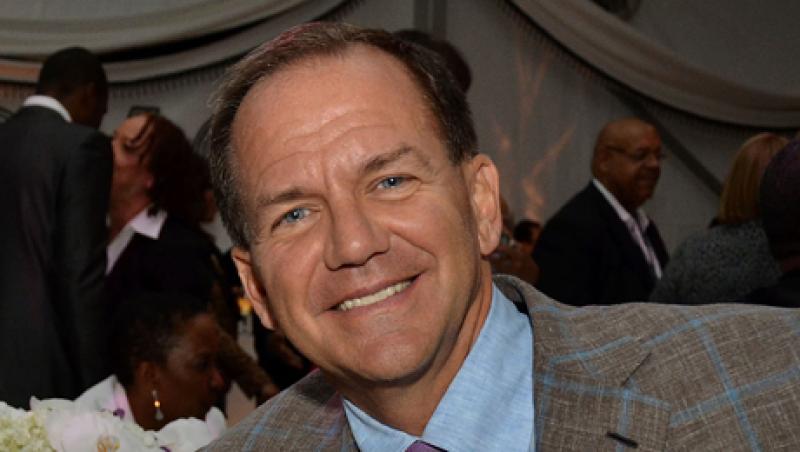

Paul Tudor Jones II’s announcement this week that he is launching a new macro fund is right out of the playbook of his buddy Louis Bacon of Moore Capital Management. It also may have solved for Tudor Jones one of hedge funds’ trickier problems: what to do when the marquee name in a hedge fund retires.

The 57-year-old Jones said he has raised $500 million for Tudor Discretionary Macro Portfolios, which will be run by 14 managers.

Jones’s Greenwich, Connecticut firm, Tudor Investment, already manages $11.4 billion, including about $9 billion in BVI Global, which he personally oversees. BVI has enjoyed a roughly 24 percent net annualized return since its 1986 inception.

It is not coincidental that by creating the macro fund managed by 14 individuals, including many senior Tudor people, Jones’s set-up now resembles Moore Capital.

Today, Bacon, 55, still controls roughly 70 percent of the $8.2 billion in assets that are currently invested in Moore Global Investment and Remington funds and sets the risk exposure for the funds, working closely with Richard Axilrod, his chief strategist who has been with the firm since 1996.

Meanwhile, another $3.9 billion is invested in Moore Global Macro Managers, launched in 1993 and mostly run by an all-star lineup of 14 managers but not Bacon. This fund is widely considered his legacy fund.

As we pointed out in our recent feature story, succession planning will become a major, thorny issue for many of the current generation of successful hedge fund managers over the next decade, including Jones.

Sources close to Bacon say he has no plans to retire in the near future and remains as engaged as ever in managing the firm’s assets. But these same sources acknowledge that it would be unrealistic to expect someone else to replicate his performance and risk profile at MGI and Remington. Whenever Bacon decides to step aside, they say, those two funds will most likely become a family office for Bacon’s personal wealth, while Macro Managers funds could continue to trade independently.

In the summer of 2010, the hedge fund world was rocked by the sudden retirement of then 57-year-old Stanley Druckenmiller. At the time, Jones issued a statement saying: “I have no intentions to stop trading or retire in the next five years and plan to stay engaged as CIO for years to come.” This summer, in another statement on his future, Jones said: “Right now, I really love trading and the opportunity set I see for the next four or five years seems very compelling so retirement seems not for me."

By creating the new macro fund, Jones accomplishes a number of things. First of all, he finds another reason to retain many of his top managers, virtually unknowns outside the company and its little circle of hedge funds. Perhaps down the road one of the strategy teams can make the case they can raise enough money to run a successful stand-alone fund.

More significantly, Jones has done what few hedge fund managers have done: He has prepared for the day when he might retire — when he no longer loves trading or sees the undefined opportunities he sees now. At that moment, he could unwind BVI, keeping his own money in the fund and making it an unofficial family office. Then, if he wants to keep the firm going, he can offer a few funds — including the macro fund — the firm’s quantitatively driven portfolio and ride off into the sunset.