Today, European Central Bank President Mario Draghi has called the bank’s governing council to order in Malta. While the majority of analysts polled by data providers in recent weeks do not anticipate that the meeting will end with an announcement of increased monetary easing, most do expect fresh market intervention in the near future. Continued low inflation levels, exacerbated by low oil prices, and concerns over slowing growth in the developing world have cast a shadow over European growth prospects. Prospects for easing appear to have been embraced by equity investors, with the Stoxx Europe 600 index climbing into positive territory in early trading after a sharp selloff in China’s stock market drove Asian indexes lower.

Yahoo disappoints investors. Yahoo! lowered forward projections for the final quarter of 2015 Tuesday after reporting third-quarter earnings per share of $0.15 cents on revenues of $1.23 billion—well below analyst estimates and the largest quarter-over-quarter sales decline in over five years. Critically, the Sunnyvale, California-based Internet company also indicated that the spinoff of its Alibaba Group Holding position may occur after the initial target deadline of year-end.

Weak trade data from Japan. Japanese Ministry of Finance trade data released today revealed the lowest export levels in over a year in September, with the total value of shipments rising by 0.6 percent year-over-year versus consensus forecasts of a 3.8 percent rise. The data also showed a sharp, 3.5 percent decline in cargo headed to China versus September 2014. The drop in external demand may increase political pressure on the Bank of Japan to expand its easing program at the upcoming monetary policy meeting on October 30.

Intel invests in China. On Tuesday, Santa Clara, California-headquartered Intel Corp. unveiled a plan to overhaul its semiconductor fabrication plant in Dalian, China for an expected $3.5 billion over three-to-five years, a project that could ultimately cost $5 billion. According to executives, Intel is upgrading the plant to focus on NAND flash memory chips in a joint venture with Boise, Idaho-based Micron Technology, which will diversify the pioneering chipmaker’s current processor-focused product mix.

Blackstone buys Stuy Town. An investment consortium led by New York alternative-asset giant Blackstone Group has agreed to acquire the 80-acre Stuyvesant Town-Peter Cooper Village development in Manhattan for $5.3 billion in a transaction valued roughly $100 million below the project’s record purchase by Tishman Speyer and BlackRock in 2009. The prior ownership group defaulted on the credit facility securing the properties in 2010 during the credit crisis when the assessed valued declined by more than 50 percent.

Reorganization announced at Credit Suisse. After posting third-quarter earnings that contracted by 24 percent versus the same period last year, Credit Suisse Group CEO Tidjane Thiam announced that the Swiss bank will raise over $6 billion in new capital and a separate listing of the company’s retail-banking division as part of an organizational overhaul. Wealth management and advisory business lines will be a focus over trading in the new structure, with the bank investing to further expand in Asian markets.

President of Brazil may face impeachment. Brazilian President Dilma Rousseff faces a fresh political challenge after a legal request was filed with the lower house of that nation’s legislature on Tuesday to begin impeachment proceedings against her. Rousseff is embroiled in an ongoing corruption scandal involving state-controlled oil company Petrobras that has implicated dozens of other high officials. She also faces accusations that her administration distorted government fiscal data.

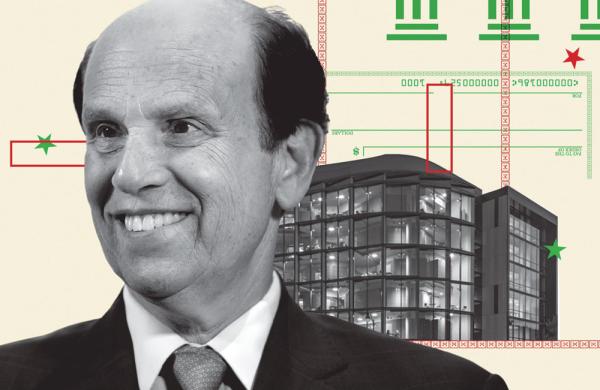

Portfolio Perspective: Spill-over (or Sustainable) Rally? — Tom Stringfellow, Frost Investment Advisors

Regarding the earnings picture for the quarter just past, it’s still early into the season but the trends continue to point toward more positive surprises than earlier expectations. Through last Friday, 12 percent of the S&P 500 constituent companies had released their third0q report card, with 81 percent of the companies reporting earnings above their longer term (five-year) averages. According to FactSet data, companies in aggregate are delivering an earnings stream 6.6 percent above Street estimates. Although expectations for the quarter are firmly in the negative camp, the trend is slowly improving and may well surprise investors, as has been the case for the past several quarters.

Tom Stringfellow is the president and chief investment officer of Frost Investment Advisors in San Antonio, Texas.