followed. Twitter, meanwhile, took more than an hour before public trading began after its November 7, 2013, IPO, which market watchers took as a sign that the underwriters had underestimated demand. The stock price jumped 70 percent on its opening day and had almost tripled by Christmas.

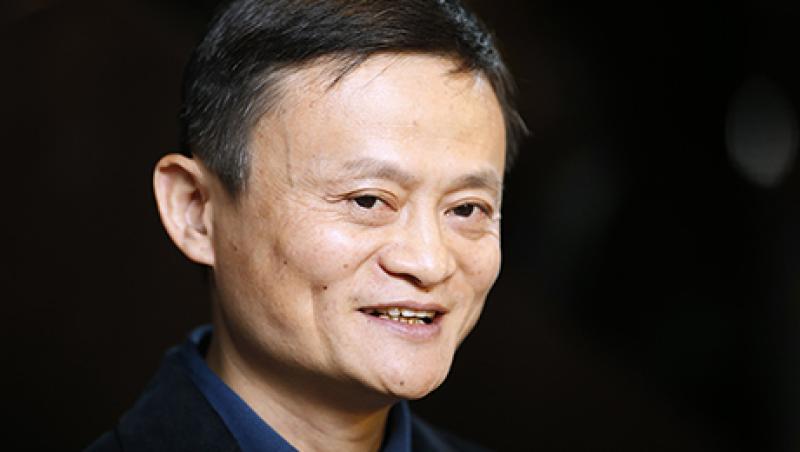

With shares in Chinese e-commerce giant Alibaba Group Holding set to begin trading on Friday morning, capping an historic IPO, the banks organizing the deal are scrambling to make sure the sale avoids the mistakes of the past. But their task is being complicated by a number of peculiarities in the structure of the deal. If the share price falls below the deal price, the IPO will be declared a failure; if it takes too long to open, sentiment could be damaged; if it climbs too high, bankers will be accused of mispricing.

Market participants associated with the deal or interested in buying Alibaba have been reluctant to speak on the record in the lead-up to Friday’s sale, but they broadly agree that the stock should go immediately higher, with most suggesting a 15 to 20 percent pop on the first day as the minimum standard for declaring the IPO a success. But most also agree that there is much that could go wrong.

First, there is the simple question of size. Bankers for Alibaba, which has had enormous success in China building a sprawling and at times seemingly chaotic business built on online shopping, social networking, cheap finance and much else besides, announced Thursday that the company's shares would be priced at $68, the top of the indicated range. This means the offering will raise $21.8 billion, the largest in U.S. history, surpassing the $17.9 billion that Visa raised when it went public in 2008 and Facebook's $16 billion deal in 2012. If underwriters exercise an option to sell more shares, Alibaba's offering could reach $25 billion, smashing the world record $22.1 billion that Agricultural Bank of China raised with its 2010 IPO in Hong Kong and Shanghai.

Second, there is the question of demand. Investors thronged road shows in New York, London, Hong Kong and Singapore, fueling speculation of excess demand, but in truth no one will know for sure until Friday. Also, different types of investor want different things. Large investors, such as multibillion-dollar mutual funds, need a lot of stock to create a position big enough to be significant for their portfolios. Underwriters are expected to try to keep these large firms happy; whether that keeps the big players on the sidelines on Friday, or generates a buying frenzy from smaller investors, also remains to be seen.

This task will be made more difficult by the third peculiarity of the Alibaba deal, which is that the six underwriting banks — Citigroup, Credit Suisse Group, Deutsche Bank, Goldman Sachs Group, JPMorgan Chase & Co. and Morgan Stanley — are a band of equals. That’s a contrast to Wall Street’s typical approach, in which one underwriter is assigned the lead role of allocating IPO shares. Alibaba’s federated deal structure should make the competition among the banks to parcel out their share allocations to investors before public trading begins especially intense: They all deal with the same large institutional clients; they each want to keep their clients happy; and they each want credit for giving investors what they want. The triple whammy of deal size, investor demand and federated deal structure means there is much room for delays and complications to develop. Finally, there is the fact that unlike other recent deals such as Facebook’s, where pre-IPO investors were subject to a lengthy lockup period, a large group of Alibaba early-stage investors will be able to sell 128 million shares — roughly a third of the whole public offering — immediately.

On top of that, there is the question that haunts any big IPO in the post-Faceboook era: Will the exchange’s technology systems be resilient enough to cope with the stress of demand and early trading?

Ordinarily, the opening day of an IPO is largely a pricing-and-trading game, with more patient, longer-term investors sitting things out. In this case, however, traders expect there to be little flipping of Alibaba shares on the opening day — indeed, underwriters have reportedly been most keen to cater to long-term investors. Whether that demand represents a deep belief in the long-term growth potential of Alibaba or a simple expression of herd sentiment is unclear; the large mutual funds and sovereign wealth funds expected to make up the bulk of large-block institutional demand for the stock have been tight-lipped in the lead-up to Friday’s sale.

But smaller, long-term equity hedge funds Institutional Investor spoke to have all taken the same view: if your strategy is to make money quickly, Friday is your day. But if you care less about intraday price moves and more about underlying value, you’ll do better to wait a few weeks, or even months, until a clearer picture emerges of where the stock price will settle and what Alibaba’s long-term strategy is to grow beyond its existing businesses — and beyond China.

In the meantime, though, strap yourself in for a wild ride on Friday morning.

Follow Aaron Timms on Twitter at @aarontimms. He will be tweeting live from the floor of the New York Stock Exchange for the start of trading on Friday.