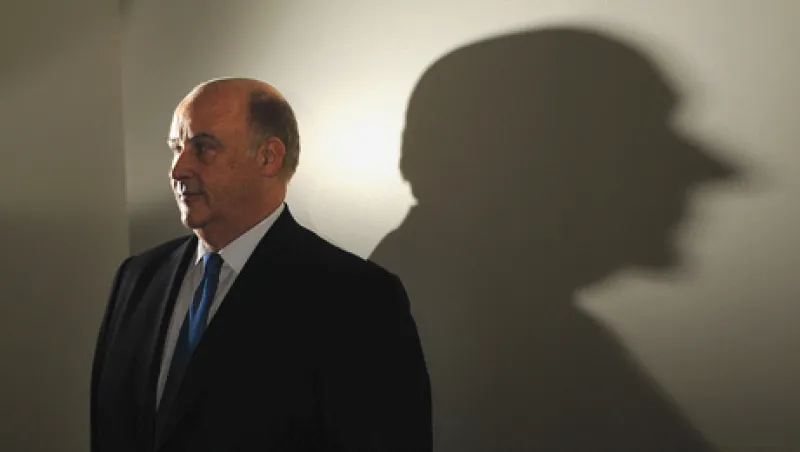

MANHATTAN, NEW YORK, NOVEMBER 30, 2011 Don Robert, CEO of Experian, is seen in JP Morgan offices in Manhattan, NY. 11/30/2011 Photo by Jennifer S. Altman

Jennifer S. Altman/Jennifer S. Altman

MANHATTAN, NEW YORK, NOVEMBER 30, 2011 Don Robert, CEO of Experian, is seen in JP Morgan offices in Manhattan, NY. 11/30/2011 Photo by Jennifer S. Altman

Jennifer S. Altman/Jennifer S. Altman