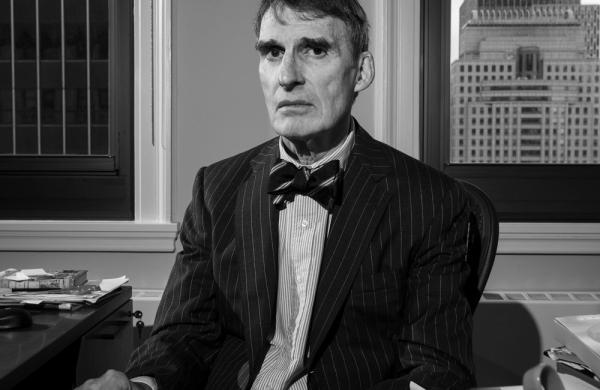

Jeffrey Ubben’s ValueAct Capital Management is looking to raise as much as $1.5 billion in new capital, according to a Wall Street Journal report. The San Francisco-based activist firm runs about $15 billion. It is asking investors to lock up their money for three to five years, according to the report. We reported earlier in the year that ValueAct typically keeps its core positions for 3.5 years, and 4.5 years when it holds a board seat. ValueAct joins Daniel Loeb’s Third Point and Nelson Petz’s Trian Fund Management, who are also seeking additional capital from investors, according to The Journal.

___

Some well-known hedge funds suffered big losses Friday, when shares of teen clothing chain d’ELiA’s sank by 85 percent after it said it will file for Chapter 11 bankruptcy, liquidate all merchandise and dispose of furnishings, trade fixtures and equipment. At the end of September, David Gallo’s New York-based Valinor Management was the largest shareholder, with nearly 9 percent of the total shares. Leon Cooperman’s New York-based Omega Advisors was the fourth largest investor after taking an initial 5.82 percent stake in the third quarter, while Charles (Chase) Coleman III’s New York-based Tiger Global Management owned 4.64 percent of the stock. However, the stock was a very small portion of each of these three firms’ overall portfolios. Earlier in the year, a very small New York-based hedge fund firm called Flatbush Watermill reported that it bought a 10.6 percent stake in d’ELiA’s in a private placement and would nominate one person to the board.

___

Starboard Value sold nearly one million shares of Tessera Technologies, reducing its stake in the semiconductor company by 21 percent. It now owns 7.1 percent of the total outstanding shares. In a regulatory filing, Starboard explained that the sale is mostly designed to rebalance the New York activist hedge fund firms’s portfolio given the “significant appreciation” in the company’s stock price. Shares of Tessera have nearly doubled since their mid-January low. Starboard said it “intends to remain a large shareholder” of Tessera and that Starboard principal Peter Feld remains “an active member” of Tessera’s board of directors.

___

The HFRI Fund Weighted Composite Index, published by Chicago-based data tracker Hedge Fund Index, rose 1.2 percent in November, bringing its gain for the year to a paltry 3.7 percent. Last month’s gain snapped a two-month losing streak. The top performing broad strategy in November was macro, up 2.6 percent. This captures both computer-driven and human-driven strategies.

___

Barclays raised its price target on hedge fund favorite Dollar General on Friday from $58 to $63 but maintained its equal weight rating on the stock, citing “the market’s focus on the acquisition” of Family Dollar. As we earlier reported, four of the nine largest shareholders are hedge funds. Dollar General recently said it will update investors on its discussions with the Federal Trade Commission before Family Dollar’s shareholder vote on December 23.