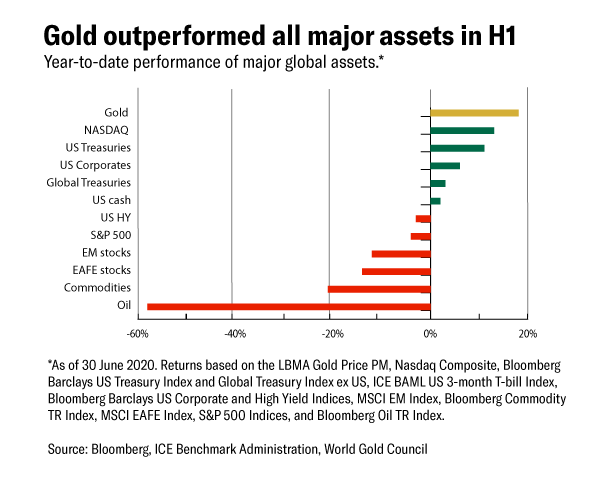

Gold performed remarkably in the first half of 2020, increasing by 16.8% in U.S.-dollar terms, and significantly outperforming all other major asset classes. By the end of August, the LBMA Gold Price PM was trading at an all-time high of more than $1,970/oz, and reaching record or near-record highs in all other major currencies. Though equity markets around the world rebounded sharply from their Q1 lows, the high level of uncertainty surrounding the COVID-19 pandemic and the ultra-low interest rate environment supported strong flight-to-quality flows. Like money market and high-quality bond funds, gold benefited from investors’ need to reduce risk, with the recognition of gold as a hedge further underscored by the record inflows seen in gold-backed ETFs.

The shape of things to come

The pandemic is having a devastating effect on the global economy. The IMF is currently projecting a 4.9% contraction in global growth in 2020, with high levels of unemployment and wealth destruction. In addition, there is a growing consensus that a swift V-shaped recovery is morphing into a slower U-shape recovery or, more likely, W-shaped as recurring waves of infections set the global economy back.

For investors, this is not creating persistently high levels of uncertainty, but might also have a long-lasting impact on their portfolio performance. Against this backdrop, gold can be a valuable asset, helping investors diversify risks and potentially contributing to improved risk-adjusted returns.

Asset allocation upended

In response to the pandemic, central banks around the world have aggressively cut rates and/or expanded asset purchasing programs to stabilize and stimulate economies. However, these actions are leading to several unintended consequences on asset performance, including:

- Soaring equity market valuations are not always backed by fundamentals, increasing the chance of pullbacks.

- Corporate bond prices are also increasing, pushing investors further down the credit-quality curve.

- Short-term and high-quality bonds have limited – if any – upside, reducing their effectiveness as hedges.

How to Understand Gold Performance

While investors are clearly embracing gold as evidenced by strong demand (particularly for gold-backed ETFs), understanding how to value gold remains a barrier for some. Qaurum is a web-based quantitative tool that helps investors intuitively understand the drivers of gold performance. Behind its user-friendly interface, Qaurum is powered by the Gold Valuation Framework (GVF), an academically validated methodology based on the principle that the price of gold and its performance can be explained by the intersection of demand and supply. Accessible from Goldhub.com, the World Gold Council’s data and research site, Qaurum allows investors to assess how gold might react across different environments in three easy steps:

- Select a hypothetical macroeconomic scenario provided by Oxford Economics, or customize your own.

- Generate forecasts of demand and supply, and view the impact of key macro drivers.

- Calculate and visualize implied returns for gold.

Learn more about Qaurum and the GFV methodology.

Equities are getting (very) expensive

Global equities were on a virtually uninterrupted one-way upward trend for more than a decade. The pandemic changed that, resulting in a significant pullback, with all major equity indices experiencing sharp selloffs in the first quarter. Equities have recovered since, but stock prices do not appear fully supported by company fundamentals or the overall state of the economy. This has often been referred to as the Wall Street vs. Main Street divide. In the U.S. for example, in the span of a few months, P/E ratios have jumped to levels not seen since the dot-com bubble.

While many investors are looking to take advantage of the positive price trend, there is growing concern that such frothy valuations may result in a significant pullback, especially if the economy experiences a setback from a second wave of infections. Gold’s effectiveness as a hedge may help mitigate risks associated with equity volatility.

Bonds may offer only limited protection

The low rate environment has also pushed investors to increase the level of risk in their portfolios via buying longer-term and/or lower-quality bonds, or simply replacing bonds with even riskier assets, such as stocks or alternative investments. Going forward, it’s unlikely investors will achieve the same bond returns they have seen over the past few decades. World Gold Council analysis suggests that investors may see an average compounded annual return of less than 2% (±1%) in US bonds over the next decade. This could prove particularly challenging for pension funds, as many are still required to deliver annual returns between 7% and 9%. Lower rates increase pressure on the ability to match their liabilities and limit the effectiveness of bonds in reducing risk. In this context, investors may consider gold as a viable substitute for part of their bond exposure.

Stagflation, disinflation, deflation?

While it is fairly evident that lower interest rates and asset purchasing programs are impacting asset price valuations, it is less clear what effect expansionary monetary and fiscal policies will have on inflation. Some believe that quantitative easing and increasing debt levels are inherently inflationary and that, sooner or later, consumer prices will spiral out of control even if economic growth remains subdued (i.e., stagflation). Others, however, point out that previous – albeit not as aggressive – quantitative easing measures have not resulted in rampant inflation (at least not yet).

An additional camp points to the Japanese experience and predicts that deflation may happen first. In fact, there are some indications that this is starting to happen already. For example, while the price of necessities spiked during the lockdown in China, consumer price inflation has fallen from 5.2% in February to 2.5% in June. And some economists predict outright deflation by the end of the year.

Gold has historically protected investors against extreme inflation. In years when inflation was higher than 3% gold’s price increased 15% on average. Notably too, research by Oxford Economics shows that gold should do well in periods of deflation. Such periods are characterized by low interest rates and high financial stress, all of which tend to foster demand for gold.

Gold investment likely to offset weak consumption

Gold’s behavior can be explained by four broad sets of drivers:

- Economic expansion: Periods of growth are very supportive of jewelry, technology, and long-term savings.

- Risk and uncertainty: Market downturns often boost investment demand for gold as a safe haven.

- Opportunity cost: Interest rates and relative currency strength influence investor attitudes towards gold.

- Momentum: Capital flows, positioning and price trends can ignite or dampen gold’s performance.

Conversely, an economic contraction will likely result in lower demand for gold in the form of jewelry, technology, or long-term savings. This is particularly evident in key gold markets such as China or India.

Historically, investment demand during periods of financial stress has offset weakness in consumer demand, and 2020 will likely be no exception. However, gold’s performance may depend on the speed and shape of the recovery, when investors can analyze using Qaurum.