How things change. Not even a week ago, economists expected the Federal Reserve to begin raising interest rates by December, if not in September. After Black Monday and the wild volatility that followed, however, some former Fed officials are predicting no interest rate hike before year-end.

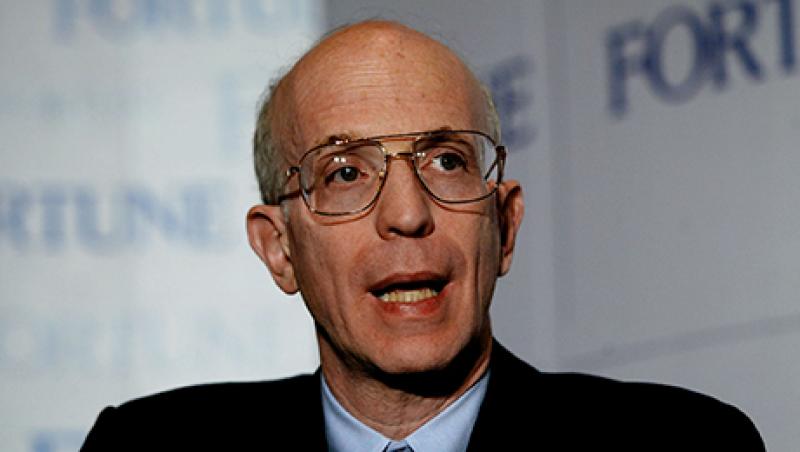

“A plunging market would worry the Fed very much,” says former Fed vice chair Alan Blinder, who is an economics professor at Princeton University. “They don’t want to throw lighter fluid into a raging fire.”

The worry is that a violent stock drop would produce a reverse wealth effect, leading consumers with stock portfolios to curb their spending and businesses to do the same. That could keep the economy and inflation from growing as fast as Fed officials would like. In past weeks — before the market gyrations — policymakers have noted a desire to see further improvement on both fronts before acting on rates.

The Standard & Poor’s 500 index plummeted 11 percent from its August 17 close of 2,102.44 to its August 25 close of 1,867.61.

There’s something of a feedback loop, says Douglas Elmendorf, a former assistant director of research and statistics at the Fed, though he is better known as the most recent director of the Congressional Budget Office. “Our financial turmoil is partly the result of weakness in other economies and then contributes to weakness overseas,” says Elmendorf, who is currently a visiting fellow at Washington’s Brookings Institution. “That’s a consideration for the Fed, because it reduces demand for U.S. exports.”

Blinder stresses, however, that foreign developments are relevant for the Fed only to the extent that they affect the U.S. economy, since the 1913 Federal Reserve Act dictates that the central bank base its policy solely on the strength of the U.S. economy. In addition, the ex–Fed officials say that a volatile stock market without a major decline won’t be enough to influence the Fed. “Volatility, per se, isn’t something the Fed pays much attention to, absent a big break like 1987,” says Edwin Truman, former director of international finance at the Fed and now a senior fellow at the Peterson Institute for International Economics in Washington. Two factors that do weigh heavily on Fed policymaking decisions are economic growth and inflation.

“If the economy was booming or inflation was closer to the Fed’s target, it would go [raise rates],” Elmendorf says. “But adding [stock market] turmoil to an economy growing slowly and with inflation below target discourages a move.”

Much of the rout in U.S. stocks stems from macroeconomic woes in China. Though the Chinese government reports gross domestic product growth of 7 percent, outside economists say the figure is closer to 3 to 5 percent. And that’s a problem for some major U.S. companies.

Whereas only 16 corporations on the S&P 500 garner at least 10 percent of their revenue in China, according to Wells Fargo Securities, that proportion is rising for many companies. And China’s devaluation of the yuan two weeks ago, which pushed the currency down 3 percent against the dollar, will likely curb U.S. exports to the nation. China’s own stock blowout is contributing to weakness in the U.S. market. The Shanghai Composite index cratered 22 percent in the four sessions through August 25 alone.

“If stocks stay down 10 percent from a week ago, with the market remaining nervous about China, that could stay the Fed’s hand,” says Joseph Gagnon, senior fellow at the Peterson Institute and a former associate director of monetary affairs at the Fed.

U.S. GDP grew 2.3 percent in the second quarter, and the Atlanta Fed’s forecasting model puts growth at just 1.3 percent for the third quarter. As for inflation, the personal consumption expenditures price index, the Fed’s favored inflation gauge, rose just 0.3 percent in the 12 months through June. The central bank’s inflation target is 2 percent.

The former Fed officials say there is a good chance the central bank will refrain from boosting rates at its meeting in September, thanks in part to stock market weakness. And if the central bank doesn’t move next month, there’s a good chance it stays its hand until next year. That’s because its October meeting doesn’t include a press conference at which Fed chair Janet Yellen could explain a rate hike decision, and financial markets can be volatile in December, when Fed policymakers meet for the final time this year.

“Stocks could easily be what helps keep the Fed on hold through year-end,” Gagnon says.

Get more on macro.